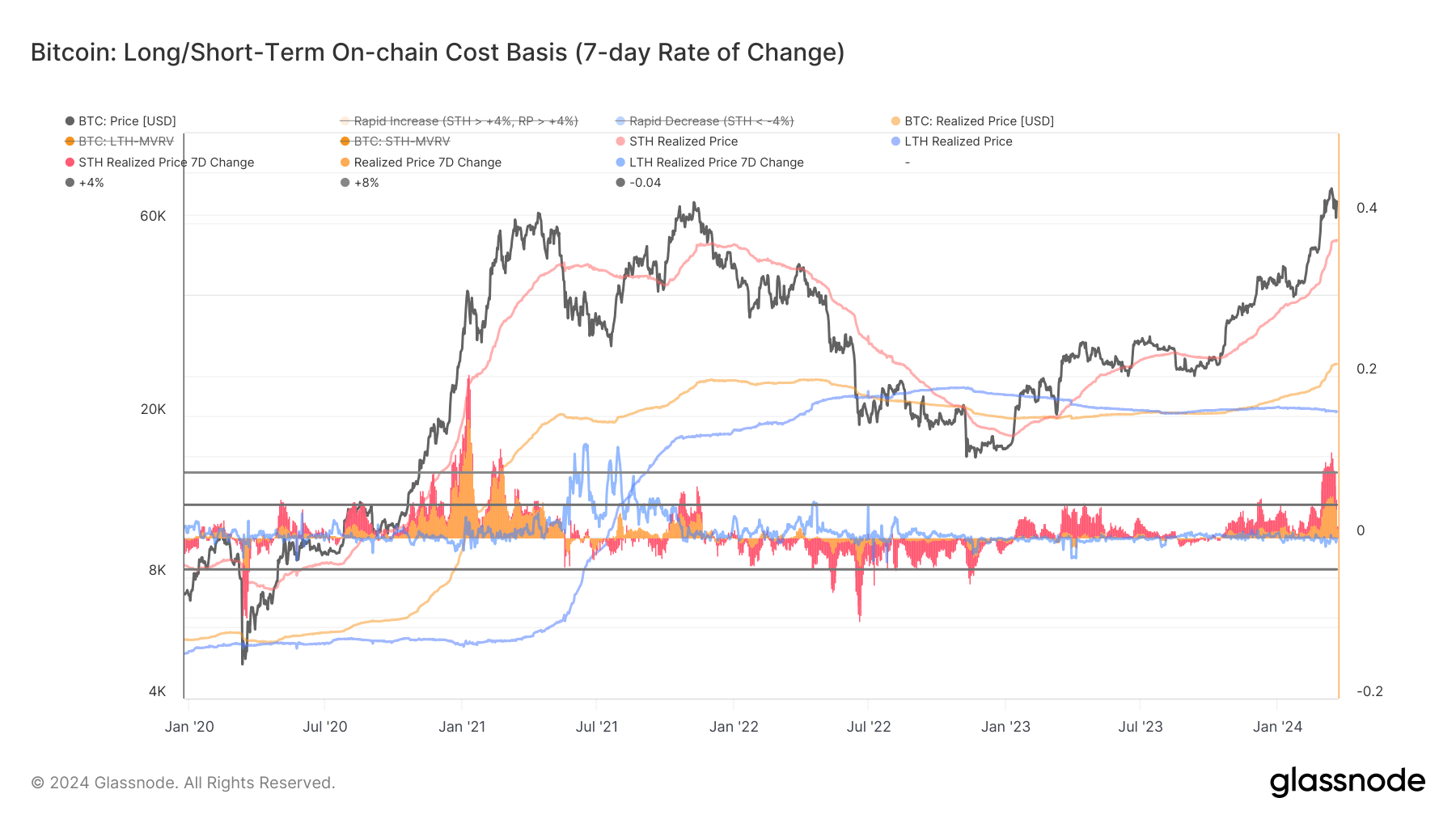

The realized Bitcoin terms represents the mean on-chain acquisition cost. It’s a useful metric arsenic it perfectly gauges the market’s valuation baseline astatine immoderate fixed point. When dissected done the lens of short-term and semipermanent holders, it provides insights into the cohorts’ concern horizons and their acute effect connected Bitcoin’s price.

