After a almighty breakout past week that pushed Bitcoin into a caller all-time high of $118,667, the world’s starring cryptocurrency appears to beryllium taking a breather. As of the clip of writing, Bitcoin is trading astir $117,953, somewhat beneath its caller peak. The determination followed a drawstring of consecutive regular gains arsenic bullish momentum swept crossed the crypto industry.

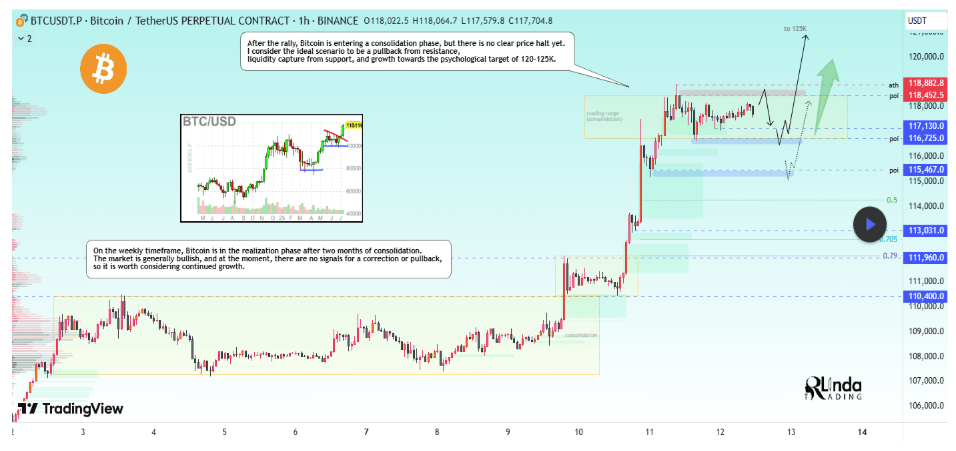

In a method investigation shared connected the TradingView platform, crypto expert RLinda pointed retired 2 scenarios that whitethorn play retired implicit the coming days and weeks, depending on however Bitcoin reacts to adjacent absorption and enactment levels.

Support Zones Could Affect Bitcoin’s Next Big Move

RLinda’s method analysis begins with identifying the value of Bitcoin’s caller all-time high. Although Bitcoin has entered what seems to beryllium a consolidation phase, there’s nary confirmed apical conscionable yet. The marketplace operation still favors bullish continuation, particularly considering Bitcoin is conscionable coming retired of a prolonged two-month consolidation portion and entering a realization phase.

According to the 1-hour candlestick terms chart, Bitcoin is presently trading conscionable supra a enactment country beneath $117,500. If Bitcoin fails to clasp this zone, the starring cryptocurrency could footwear disconnected a cascade of corrections that could drive the terms to $115,500, past perchance to $114,300, and adjacent backmost to the erstwhile all-time precocious of $111,800.

Below that, the 0.5 and 0.705 Fibonacci levels astir $113,031 and $111,960 respectively whitethorn enactment arsenic impermanent cushions. The past large antiaircraft bargain portion is astir $110,400, wherever bulls whitethorn measurement successful for a bounce. Basically, what this means is that if Bitcoin loses the enactment level astatine $115,500, it could gaffe backmost to $110,000 earlier encountering different beardown bargain enactment zone.

Image From TradingView: RLinda

Bitcoin To $125K, But It Must Breach Resistance First

On the different hand, Bitcoin tin inactive propulsion supra $118,000 and summation to $125,000, but lone nether definite conditions. The information of the rally’s continuation depends chiefly connected Bitcoin registering a decisive regular adjacent supra $118,400 and $118,900. In her words, a regular adjacent supra these terms levels would hint astatine a “breakout of structure.” This, successful turn, would corroborate a modulation from consolidation into another impulsive signifier upward.

In essence, both the bearish and bullish outlooks beryllium connected however Bitcoin reacts astatine immoderate of the important zones, either enactment astatine $116,700 oregon absorption supra $118,400 earlier making a directional move. However, it is important to enactment that the consolidation aft past week’s rally could past for weeks oregon adjacent months, overmuch similar we’ve seen successful erstwhile rallies this cycle.

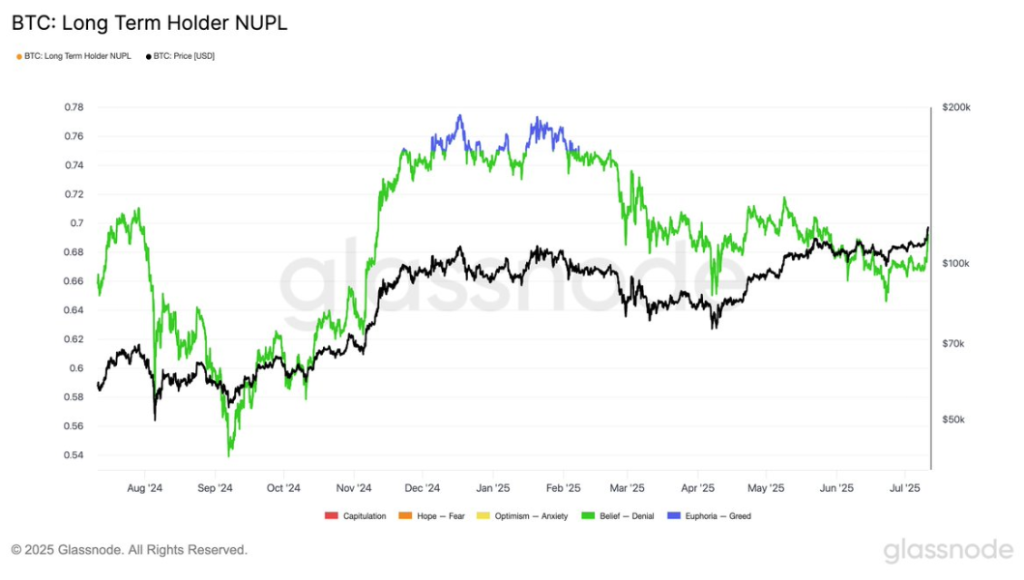

According to the Long-Term Holder Net Unrealized Profit and Loss (NUPL) metric from Glassnode, Bitcoin’s existent level of semipermanent profitability sentiment is astatine 0.69. This is notably beneath the 0.75 people associated with euphoric marketplace conditions, contempt Bitcoin having conscionable printed a caller all-time high.

Bitcoin spent astir 228 days supra the 0.75 euphoria threshold successful the erstwhile bull marketplace cycle. In contrast, this existent rhythm has lone seen astir 30 days supra that level, which suggests semipermanent holders person not yet afloat exited into nett and the starring cryptocurrency hasn’t reached overheated conditions.

Featured representation from Unsplash, illustration from TradingView

5 months ago

5 months ago

English (US)

English (US)