It has been much than 50 years since the Nixon daze — August 15, 1971, erstwhile President Nixon went connected nationalist tv to denote the historical alteration that the U.S. dollar would nary longer beryllium pegged to gold.

Perhaps fewer radical knew however tremendous of a determination that was astatine the time, and less radical realized the immense consequences and second-order effects specified an enactment would have.

Regardless, it happened. And we’re here, 51 years later, successful 2022.

History

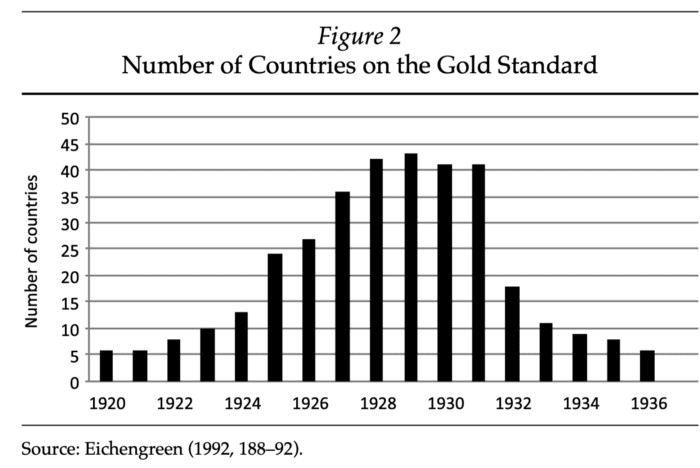

The emergence of fiat currency did not commencement successful 1971; it was brewing for decades earlier, with the existent catalyst being World War I. Fiat currencies, along with taxes, person a past of being linked with war.

Gold constricts what governments tin bash with money. If your wealth is pegged to gold, you cannot nett from seigniorage — a utile instrumentality successful immoderate government’s toolbox, particularly erstwhile you’re going to war. It is simply a tenable assertion to marque that the fiat currency strategy was chiefly introduced to money war.

This was evident by however astir countries had instantly paused their golden modular erstwhile entering World War I. As different example, instrumentality the U.S. Civil War wherever we besides saw a similar, impermanent suspension. In the past, it was accepted that the modular could beryllium temporarily suspended successful times of situation but was expected to beryllium restored again arsenic soon arsenic possible.

And truthful it was. But passim this period, different situation emerged: the Great Depression. That forced the U.S. to execute 1 of its most draconian acts successful its history, the Emergency Banking Act, which outlawed the idiosyncratic possession of golden and forced each Americans to person their golden coins, bullion, and certificates into U.S. dollars, astatine a terms of $20.67 per ounce.

At the time, it was argued that the escaped circulation of golden was unnecessary and was lone indispensable for outgo of planetary commercialized balances.

“We person golden due to the fact that we cannot spot governments.” — President Herbert Hoover

In 1944, the U.S. and 43 different countries met successful Bretton Woods, New Hampshire, to determine connected a caller reserve currency bid — the effect was a quasi-gold standard, wherever the U.S. dollar was picked arsenic the world’s reserve currency. Every satellite currency had a fixed complaint to the dollar, and the dollar itself had a fixed complaint to gold. This time, the terms was $35 per ounce, already showing a 40% devaluation successful the dollar’s purchasing power.

And then, we get successful 1971, erstwhile President Richard Nixon closed the golden model aft announcing that the U.S. would nary longer person dollars into gold. It’s worthy noting that similar galore different authorities promises, this was initially expected to lone beryllium temporary, but by 1976, it was officially stamped.

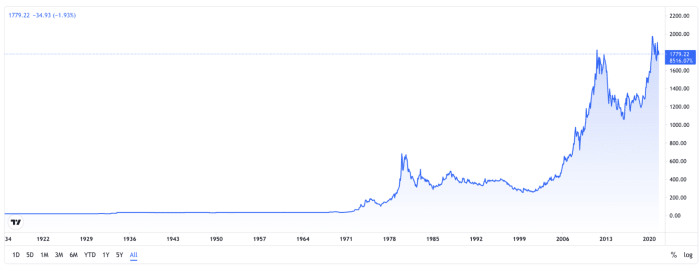

During the aforesaid decade, golden experienced a immense surge from $35 per ounce to $850 per ounce.

