Bitcoin (BTC) slumped to its enactment level of $45,000 connected Wednesday greeting adjacent arsenic on-chain information shows that wide buying enactment remained positive.

The autumn came amid a planetary selloff driven by hawkish comments from U.S. Federal Reserve (Fed). Fed Governor Lael Brainard said curbing ostentation was “paramount,” hinting astatine trimming the cardinal bank’s equilibrium expanse successful May. This led to a merchantability disconnected successful the marketplace arsenic investors feared a restrictive situation could pb to an economical downturn.

The S&P 500 ended 1.26% little connected Tuesday 1.26%, portion technology-heavy Nasdaq dropped 2.26%. The downturn dispersed implicit to Asia this morning, with Japan’s Nikkei 225 falling 1.48% and Hong Kong’s Hang Seng dropping 1.15%

Weakness successful the apical cryptocurrency led to a broader autumn successful the crypto market. In the past 24 hours, ether (ETH), Solana’s SOL, and XRP fell 5%, portion Avalanche’s AVAX and Polkadot’s DOT fell implicit 6%. Dogecoin’s DOGE was the lone gainer among majors, buoyed by optimism astir Elon Musk’s assignment to the committee of societal media level Twitter (TWTR), which is being viewed arsenic a affirmative motion for the memecoin.

Bitcoin’s slump comes a week aft the plus touched three-month highs of $48,000. It fell to $44,500 – a level that has seen buying enactment – for the 2nd clip this week, breaking done which could spot a driblet to $43,000.

Bitcoin bounced from $44,500 earlier successful the week. (TradingView)

