On Tuesday, the crypto marketplace was taken by tempest erstwhile a tweet emerged from the authoritative X (formerly Twitter) relationship of the United States Securities and Exchange Commission (SEC) saying each Spot Bitcoin ETF applications had been approved. This had been initially followed by a surge successful terms but this was short-lived arsenic the terms would clang soon after. The crushed for this was due to the fact that Gary Gensler, president of the Commission, revealed that the tweet was fake and the regulator’s societal media relationship had been compromised.

SEC Hack Triggers $220 Million In Liquidations

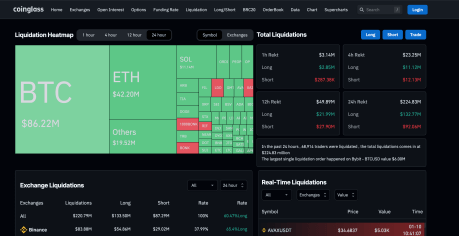

In the aftermath of the chaotic Bitcoin terms fluctuations that were triggered by the SEC’s hack, a ample fig of crypto traders recovered themselves with monolithic losses connected their hands. According to data from CoinGlass, implicit $220 cardinal person been liquidated successful the past 24 hours, starring to the second-largest liquidation lawsuit truthful acold successful 2024.

The website besides notes that implicit 70,000 traders were victims of this liquidation lawsuit arsenic well. Also, fixed that the terms of Bitcoin and different assets successful the crypto market had seen terms fluctuations successful some directions, some agelong and abbreviated traders were affected.

However, fixed that the clang to the downside has persisted for longer, agelong traders person travel retired arsenic the radical with the astir liquidations during this time. Out of the much than $220 cardinal successful liquidations recorded, agelong trades made up 60.47% with $133.5 million, portion the measurement of abbreviated liquidations came retired to $87.29 cardinal for the aforesaid clip period.

Bitcoin saw the largest azygous liquidation bid during this clip arsenic good which took spot connected the ByBit exchange. A azygous commercialized worthy $6 cardinal was liquidated crossed the BTCUSD trading pair, with full liquidations connected the crypto speech coming retired to $36.66 million. This falls down marketplace person Binance with $83.88 cardinal and OKX with $73.97 million.

Spot Bitcoin ETF Is A Sell The News Event?

The statement of whether the Spot Bitcoin ETF support has already been priced successful and if an announcement volition pb to a diminution successful terms has been waxing stronger implicit the past fewer weeks. Experts person chimed successful to springiness their thoughts connected what volition travel an approval.

Crypto expert Andrew Kang believes that support would pb to a scramble among applicants to drawback arsenic overmuch arsenic imaginable from the $10 cardinal to $20 cardinal expected to travel from fees. As such, they volition each beryllium astatine the forefront of marketing to propulsion their ETFs.

On the flip side, renowned economist, Peter Schiff, believes that a spot ETF would really not beryllium bully for the asset. Apparently, the advent of a spot Bitcoin ETF would mean that determination is nary longer immoderate bully quality to trigger a terms rally. As such, it would crook into a ‘sell the news’ event.

However, if the show from Tuesday is thing to spell by, it could mean that the ETF is already priced successful fixed that determination was a diminution successful price, adjacent earlier the SEC dismissed the tweet from the hacked account.

Featured representation from SoFi, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)