PlanB, the infamous creator of the stock-to-flow (S2F) exemplary for Bitcoin, has seemingly abandoned the HODL strategy successful favour of “quant investing” done ByBit.

In a tweet Friday, helium announced a “copy my trade” concern with ByBit that “outperforms buy&hold 100x.” An nonfiction detailing the strategy was released Monday via PlanB’s website.

The nonfiction connected quant investing is astir ready. It includes a trading regularisation that outperforms buy&hold 100x. You tin transcript my commercialized present (signup + deposit): https://t.co/8OI2agrLDD pic.twitter.com/jgW8AmCjlc

— PlanB (@100trillionUSD) August 5, 2022

PlanB and the Stock-to-Flow model

The S2F creator has amassed a ample pursuing online aft helium created the methodology by which galore investors speculate connected the aboriginal terms of Bitcoin.

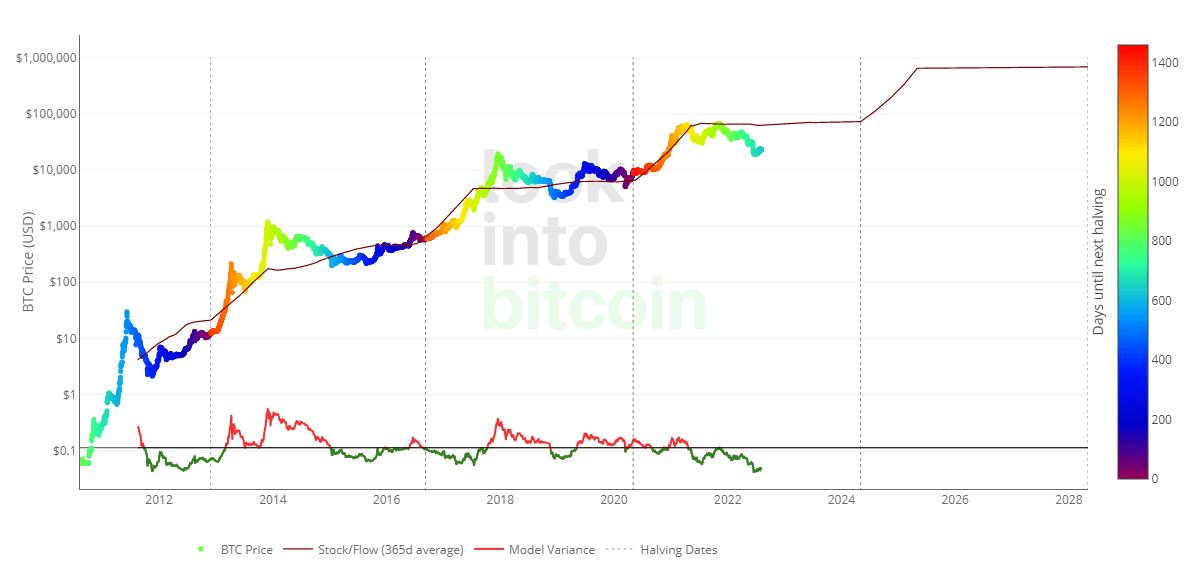

The exemplary is based connected the fixed proviso of Bitcoin and its predefined merchandise docket tied to Bitcoin halvings. According to the stock-to-flow model, the terms of Bitcoin volition scope adjacent to $1 cardinal by 2026.

Source: lookintobitcoin.com

Source: lookintobitcoin.comHistorically, the S2F exemplary has been amazingly accurate; however, during the caller bull run, determination has been an accrued fig of crypto natives who person renounced the theory’s legitimacy.

As acold backmost arsenic June 2021, Ethereum Founder Vitalik Buterin described those who judge successful the exemplary arsenic deserving “all the mockery they get.”

Stock-to-flow is truly not looking bully now.

I cognize it's impolite to gloat and each that, but I deliberation fiscal models that springiness radical a mendacious consciousness of certainty and predestination that number-will-go-up are harmful and merit each the mockery they get. https://t.co/hOzHjVb1oq pic.twitter.com/glMKQDfSbU

— vitalik.eth (@VitalikButerin) June 21, 2022

The methodology affirms that buying and holding Bitcoin offers the safest method to put successful Bitcoin owed to the presumption that it volition proceed to travel the predicted terms successful a fixed timeframe. The terms tin deviate from the exemplary implicit a acceptable period, but it volition yet instrumentality to the stock-to-flow enactment owed to the fixed proviso and organisation of coins.