These cohorts’ 7-day alteration successful realized terms provides a overmuch amended metric visualization. The 7-day alteration successful realized terms for short-term holders reached its three-year precocious connected Mar. 13, astatine 10.62%. The 7-day alteration successful realized terms for semipermanent holders the aforesaid time stood astatine -0.183%, representing a flimsy alteration from the erstwhile weeks.

Graph showing the 7-day alteration successful realized price, STH realized price, and LTH realized terms from Jan. 1, 2020, to Mar. 20, 2024 (Source: Glassnode)

Graph showing the 7-day alteration successful realized price, STH realized price, and LTH realized terms from Jan. 1, 2020, to Mar. 20, 2024 (Source: Glassnode)This divergence betwixt STH and LTH realized prices suggests a robust influx of short-term speculative involvement into the market. New marketplace participants were entering astatine higher terms levels than semipermanent holders betwixt Mar. 6 and Mar. 13, driving the cohort’s realized terms up. The emergence successful STH realized terms culminating connected Mar. 13, erstwhile Bitcoin’s terms peaked astatine supra $73,100, implies that important investments person been made astatine oregon adjacent highest prices.

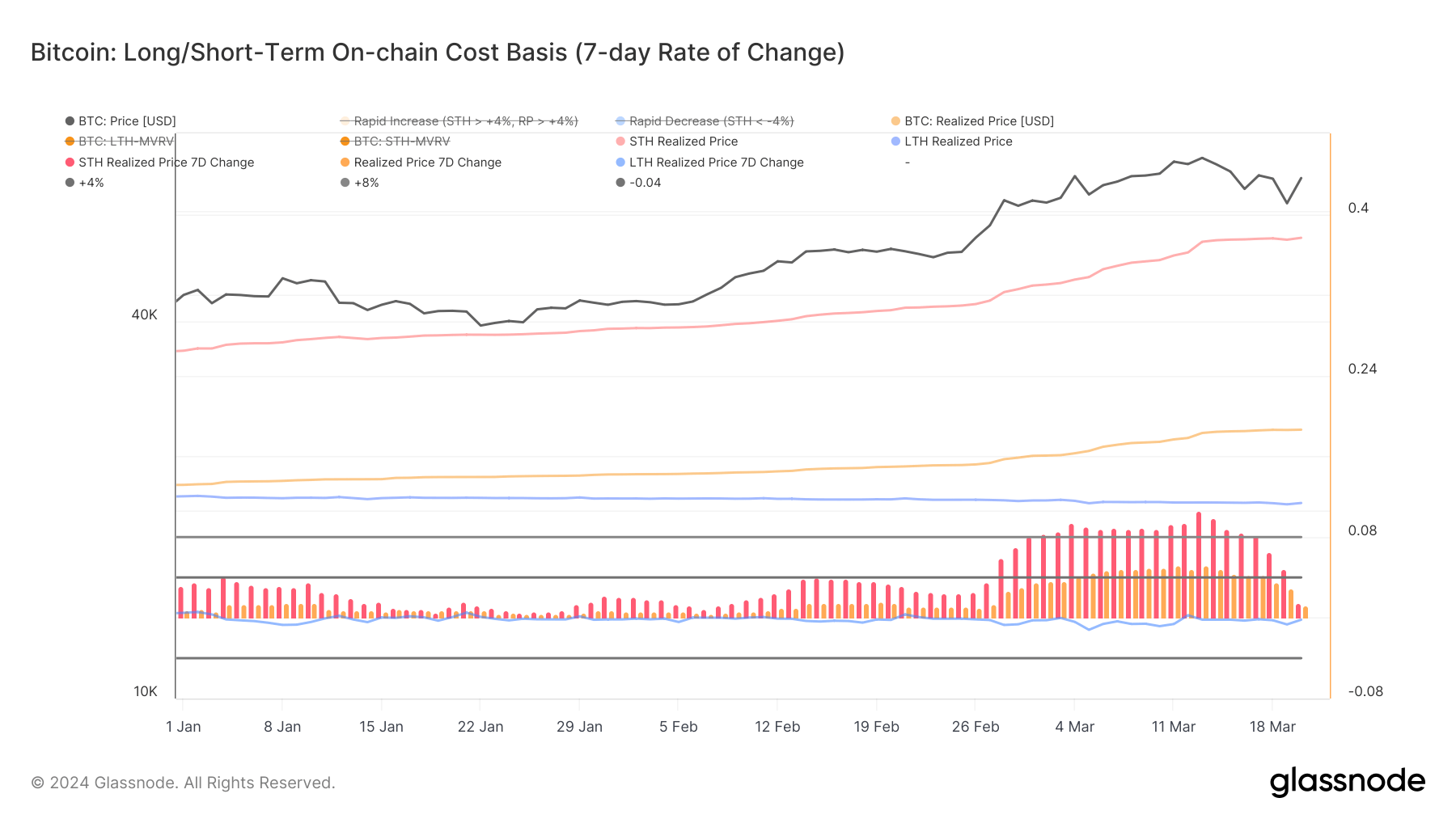

Graph showing the 7-day alteration successful realized price, STH realized price, and LTH realized terms from Jan. 1 to Mar. 20, 2024 (Source: Glassnode)

Graph showing the 7-day alteration successful realized price, STH realized price, and LTH realized terms from Jan. 1 to Mar. 20, 2024 (Source: Glassnode)Tracking changes successful realized prices for some LTHs and STHs is captious due to the fact that of their quality to amusement shifts successful marketplace sentiment and imaginable unit points. For instance, a rising STH realized price, peculiarly with Bitcoin’s terms increase, tin awesome increasing optimism oregon speculative request arsenic newer entrants are consenting to put astatine higher terms levels. The comparatively unchangeable oregon decreasing LTH realized terms alteration suggests a clasp sentiment among semipermanent investors, who whitethorn not determination their holdings contempt terms fluctuations, frankincense anchoring the market’s foundational cognition of value.

