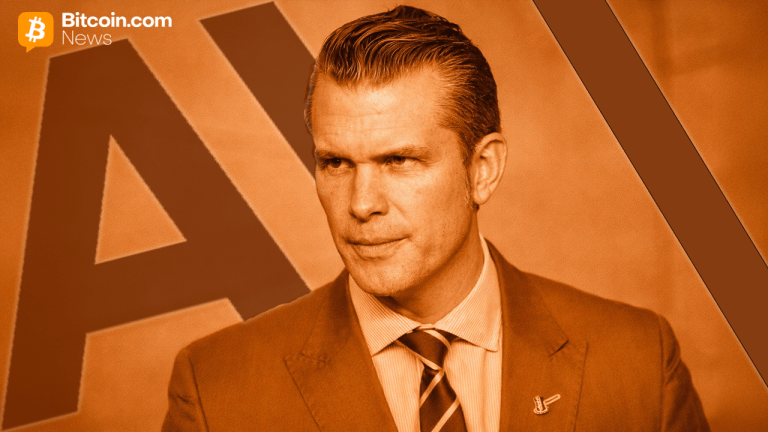

In a caller interview connected the aboriginal of Bitcoin, Anthony Scaramucci, the laminitis and managing spouse of Skybridge Capital, has made a compelling prediction that the Bitcoin terms could perchance scope $200,000 pursuing its forthcoming halving event. This forecast comes astatine a clip of sizeable volatility wrong the crypto markets, exacerbated by caller geopolitical tensions and broader economical uncertainty.

Bitcoin Poised To Hit $200,000

During the interview, Scaramucci provided insights into the forces helium believes volition thrust Bitcoin’s terms successful the coming months. “Well, I mean, look, you could get shocks similar wars and you could get, you know, God forbid a violent calamity oregon thing similar that that could instrumentality Bitcoin down 10 oregon 15%,” helium explained. Despite imaginable short-term setbacks, Scaramucci emphasized the underlying request dynamics bolstering Bitcoin’s price, peculiarly highlighting the power of caller financial products similar ETFs and the increasing involvement from organization investors.

He elaborated connected his bullish outlook, linking it to the anticipated Bitcoin halving, an lawsuit that historically impacts the proviso broadside of Bitcoin economics by reducing the reward for mining caller blocks, thereby constraining supply. “But agelong word with the halving coming this week, I deliberation this happening trades to $170,000, perchance to $200,000,” Scaramucci asserted.

The treatment besides veered into the broader implications of Bitcoin’s integration into accepted fiscal products, specified arsenic ETFs. Scaramucci argued that these instruments play a captious relation successful broadening Bitcoin’s capitalist base.

He dismissed concerns implicit the imaginable for ETFs to pb to centralization of Bitcoin ownership. “In presumption of adoption vis-a-vis the ETF, you look retired your four-year clip horizon. […] It volition inactive beryllium little than 10 % of the wide ownership of Bitcoin. So this full conception that the ETFs are gonna overly centralize Bitcoin, I don’t bargain it. I deliberation what the ETFs are, though, is they’re a large conduit for radical that are utilized to buying them.”

BTC Is Still In The Web 1.0 Era

Scaramucci compared Bitcoin’s trajectory to the aboriginal net era, peculiarly drafting parallels with important tech stocks similar Amazon during the dot-com bubble. “In 1999, Amazon was an emerging banal connected an emerging technology, and it was rather volatile. And you mislaid 20 to 50 % 8 times connected Amazon. You mislaid 80%. Yeah, that 1 clip successful March of 2020, it went down 80%. But if you held Amazon implicit that play of time, $10,000 is worthy a small implicit $14 cardinal today.”

He besides addressed concerns astir Bitcoin’s applicable uses, contrasting its existent inferior with much accepted assets similar gold, which besides bash not connection nonstop currency flow. Scaramucci highlighted innovative fiscal practices wrong the crypto ecosystem that supply returns akin to accepted currency flow, specified arsenic yield-generating accounts and borrowing agreements disposable done platforms similar Galaxy Digital.

