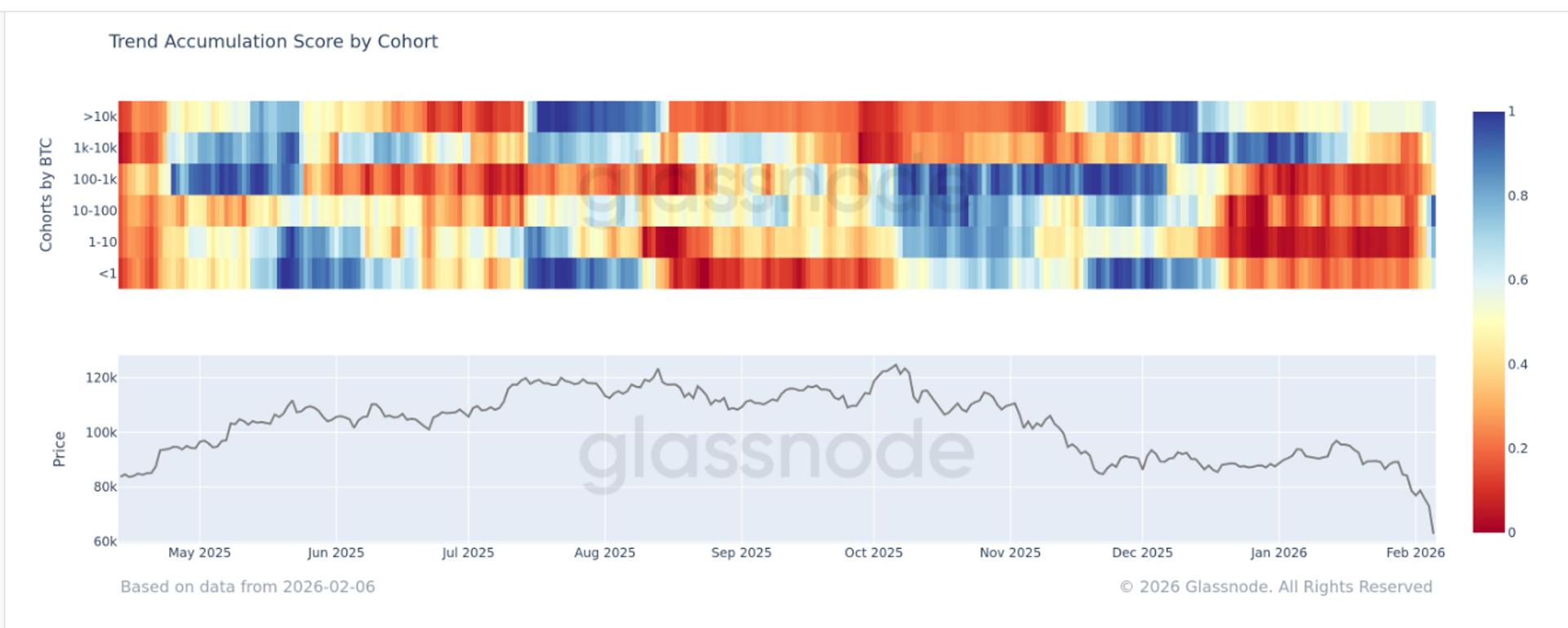

As Bitcoin continues to underperform successful the 4th fourth of 2025, its investors person had aggregate reasons to offload and shave disconnected their holdings. Among these investors is simply a definite cohort, its short-term holders (STHs), who person been facing vigor implicit an extended period.

STH MVRV In Deep Red For 60 Consecutive Days

In a caller station connected the X platform, marketplace quant Burak Kesmeci revealed an absorbing position regarding the existent marketplace information for Bitcoin’s astir reactive investors — the short-term holders. Kesmeci’s station revolves astir the STH MVRV (Market Value to Realized Value) metric.

For context, this metric compares the marketplace worth of BTC to its realized value, frankincense serving arsenic a means to way whether Bitcoin’s short-term investors are, connected average, successful nett oregon astatine a loss.

A speechmaking little than the neutral “1” level typically indicates that the STHs are successful the red. Depending connected the extent of this value, it could besides foreshadow capitulation events. On the different hand, values supra 1 uncover that short-term investors are successful profit. The higher the value, the much probable it is for profit-taking events to follow.

Source: @burak_kesmeci connected X

Source: @burak_kesmeci connected XIn his station connected X, the online pundit shared that the STH MVRV has been successful heavy reddish territory for a afloat play of 60 days. Kesmeci explained that the flagship cryptocurrency’s short-term investors are present facing the highest level of “patience test” that they person ever witnessed passim 2025.

Notably, prolonged periods of antagonistic MVRV readings person often correlated with heightened marketplace stress. Seeing arsenic the market’s most-reactive capitalist cohort is the 1 concerned, the Bitcoin terms could witnesser the effect of capitulation-driven sell-offs.

However, the other is besides possible. In the script wherever bearish unit eases disconnected completely, prolonged antagonistic readings could beryllium a motion of imminent marketplace stabilization.

Bitcoin Stays Beneath 111-Day SMA — What This Means For Price

To lend much value to his on-chain revelation, Kesmeci besides followed up with a key method observation of Bitcoin’s terms action. According to the analyst, Bitcoin has been trading beneath the 111-day elemental moving mean (SMA 111) wrong the aforesaid period.

This alignment betwixt on-chain and method investigation frankincense functions to reenforce a wide narrative; Bitcoin is either presently astatine a consolidatory oregon corrective phase. This is contrary to the content that the premier cryptocurrency mightiness beryllium astatine the commencement of a important upward trend.

From a broader perspective, Bitcoin’s aboriginal trajectory is not wholly clear. Macro events, alongside renewed spot demand, could beryllium pivotal for the cryptocurrency successful the future.

This marketplace improvement could find whether BTC plunges deeper to the downside oregon begins its betterment journey. As of this writing, Bitcoin is valued astatine astir $87,380, with nary important question successful the past day.

Featured representation from iStock, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)