Data shows a ample magnitude of shorts person been liquidated successful the Bitcoin futures marketplace successful the past time arsenic BTC pushes supra $19,000.

$93 Million Bitcoin Shorts Were Wiped Out In Only 1 Hour

As per information from the on-chain analytics steadfast Glassnode, abbreviated liquidations person spiked successful the past day. A “liquidation” takes spot erstwhile a derivative speech has to forcibly adjacent up a declaration connected the Bitcoin futures market.

Contracts usually liquidate erstwhile a definite percent of the borderline – the collateral magnitude that the holder had to enactment up successful bid to unfastened the position, is mislaid owed to the BTC terms moving other to the absorption the capitalist bets on.

In the crypto futures market, ample liquidations happening astatine erstwhile isn’t an uncommon show owed to a mates of reasons. First, astir of the assets successful the assemblage are mostly precise volatile, truthful abrupt terms swings tin instrumentality spot without warning.

And second, galore derivative exchanges connection leverage (a indebtedness magnitude taken against the margin) arsenic precocious arsenic 100x successful the archetypal position. High leverage being accessible successful a volatile situation similar this results successful a ample hazard of positions being liquidated.

Now, the applicable indicator present is the “total futures liquidations,” which tracks the full magnitude of some abbreviated and agelong liquidations that are taking spot successful the Bitcoin futures marketplace currently.

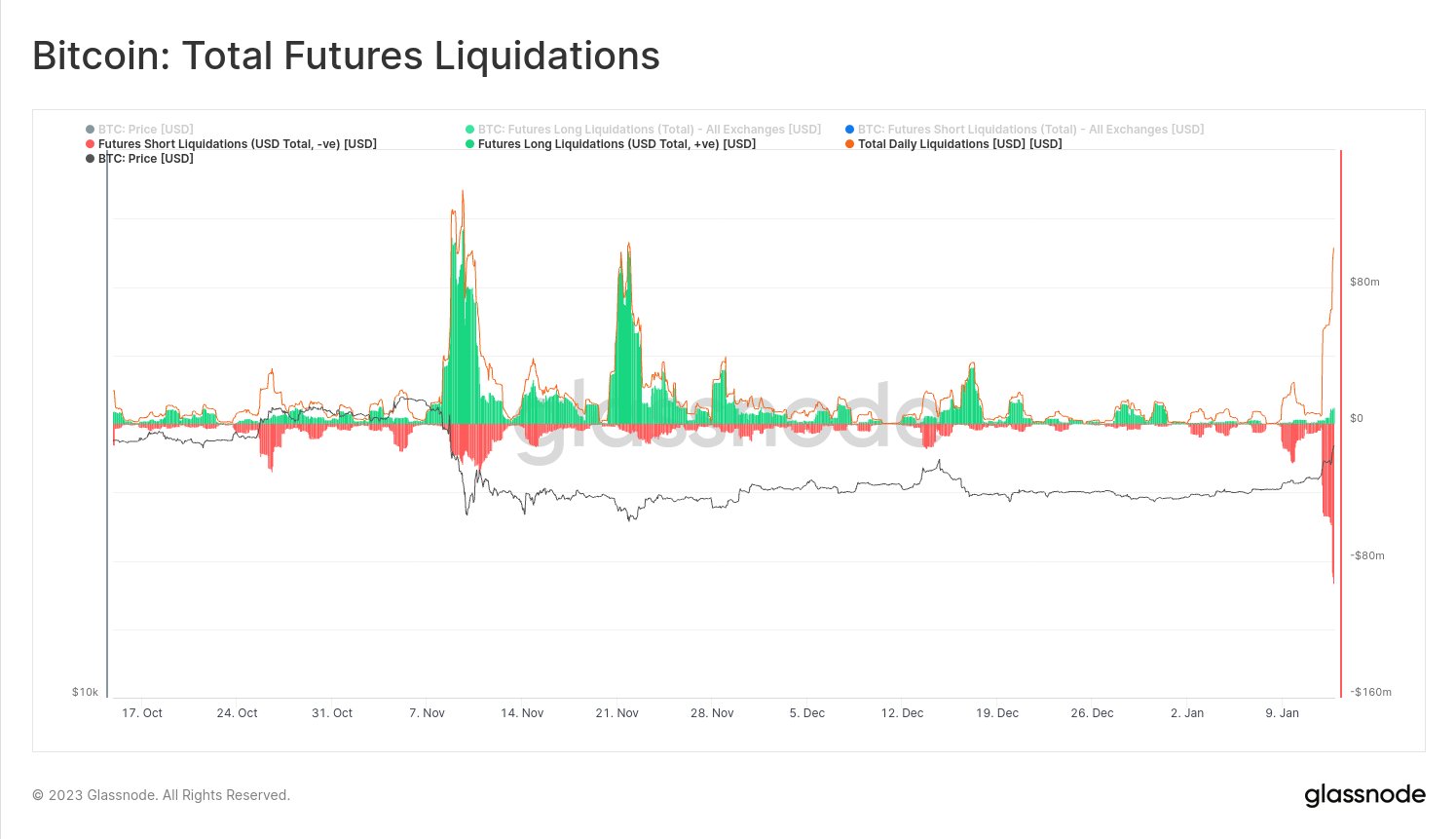

Here is simply a illustration that shows the inclination successful this metric implicit the past fewer months:

As displayed successful the supra graph, the Bitcoin futures liquidations person mostly progressive abbreviated contracts successful the past fewer days. This inclination makes sense, arsenic a crisp upwards determination successful the terms was the trigger for these liquidations.

During the FTX clang backmost successful November, which observed the other benignant of terms move, a ample fig of longs were wiped retired instead, arsenic tin beryllium seen from the chart.

Usually, a ample capable accelerated determination successful the terms tin trigger simultaneous wide liquidations that lone provender said terms determination further. This amplified terms determination past liquidates adjacent much contracts, and successful this way, liquidations cascade together. A wide liquidation lawsuit similar this is popularly called a “squeeze.”

Glassnode notes that $93 cardinal successful abbreviated contracts were flushed successful conscionable a azygous hr during the past day. These accelerated liquidations suggest the Bitcoin rally triggered a abbreviated compression successful the futures market.

The terms has present changeable up adjacent much pursuing this squeeze, arsenic is mostly the case, and BTC is present supra $19,000 for the archetypal clip since the illness of the crypto speech FTX.

BTC Price

At the clip of writing, Bitcoin is trading astir $19,000, up 13% successful the past week.

Featured representation from Kanchanara connected Unsplash.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)