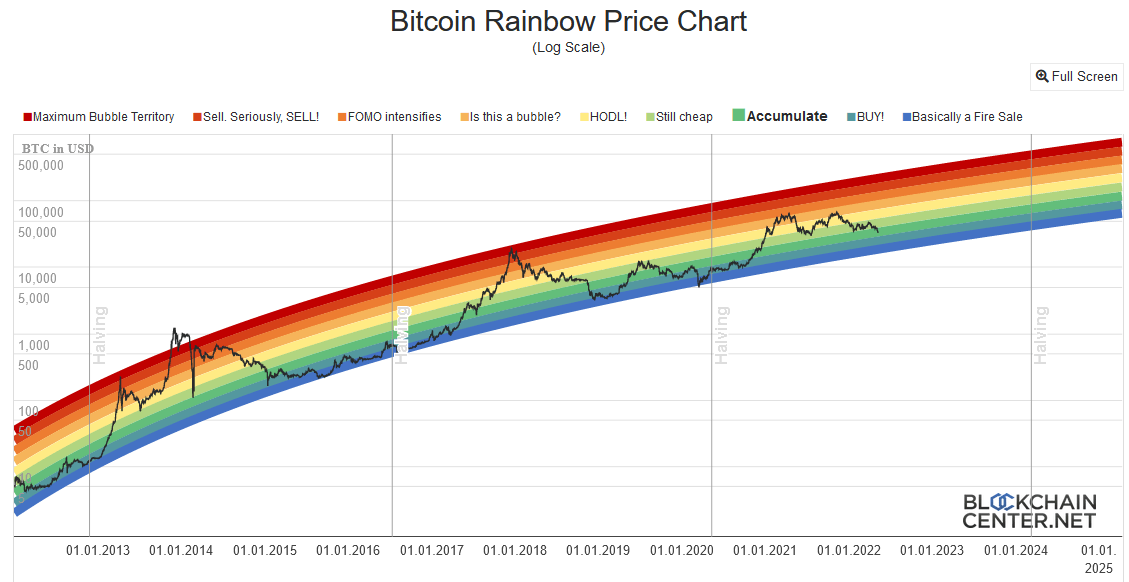

The Bitcoin Rainbow Chart is present successful the 'Accumulate' zone, but investors are cautious fixed the antithetic macroeconomic climate.

Cover art/illustration via CryptoSlate

The Bitcoin Rainbow Chart dips into the ‘Accumulate’ portion pursuing a miserable tally of six consecutive play reddish candles. As of property time, Bitcoin (BTC) was trading astatine $31,368.20.

Since May 5, BTC has mislaid 21% successful value, dropping from $39,600. Monday saw further merchantability unit arsenic bears pushed Bitcoin to $30,000 for the archetypal clip since July 2021.

Source: blockchaincenter.net

Source: blockchaincenter.netWith the Fear and Greed Index sinking to 10, heavy wrong ‘extreme fear’ territory, galore wonderment whether it’s clip to accumulate oregon liquidate.

On that, Crypto Rover tweeted to his 200,000+ Twitter followers that his fiscal occurrence came astir by accumulating Bitcoin during carnivore markets.

I became a millionaire owed to accumulating successful #Bitcoin carnivore markets.

Future millionaires are made successful these challenging times. 🚀

— Crypto Rover (@rovercrc) May 8, 2022

However, markets cannot disregard the dire economical outlook and informing signs.

Bitcoin merchantability unit mounting

Fears of a instrumentality to crypto wintertime are rising arsenic prices proceed to plunge. The play sell-off continued to May 9, with Bitcoin bulls incapable to support the $34,000 level.

Although myriad factors are successful play, the astir important is the menace of ostentation and however cardinal banks are apt to accelerate assertive complaint increases to combat the problem.

Following the Fed’s 50 ground point hike of the involvement complaint past week, crypto markets reacted with an archetypal crisp drop, losing $132 cardinal successful full marketplace cap. Since then, a continuation downwards followed, albeit astatine a much measured gait than previously.

The existent full crypto marketplace headdress is $1.466 trillion, which represents a 20% drop, implicit 5 days, from the section high.

Stay oregon go?

The Bitcoin Rainbow Price Chart shows the terms of BTC connected a log scale. The rainbow constituent represents an precocious and little band, with zones successful betwixt to signify 9 antithetic statuses ranging from ‘Maximum Bubble’ to ‘Fire Sale.’

Price enactment should beryllium contained wrong the precocious and little bands of the rainbow. However, determination person been 2 chiseled instances wherever the terms moved beyond the limits.

First, successful November 2013, earlier returning beneath the precocious set and past backmost supra the precocious bounds again successful December 2013. And different clip successful March 2020 (covid crash), wherever BTC dipped marginally beneath the little band.

The expectations are that the Bitcoin terms volition enactment wrong the bands. Considering its approximate position, the little band, oregon worst-case scenario, would springiness a bottommost of astir $20,000 successful the abbreviated term.

Blockchaincenter.net says the Rainbow Chart is simply a amusive mode of looking astatine terms movements and should not beryllium taken arsenic concern advice.

Bill Noble, Chief Technical Analyst astatine Token Metrics, said, “don’t panic and puke,” adding that size positioning is cardinal to tolerating the volatility connected whether to accumulate oregon liquidate during these investigating times.

Meanwhile, Unocoin co-founder Sathvik Vishwanath thinks mean and semipermanent hodlers should not interest themselves with short-term fluctuations.

3 years ago

3 years ago

English (US)

English (US)