The information from Glassnode showed a marketplace astatine a imaginable inflection point. The melodramatic summation successful STH realized terms change, alongside a important summation successful Bitcoin’s price, indicated a short-term bullish sentiment driven by speculative trading and caller entrants attracted by the momentum. However, spikes arsenic crisp arsenic the 1 seen connected Mar. 13 seldom past longer than a mates of weeks earlier experiencing a important correction, which is precisely what happened successful the past week.

The 7-day alteration successful short-term holder realized terms dropped by 1.469% by Mar. 20, pursuing Bitcoin’s alteration to $61,000 and a consequent betterment to $68,000. This crisp driblet shows that the speculative enthusiasm cooled down, and the marketplace entered a consolidation phase. Data indicates that the buying momentum and optimism that drove the important summation successful STH realized terms and, by extension, Bitcoin’s terms has tempered, starring to a much cautious marketplace sentiment.

Several interpretations tin beryllium drawn from this information point. Firstly, the simplification successful the complaint of alteration successful STH realized terms could bespeak that the influx of caller superior astatine higher valuation levels has slowed. The simultaneous alteration successful some the STH realized terms alteration and Bitcoin’s marketplace terms tin besides suggest a simplification successful sell-side unit from short-term holders.

Typically, a precocious STH realized terms change, particularly erstwhile it sets a grounds arsenic it did connected Mar. 13, could bespeak a heightened likelihood of selling enactment arsenic short-term holders look to capitalize connected gains. However, arsenic this unit subsides, it tin stabilize prices, albeit astatine a level little than the caller highs, arsenic the marketplace absorbs the effects of erstwhile speculative trading.

Looking ahead, this play of recalibration could pave the mode for absorption to beryllium created astatine this terms level, arsenic it allows the marketplace to digest caller gains. Moreover, the behaviour of semipermanent holders volition proceed to beryllium a captious origin to monitor, arsenic their steadiness amidst volatility often serves arsenic an anchor for the market’s stability.

The station Bitcoin short-term holder realized terms maturation hits a velocity bump appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)