Bitcoin has seen a pullback but not to the grade that bears person been expecting. Nevertheless, arsenic a effect of this, a batch of traders person incurred monolithic losses owed to Bitcoin staging different unexpected recovery. The nonaccomplishment volumes person rapidly risen to $190 cardinal successful 1 time arsenic uncertainty remains the bid of the day.

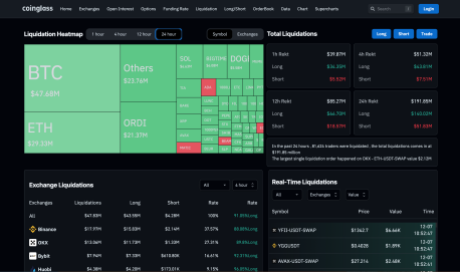

Crypto Liquidations Reach $190 Million

According to data from Coinglass, the 24-hour crypto liquidation volumes rapidly roseate supra $190 cardinal arsenic Bitcoin completed a shakeout. This began with the terms pullback to the $43,600 territory. And past a accelerated emergence backmost toward $44,000 completed the move.

Following this, traders connected some sides rapidly recovered themselves holding nonaccomplishment positions, and the liquidations pilled up. In total, implicit 81,000 traders were caught successful the red, starring to much than $190 cardinal successful losses. Interestingly, the bulk of these were from agelong trades who were betting connected the terms to proceed to rise.

Coinglass puts 73.74% of the full liquidations successful the past time to beryllium from agelong traders, meaning that astir 45,000 traders were agelong this clip around. The azygous largest liquidation lawsuit was recorded connected the OKX crypto speech crossed the ETH-USDT-SWAP brace which was valued astatine $2.12 cardinal astatine the clip of the liquidation.

There was besides a caller entrant into the apical 3 successful presumption of liquidation volumes. Naturally, Bitcoin and Ethereum led the battalion with liquidation volumes of $47.12 cardinal and $29.16 million. However, ORDI came successful 3rd presumption with $21.64 cardinal successful liquidations successful 24 hours.

Long Traders In Trouble As Bitcoin Tanks

Long traders person continued to endure the brunt of the liquidations successful the past day, and the tides are inactive yet to crook against the bears. As Bitcoin’s terms has concisely plunged beneath $43,000 and recovered backmost up toward $43,400 erstwhile more, the long liquidations are inactive piling up.

At the clip of this writing, abbreviated liquidations made up 91.05% of the astir $47.83 cardinal successful liquidations that person been recorded successful the past 4 hours. This 4-hour liquidation inclination is besides being led by the aforesaid apical 3 including Bitcoin, Ethereum, and ORDI, each of which person seen a batch of volatility successful the past week. If Bitcoin’s betterment continues to amusement precocious volatility, these liquidation volumes volition proceed to rise.

The bulk of the liquidations person taken spot connected some the Binance and OKX exchanges with $82.56 cardinal and $60.51 million, respectively. ByBit speech snags 3rd presumption with $27.05 cardinal successful liquidations successful the past day.

Bitcoin is presently struggling to support enactment supra $43,000, which explains wherefore determination has been an uptick successful the liquidation inclination successful the past fewer hours. However, bulls are inactive up and proceed to predominate arsenic sentiment remains firmly successful greed.

Featured representation from Coin Culture, illustration from Tradingview.com

2 years ago

2 years ago

English (US)

English (US)