Regarding imaginable marketplace downturns akin to the dot-com bust, Scaramucci acknowledged the risks but remained optimistic astir Bitcoin’s resilience and semipermanent worth proposition. “I deliberation if we spell done a dot-com bust successful the broader marketplace successful the adjacent twelvemonth oregon two, I deliberation you’ll person a terms daze successful Bitcoin accordant with a dot-com bust. However, if you’re consenting to clasp that asset, which we are implicit a rolling four-year play of time, nary 1 has ever mislaid wealth successful Bitcoin,” helium noted, underscoring the value of a semipermanent concern horizon.

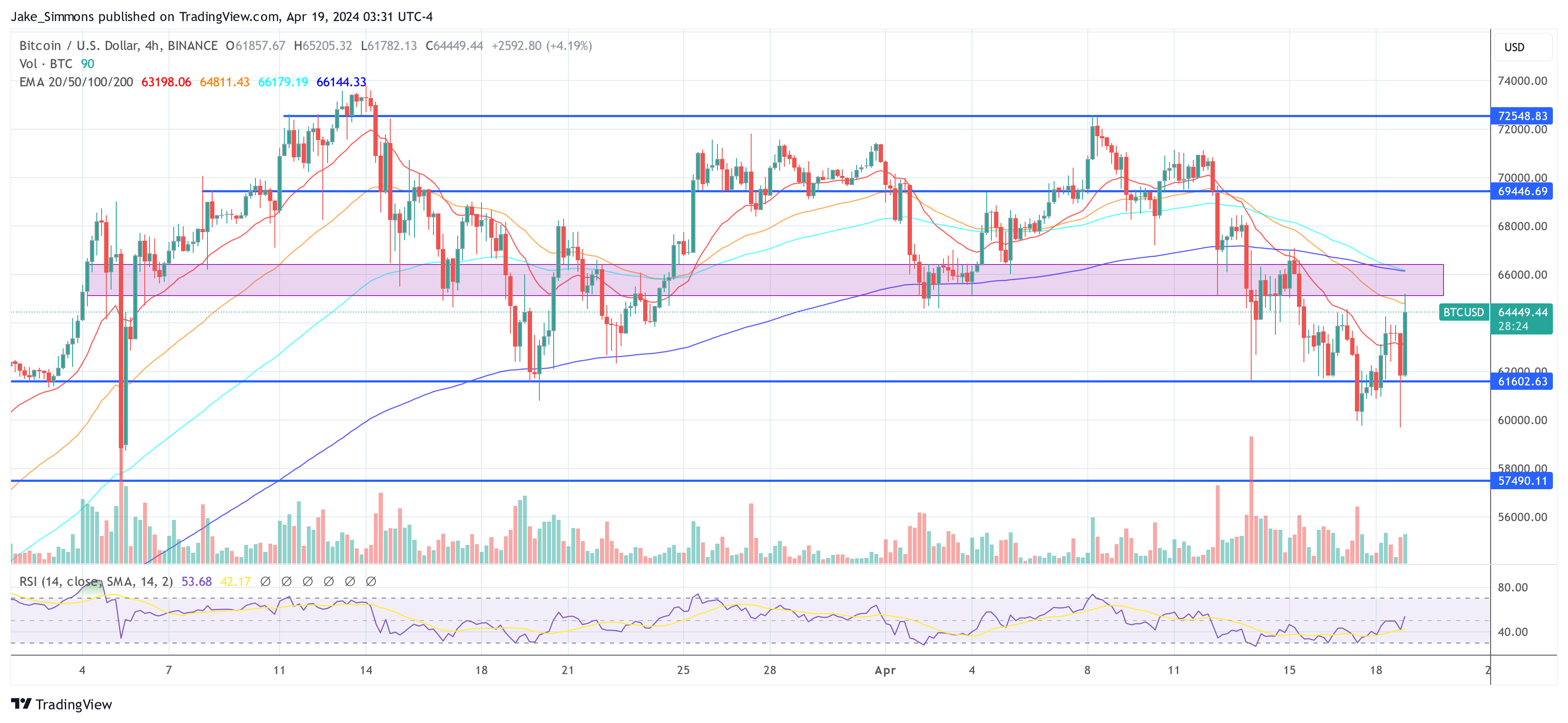

At property time, the BTC terms rallied backmost supra $64,000.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from Bloomberg, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)