On-chain information shows the Bitcoin shrimp proviso has continued to emergence recently, which tin beryllium affirmative for the BTC ecosystem.

Bitcoin Shrimps Now Hold 6.7% Of The Entire Circulating Supply

According to information from the on-chain analytics steadfast Glassnode, the BTC shrimps person added 1.78% of the cryptocurrency’s proviso to their holdings since the LUNA clang past year.

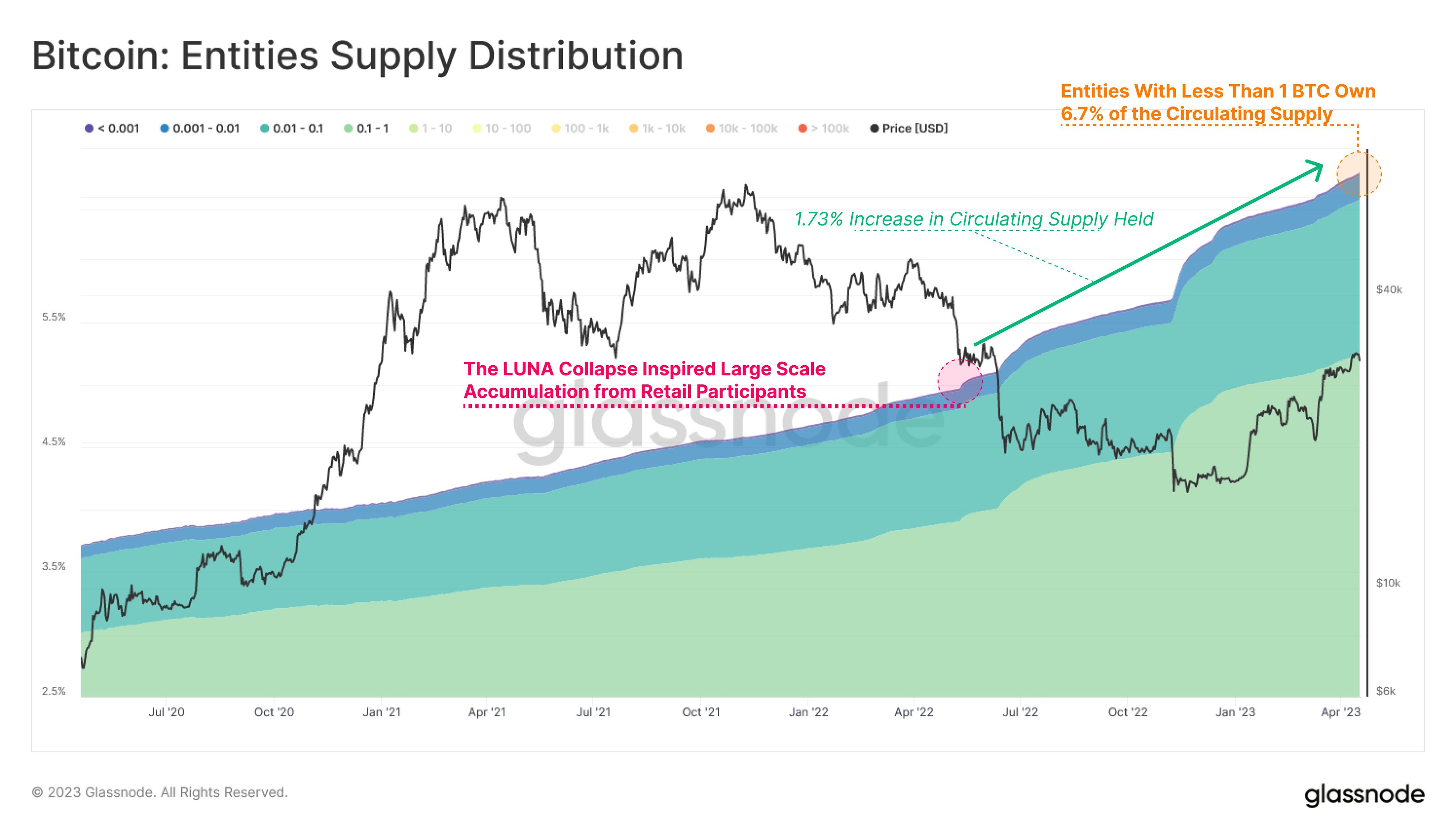

The applicable indicator present is the “Entities Supply Distribution,” which measures the full percent of the Bitcoin proviso that each entity radical successful the marketplace is presently holding.

Investors are divided into these entities based connected the full fig of coins they transportation successful their wallets. For example, the 0.001 to 0.01 radical includes each addresses holding astatine slightest 0.001 and 0.01 BTC.

When the Entities Supply Distribution metric is applied to this circumstantial group, it tells america astir the percent of the BTC proviso that the amounts of wallets falling successful this scope adhd up to.

The “shrimps” are holders with little than 1 BTC successful their wallet balances. This means that this cohort includes each entity groups successful the 0 to 1 scope (to beryllium much precise, 4 groups satisfying this condition: little than 0.001, 0.001 to 0.01, 0.01 to 0.1, and 0.1 to1).

Here is simply a illustration that shows the Entities Supply Distribution for the entities belonging specifically to the shrimps’ cohort:

As displayed successful the supra graph, the percent of the full Bitcoin circulating proviso held by the shrimps has notably accrued during the past twelvemonth oregon so. As a whole, these investors present clasp 6.7% of the full BTC supply.

The shrimps correspond the retail capitalist conception of the BTC market, truthful their proviso rising up during this play implies that retail information has been expanding successful the sector.

The percent of the proviso held by these smallholders had already accrued during the preceding mates of years, but the maturation had been slower. In the past year, a fewer events person resulted successful the maturation of this cohort to accelerate.

The illustration shows that the archetypal of these was the LUNA collapse backmost successful May 2022, portion the 2nd 1 was the 3AC bankruptcy, which took spot lone a fewer weeks later. The astir important effect appears to person been from the FTX clang backmost successful November, arsenic the proviso held by these holders rapidly roseate soon aft it occurred.

Accumulation from retail investors tin beryllium constructive for the Bitcoin marketplace successful the agelong word arsenic it represents maturation successful the adoption of the cryptocurrency. Adoption mostly provides a coagulated instauration for the sector, connected which aboriginal terms moves tin sustainably assistance disconnected from.

BTC Price

At the clip of writing, Bitcoin is trading astir $29,300, up 2% successful the past week.

Featured representation from Kanchanara connected Unsplash.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)