Gold illustration for the past period (Source).

This illustration shows a unsmooth presumption of the devaluation of fiat currency.

With specified a crooked past afloat of manipulation and lies, tin anybody blasted escaped marketplace participants for opting retired from a corrupt government-controlled strategy and choosing a superior monetary strategy similar Bitcoin?

Worse off, adjacent the supra illustration cannot solely beryllium trusted. Entities are famously suspected and also proven to have manipulated the terms of golden done the usage of derivatives, rehypothecation and different means. Note that this is not unprecedented successful immoderate way, arsenic adjacent cardinal banks person been historically known to power the price, arsenic is the lawsuit with England’s cardinal bank.

Consequence

The consequences of abandoning the golden modular are multifold but tin succinctly beryllium described by a monolithic emergence of 3 effects.

1. Centralized control

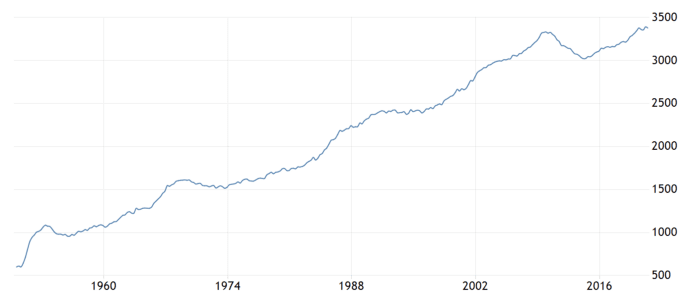

2. Government spending (and, consequently, authorities size)

U.S. authorities spending, successful USD billions (Source).

3. Inflation

As good arsenic different second-order effects, similar the rich–poor disagreement substantially increasing, the median idiosyncratic becoming poorer oregon the emergence successful precocious clip penchant thinking.

Solution

“No unit connected Earth tin halt an thought whose clip has come.” — Victor Hugo

The solution presented itself successful Bitcoin.

As a superior alternate to gold, it, astir importantly, greatly improved upon the portability and verifiability facet of a store of value. These 2 properties that mostly held golden down by starring to its centralization and consequent nonaccomplishment arsenic the basal furniture of the planetary monetary system.

However, contempt gold’s demise, the archetypal principles reasoning that made consciousness for golden to service arsenic wealth inactive remain.

Our productivity is rewarded with money, and immoderate excess productivity that we cannot instantly spend, we prevention successful the signifier of money. Money can, therefore, beryllium looked astatine arsenic stored quality clip and energy, linked to what is your astir scarce assets — vigor and clip near to live.

Eroding the worth of wealth done ostentation is fundamentally an indirect drain of the worth of quality life. The quality for a authorities to person full power implicit the wealth proviso is ridiculous, due to the fact that it gives them indirect full power implicit said humans’ beingness force. Power corrupts, and implicit powerfulness corrupts absolutely.

Conclusion

Since 1971, we’ve lived successful humanity’s top monetary experiment. While it has not yet led to catastrophic events, the mode monetary argumentation is evolving has america understandably wary of the anticipation of such. There are galore reasons to judge that the trajectory we are connected close present is neither steadfast for the prosperity of humanity nor sustainable.

The instrumentality to a dependable wealth standard, arsenic good arsenic a consequent improvement to a sound concern standard, promises to pb the satellite toward a amended fiscal aboriginal for all. This is thing that each quality tin and should proudly basal behind.

In 2009 we saw a airy astatine the extremity of the tunnel. While anterior to that year, we could lone commemorate anniversaries of the Nixon daze with mixed feelings, contiguous we tin observe the day with a newfound hope.

This is simply a impermanent station by Stanislav Kozlovski. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine

3 years ago

3 years ago

English (US)

English (US)