Bitcoin terms fell to 4-month lows beneath $100,000 arsenic sellers wholly overwhelmed buyers, and analysts speculated that “dead bodies” from the Oct. 10 sell-off are yet opening to surface.

Key points:

Bitcoin falls to 4-month lows beneath $100,000 arsenic sellers capitulate and spot BTC ETF outflows increase.

Traders pinpoint the $88,000 to $95,000 scope arsenic a imaginable bottom.

Bitcoin (BTC) selling intensified connected Tuesday arsenic BTC abruptly fell to 4-month lows of $100,800. While analysts crossed the abstraction look to beryllium scratching their heads astir the nonstop reasons for the existent selling, determination is statement that BTC terms could gaffe lower, perchance bottoming astir $95,000.

Popular trader, HORSE, traded the pursuing illustration and suggested a bottommost could beryllium approaching, if $100,000 proves not to beryllium “a trap.”

Liquidation heatmap information from Hyblock shows leveraged agelong positions astatine $100,000 are astatine hazard of absorption, followed by comparatively bladed liquidity until $88,000.

On the different hand, crypto media property and trader Scott Melker posted a cryptic tweet, noting that Bitcoin “has definitively mislaid the play 50-MA arsenic enactment 4 times successful history,” and Melker noted that each clip BTC terms mislaid this moving average, “price went connected to trial the 200-MA.”

Melker said,

“Price is presently $700 supra the 50MA. The 200 MA is sitting astir $55,000 (and rising).”Another prevailing mentation making the rounds connected X is that a scope of nonrecreational and institutional-level entities saw their portfolios crippled by the Oct. 10 crypto marketplace sell-off, which resulted successful $20 cardinal successful Bitcoin positions being liquidated and an adjacent larger fig crossed the full market.

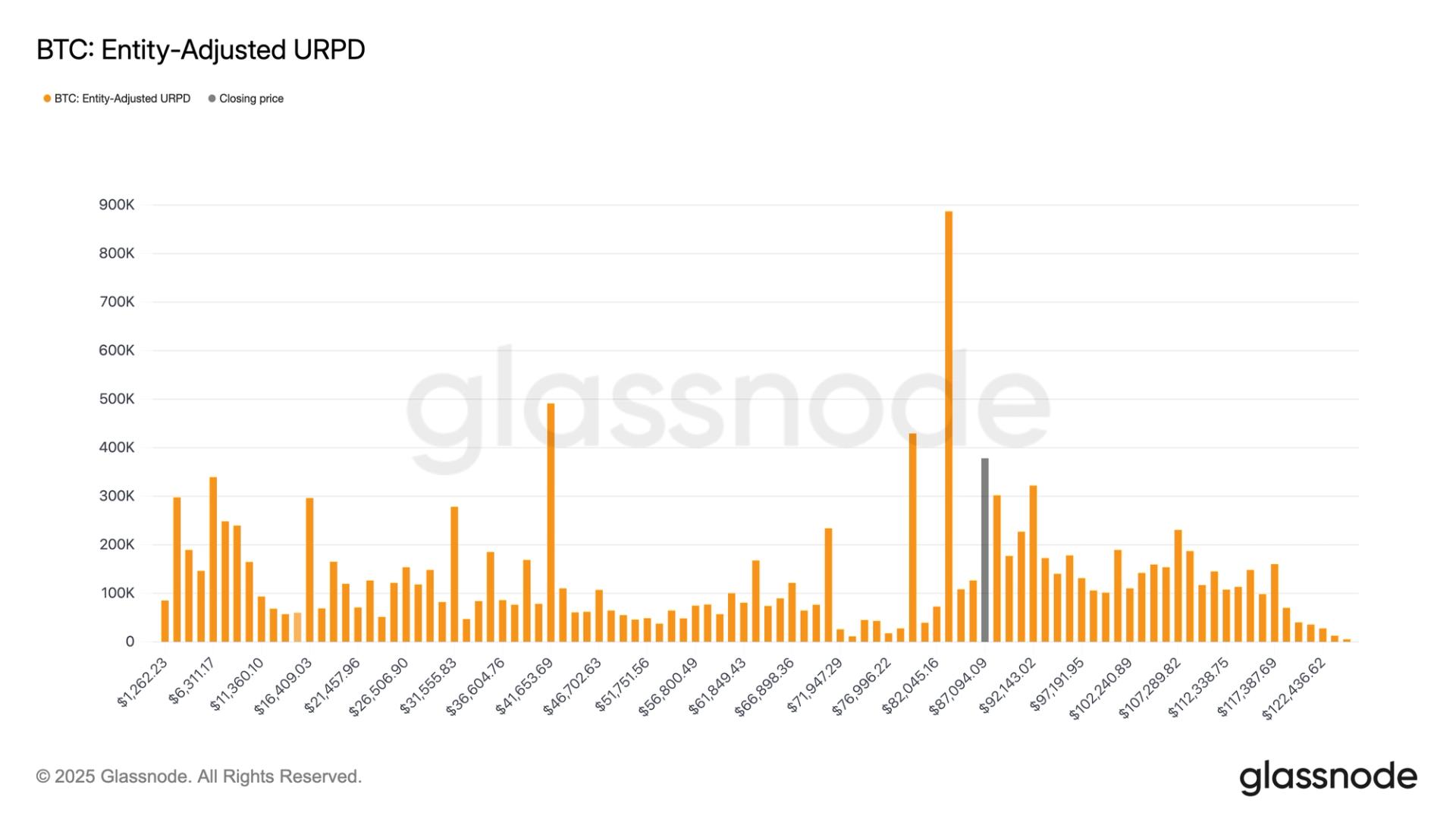

Analysts similar options trader Tony Stewart person suggested that these crippled funds are the root of Tuesday’s overwhelming selling crossed Bitcoin markets and that portion the entities stay chartless astatine the moment, “there volition by present beryllium ample firms that tin spot the blurred assemblage representation underwater.”

In the post, Stewart explains however to pinpoint which funds are nether duress and what this could mean for Bitcoin terms going forward.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 month ago

1 month ago

English (US)

English (US)