On-chain information shows Bitcoin short-term holders look to person been down the latest selloff that has taken the terms of the crypto beneath $36k.

Bitcoin Investors Holding Coins Aged Between 1 Day And 6 Months Sold Big Yesterday

As pointed retired by an expert successful a CryptoQuant post, short-term holders look to person sold the heaviest during the caller selloff.

The applicable indicator present is the “exchange inflow,” which measures the full magnitude of coins moving into speech wallets.

A modification of this metric is the “exchange inflow spent output property bands.” it tells america however overmuch the antithetic Bitcoin holder groups are contributing to the inflow.

The assorted groups are divided based connected however galore days the investors held their coins earlier transferring them to the exchange.

The 1-day to 6-month coin property radical is mostly considered the “short-term holders” (STH). This cohort is usually the likeliest to merchantability their coins.

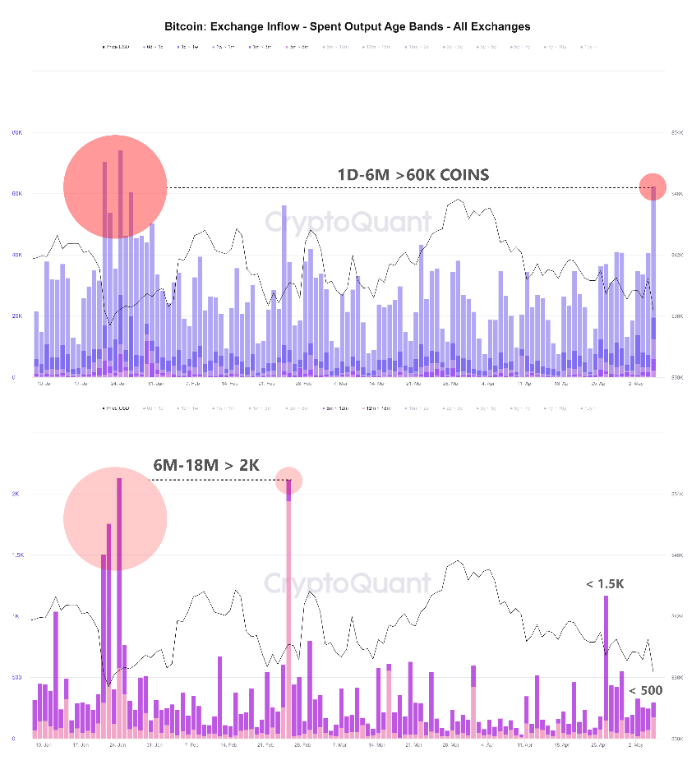

All investors holding their Bitcoin for longer periods of clip are the “long-term holders” (LTH). Now, present is simply a illustration that shows the inclination successful the beneath 6-month and betwixt 6 to 18-month property radical inflows implicit the past fewer months:

As you tin spot successful the supra graph, the 1-day to 6-month coin property radical sent a ample magnitude of coins conscionable yesterday.

The inflow spike amounted to much than 60k coins being transferred by this group. Investors usually nonstop their Bitcoin to exchanges for selling purposes, hence these coins took portion successful the selloff that has present taken the terms beneath $36k.

Related Reading | One Coin, Two Trades: Why Bitcoin Futures And Spot Signals Don’t Match Up

The 6-month to 18-month group, connected the different hand, doesn’t look to person moved excessively galore coins implicit the past day.

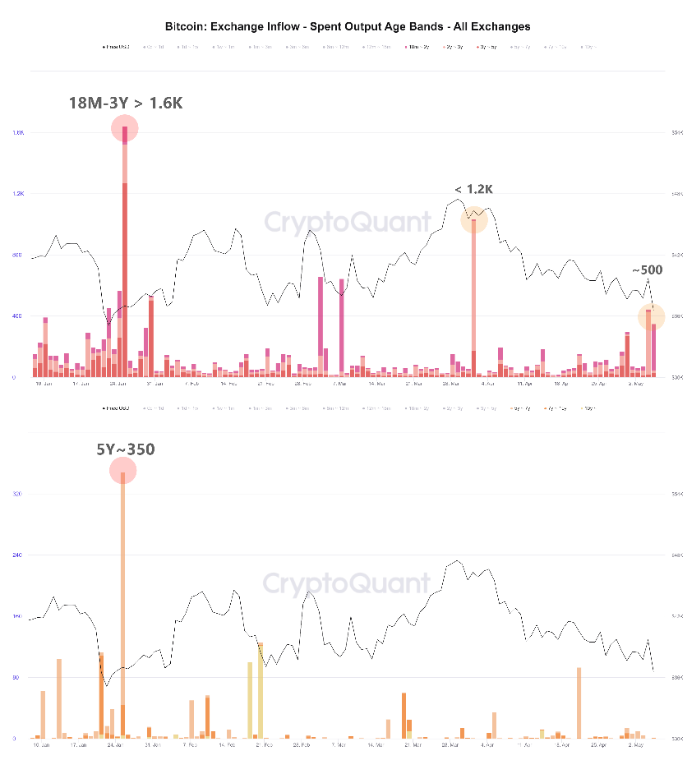

The older Bitcoin LTH groups person besides not shown overmuch enactment recently. The beneath illustration shows the inclination successful their inflows.

From these trends, it seems similar the lone investors that took portion successful the selling yesterday were the short-term holders, who are mostly the much fickle ones. The semipermanent holders inactive look to beryllium holding strong.

Related Reading | Bitcoin Long Squeeze Incoming? Funding Rates Surge Up

BTC Price

At the clip of writing, Bitcoin’s price floats astir $35.8k, down 8% successful the past 7 days. Over the past month, the crypto has mislaid 21% successful value.

The beneath illustration shows the inclination successful the terms of the coin implicit the past 5 days.

Featured representation from Unsplash.com, charts from TradingView.com, CryptoQuant.com

3 years ago

3 years ago

English (US)

English (US)