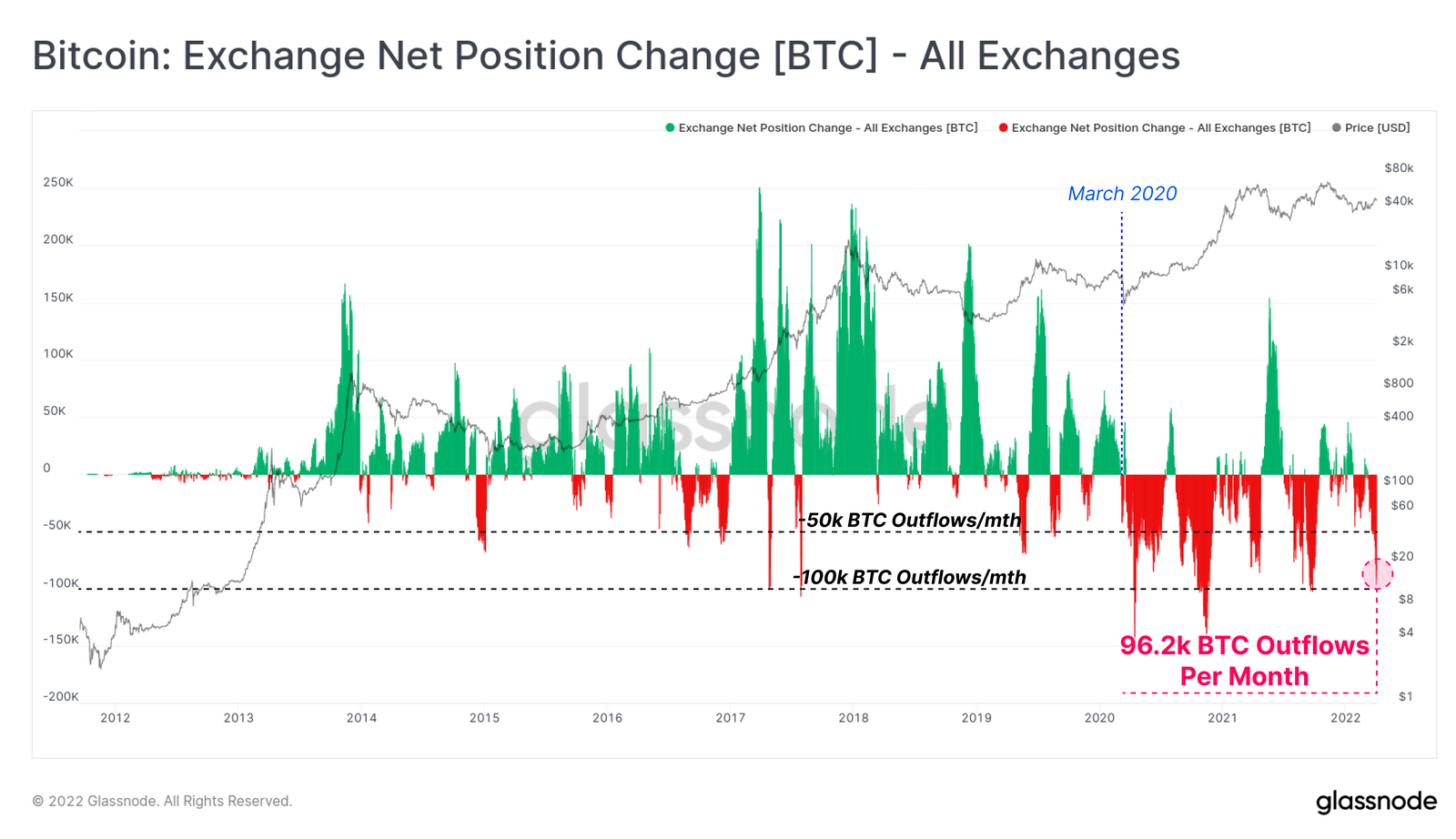

Buying enactment connected bitcoin continued to emergence connected organization request adjacent arsenic terms enactment remained volatile implicit the past fewer weeks, analytics steadfast Glassnode pointed retired successful a note this week.

“Inflows into wrapped WBTC, Canadian ETFs, and wide capitalist accumulation on-chain has been historically strong, particularly pursuing the section terms lows acceptable connected 22-January,” the enactment read.

Data amusement crypto exchanges saw important cryptocurrency outflows, with the likes of bitcoin seeing outflows of astir 96,000 bitcoin each month. Such enactment signaled “historically beardown accumulation” was taking place, Glassnode said.

Exchanges person seen 96,000 bitcoin withdrawn successful the past month. (Glassnode)

Over successful Canada, Bitcoin ETF products continued to spot inflows with full holdings expanding by 6,594 bitcoin – implicit $300 cardinal astatine existent prices – since January 2022, arsenic per Glassnode. Canadian ETFs present clasp immoderate 69,052 bitcoin.

ETFs, oregon exchange-traded funds, are a benignant of pooled concern information that tin beryllium traded connected exchanges akin to stocks, but without investors owning the underlying asset. Some said ETF request came connected the backmost of governmental tensions successful Eastern Europe, specified arsenic the ongoing Russia-Ukraine war.

“The maturation successful the influx is grounds of the increasing spot successful the capabilities of Bitcoin,” said Alexander Mamasidikov, co-founder of integer slope MinePlex, successful a Telegram message. “The continuous maturation of the Canadian ETF products is grounds of however fashionable bitcoin ETFs tin beryllium and the affirmative outlook is bound to gully much investors' funds into the integer currency to assistance support terms stableness oregon illustration a mild maturation successful the adjacent term.”

Others accidental bitcoin request would lone proceed arsenic morganatic products, specified arsenic ETFs, summation further popularity.

“Having an ETF with Bitcoin arsenic the underlying plus volition decidedly boost assurance for investments,” said Claudiu Minea, co-founder of blockchain crowdfunding level SeedOn, successful an email to CoinDesk. “This mightiness person a affirmative interaction connected the astir skeptical investors, that mightiness person considered cryptocurrencies a mediocre investment.”

“Many nationalist companies specified arsenic Microstrategy oregon Tesla already ain a sizeable Bitcoin portfolio, portion others are looking into diversifying their portfolio to see cryptocurrencies arsenic well,” Minea added.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)