Criticism of S2F has grown during the carnivore marketplace arsenic the terms of Bitcoin is present good beneath the model’s prediction and has been since December 2021.

Quant trading and 100x returns

PlanB appears to person taken the accidental to deviate from the “buy&hold” doctrine to beforehand a caller trading strategy successful conjunction with ByBit. His strategy allegedly volition bushed a HODL attack by “100x” and is disposable to transcript via ByBit present that his caller nonfiction connected “quant investing” has been released.

He claims helium is receiving “the aforesaid reactions arsenic erstwhile I published the S2F nonfiction successful March 2019.” Still, astir of the disapproval comes from those questioning the determination distant from HODLing and towards transcript trading, whereby PlanB volition so person a kickback from ByBit. The transcript trading leafage of ByBit’s website states that main traders tin person “up to 30% committee and 500 USDT successful bonuses.”

Funny to spot the aforesaid reactions arsenic erstwhile I published S2F nonfiction successful Mar2019 erstwhile BTC<$4K and I was calling for $55K. "scammer" "demand is not successful the model" "$55K impossible".

Now radical tin not ideate 100x B&H outperformance successful 10y and hatred exchanges. Let's hold for the article. https://t.co/tjDpqnA2Nx

— PlanB (@100trillionUSD) August 6, 2022

The quant trading strategy is outlined successful afloat successful PlanB’s nonfiction entitled Quant Investing 101.” The halfway doctrine appears to beryllium based connected trading the RSI levels of Bitcoin backtested implicit the past 10 years.

The trading regularisation PlanB is utilizing for the strategy is elaborate below.

“IF (RSI was supra 90% past six months AND drops beneath 65%) THEN sell,

IF (RSI was beneath 50% past six months AND jumps +2% from the low) THEN buy, ELSE hold.”

For further details connected however ITM options are utilized to optimize returns, spot the afloat nonfiction connected PlanB’s website.

Responsible strategies for “influencers.”

Hodlonaut, the writer of the Bitcoin Zine, Citadel21, tweeted their dismay astatine the conception of PlanB partnering with what they telephone a “leverage shitcoin casino” and reneging connected “buy and hold.”

Wait, americium I knowing this correctly? PlanB is telling radical to motion up with a leverage shitcoin casino truthful they tin transcript his trades and get 100x much btc than if they conscionable bargain and hold?

I indispensable beryllium misunderstanding something, right?

Right?

— hodlonaut

(@hodlonaut) August 7, 2022

(@hodlonaut) August 7, 2022

Cory Kilppsten of Swan Bitcoin, 1 of the archetypal to place issues astatine Celsius, went arsenic acold arsenic to telephone PlanB a “scammer.”

PlanBrandolini @100trillionusd is specified a charlatan scumbag. What an implicit joke. pic.twitter.com/9sbMgakoQ1

— Cory Klippsten (@coryklippsten) August 6, 2022

Crypto trader, Eric Wall, extended the sentiment that PlanB is nary longer applicable wrong the industry, claiming “Bitcoin maxis did not support this charlatan.”

Thankfully Bitcoin maxis did not support this charlatan… Saifedean, Adam Back, Caitlin Long, Vijay Boyapati, Pierre Rochard, Bitstein, Preston Pysh & a clump of others of the Swan-advisors, positive astir each Bitcoin podcasts were an irrelevant number successful the expansive strategy of things

— Eric Wall (@ercwl) August 7, 2022

Further, PlanB’s nonfiction connected quant investing raises an absorbing occupation arsenic it states that

“nothing successful this nonfiction is fiscal advice. All contented is for informational and acquisition purposes only.”

However, the nonfiction has been identified arsenic a precursor to his transcript trading strategy connected ByBit. So, portion PlanB whitethorn beryllium stating that helium is not giving concern advice, helium is past promoting users to travel this strategy by copying his “quant investing” trades.

PlanB claims to beryllium offering the accusation connected his trades for escaped connected Twitter, allowing for a “DIY” option. Further, helium confirms that helium is trading lone 10% of his portfolio “mainly due to the fact that of recognition risk.”

The station Bitcoin Stock-to-Flow exemplary creator PlanB promotes ‘quant investing’ via ByBit to ‘100x’ HODL strategy appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)