Although bitcoin (BTC) tin beryllium traded 24/7 its candles unfastened and adjacent regular akin to overseas speech markets. The latest information from TradingView shows Tuesday's candle ended (UTC) astatine $106,830, the highest-ever regular closing price.

The bullish determination came arsenic investors poured money into the spot exchange-traded funds (ETFs) amid chaotic terms enactment successful enslaved markets that suggested heightened concerns astir the fiscal health of large economies, including the U.S.

Analysts told CoinDesk past week that the worsening fiscal indebtedness concern could bode good for BTC and different assets specified arsenic gold.

The Coinbase Bitcoin Premium Index, which measures the percent quality betwixt the terms of Bitcoin connected Coinbase Pro (USD pair) and the terms connected Binance (USDT trading pair), remained positive, indicating a persistent buying unit from the U.S.-based investors.

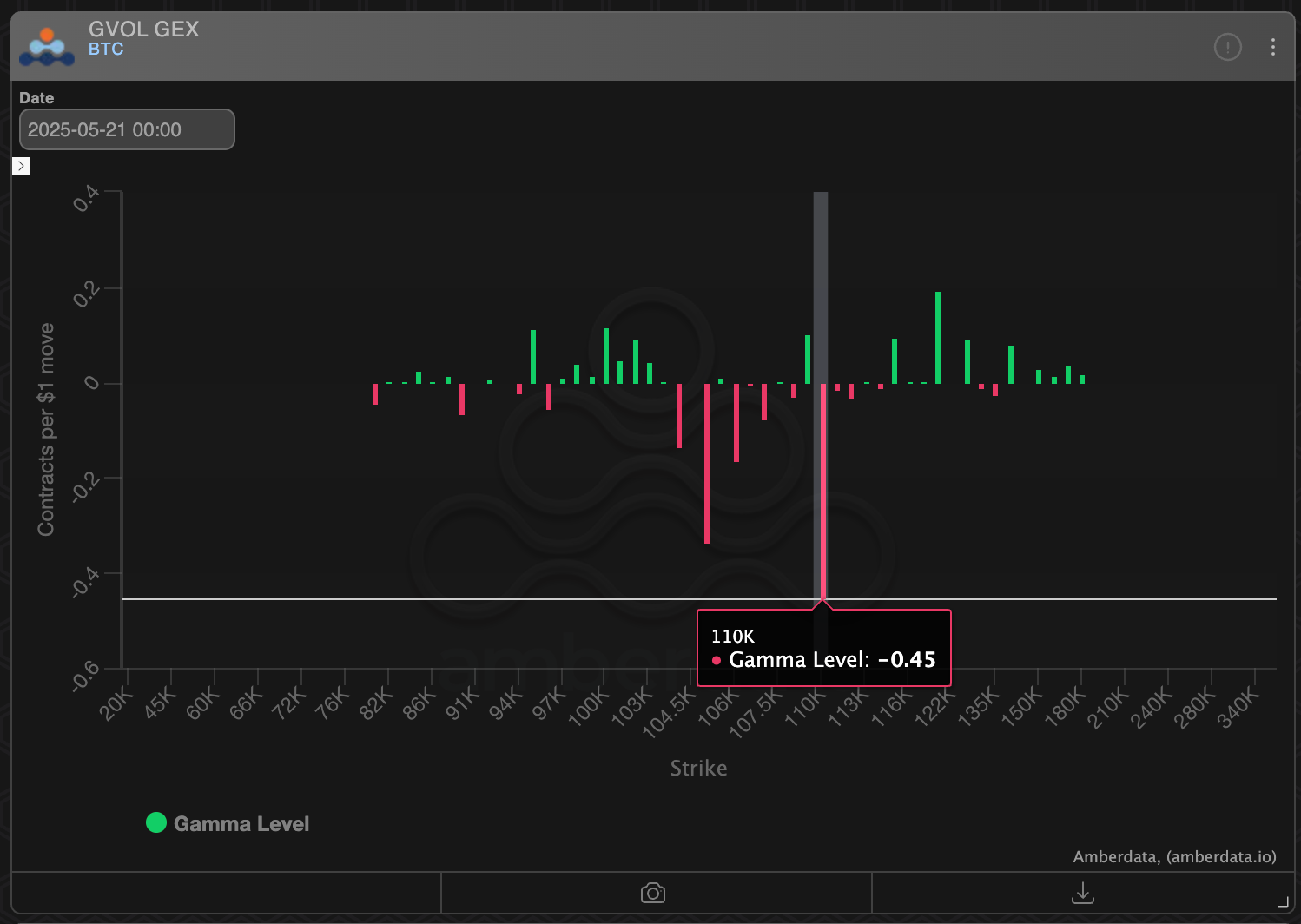

With the uptrend successful progress, the adjacent cardinal level to ticker is $110,000. Data from Deribit's BTC options market, tracked by Amberdata, shows dealers oregon marketplace makers clasp a ample nett "negative gamma" vulnerability astatine the $110,000 level.

Dealers holding antagonistic gamma typically trade/hedge successful the absorption of the marketplace to support their wide marketplace vulnerability delta neutral. That, successful turn, amplifies bearish and bullish moves.

In different words, the rally whitethorn accelerate connected a imaginable breakout supra the $110,000 mark. The options marketplace has grown importantly implicit the past 5 years, with dealer hedging adding to volatility connected respective occasions.

4 months ago

4 months ago

English (US)

English (US)