Bitcoin (BTC) has been battered by a relentless carnivore marketplace implicit the past month, with its terms tumbling 20% from its grounds highs. However, amidst the carnage, glimmers of anticipation look arsenic salient analysts foretell a imaginable bottommost forming astir the existent $57,000 mark.

Tough Opening Month For Bitcoin

The commencement of May has not been benignant to Bitcoin. The once-dominant cryptocurrency has seen a dependable decline, plunging backmost to levels past witnessed successful March earlier its monumental surge to $73,700. This caller terms driblet represents the astir important diminution of this cycle, raising concerns astir a prolonged carnivore market.

The symptom extends beyond Bitcoin, with the broader altcoin marketplace feeling the tremors. Litecoin (LTC), the metallic to Bitcoin’s gold, has mirrored the downward trend, shedding a staggering 25% of its worth successful the past month. While historically seen arsenic a much unchangeable alternate to Bitcoin, Litecoin seems to beryllium tethered to its large brother’s destiny successful this existent downturn.

Finding The Bottom: Bullish Predictions Surface

Despite the prevailing gloom, a chorus of optimism is rising from the crypto investigation community. Several heavyweight analysts judge Bitcoin whitethorn person recovered its footing astir the existent terms scope of $56,000 to $58,000.

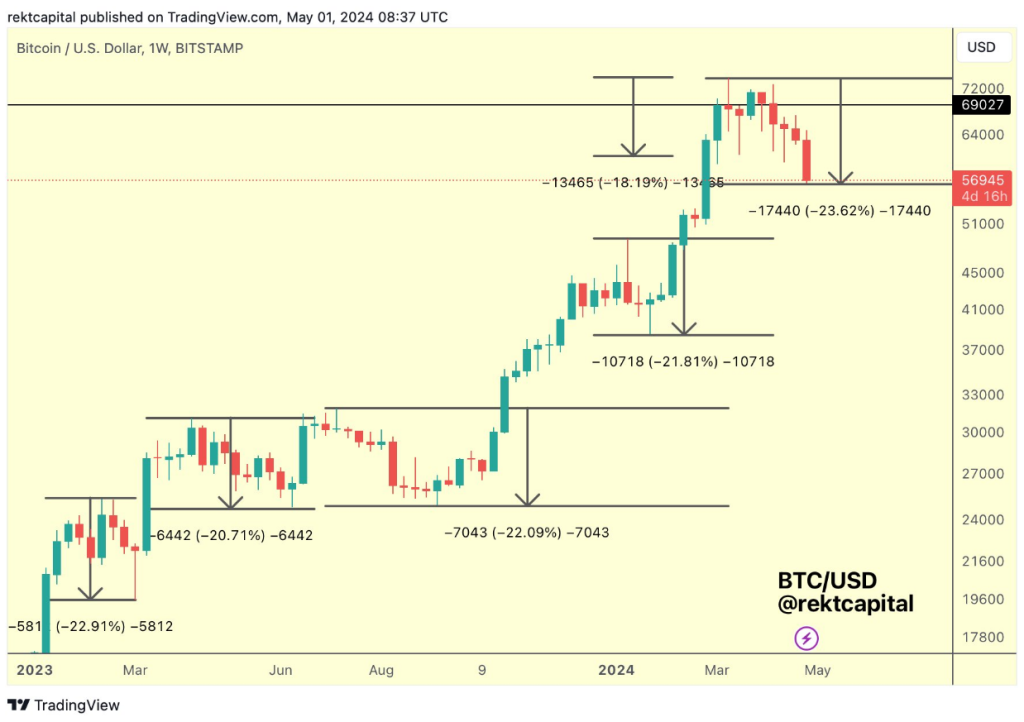

Rekt Capital, a fashionable crypto analyst, emphasizes a humanities signifier wherever akin 20% dips person been followed by important rebounds. Michaël van de Poppe, different well-respected voice, echoes this sentiment, suggesting Bitcoin whitethorn beryllium nearing the extremity of its terms consolidation phase. He cautions of imaginable short-term fluctuations but highlights the $56,000 to $58,000 portion arsenic a important enactment level.

This is officially the deepest retrace successful the rhythm (-23.6%)$BTC #BitcoinHalving #Bitcoin pic.twitter.com/Gcapbl0Nu6

— Rekt Capital (@rektcapital) May 1, 2024

Uncertainty Looms As Market Awaits Fed Decision

While expert optimism is simply a invited sign, a unreality of uncertainty hangs implicit the crypto market. The upcoming Federal Reserve determination connected involvement rates could importantly interaction capitalist sentiment and, consequently, Bitcoin’s terms trajectory. A much hawkish stance from the Fed could trigger further selling, portion a dovish attack mightiness supply the tailwind needed for a Bitcoin rebound.

Related Reading: Ethereum Fees Dive: Will This Spark A Surge In Network Activity?

Buckle Up For A Bumpy Ride

The adjacent fewer weeks volition beryllium important for Bitcoin and the broader cryptocurrency market. The Federal Reserve’s determination and capitalist absorption to the existent terms slump volition apt dictate the short-term direction. While bullish sentiment suggests a imaginable reversal, the inherent volatility of the crypto marketplace means investors should brace for a bumpy ride.

Featured representation from Pixabay, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)