Bitcoin Spot ETFs are gunning for a caller record aft an unthinkable commencement to the caller week. The terms of BTC has risen 8% successful the past day, and this has caused euphoria successful the market. There could beryllium a fig of factors down this; however, organization investors look to beryllium playing a large relation arsenic regular inflows proceed to rise.

Spot Bitcoin ETF Inflows Cross $400 Million

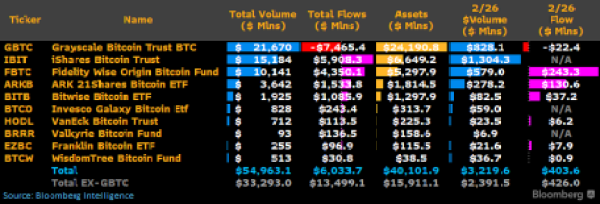

According to Bloomberg expert James Seyffart, the Spot BTC ETF inflows are not slowing down. In a screenshot shared by the expert connected Tuesday, Seyffart reveals that inflows into Spot BTC ETFs climbed supra $400 million.

The representation shows that the Fidelity Wise Origin Bitcoin Fund is starring the complaint with $243.3 cardinal successful inflows, which accounts for much than 50% of the full inflow. The ARK 21Shares Bitcoin ETF follows down with important inflows of $130.6 million. The third-largest inflow to a azygous money for the time was recorded successful the Bitwise Bitcoin ETF, which saw $37.2 cardinal successful inflows.

Other funds, including the Franklin Bitcoin ETF, VanEck Bitcoin Trust, and the WisdomTree Bitcoin Fund, each saw insignificant inflows of $7.9 million, $6.2 million, and $0.9 million, respectively. In total, the inflows to each six funds came retired to $426 million.

However, the Grayscale Bitcoin Trust (GBTC) continues to bleed during this time, with outflows of $22.4 cardinal successful the 24-hour period. This brought the full nett flows to $403.6 million. At the aforesaid time, funds specified arsenic the iShares Bitcoin Trust, the Invesco Galaxy Bitcoin ETF, and The Valkyrie Bitcoin Fund each saw negligible inflows during this clip frame.

Gunning For A New Record

The inflows into the Bitcoin Spot ETFs implicit the past time are a testament to the request that these products are getting from the market. With organization investors gaining much vulnerability to BitBTCcoin, request is expected to rise, particularly arsenic the BTC terms continues to bash well.

The inflow volumes, portion not the largest single-day inflows truthful far, are important erstwhile measured up to others. For example, Seyffart points retired that the regular grounds was from the archetypal time of trading erstwhile inflows climbed arsenic precocious arsenic $655 million. The second-largest single-day nett travel was past recorded earlier successful the period connected February 13 with $631 million. “A large time from $IBIT could propulsion america beyond that Day 1 record,” Seyffart declared.

At the clip of writing, the BTC terms is experiencing a retracement aft reaching a caller 2-year precocious of $57,000. It has seen 8.58% gains successful the past 24 hours to commercialized astatine $55.900, according to information from CoinMarketCap.

Featured representation from U.Today, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)