The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

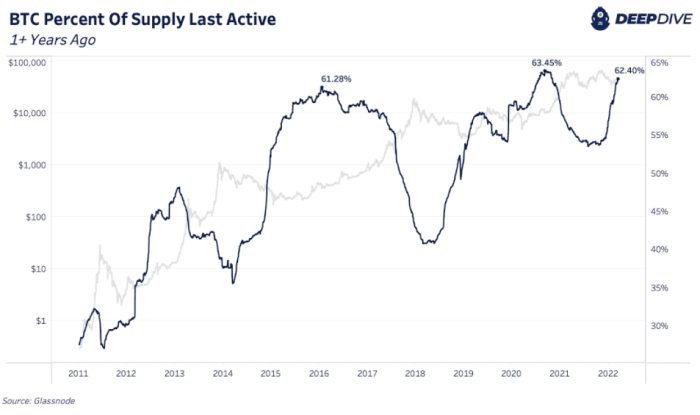

Despite our cautious macroeconomic outlook, bitcoin proviso broadside dynamics look highly strong. The magnitude of bitcoin arsenic a percent of circulating proviso that hasn’t moved successful 1 twelvemonth oregon much is astir 1% distant from all-time precocious levels.

Previous occasions of one-plus twelvemonth dormant proviso astatine akin levels predated bull markets. While macroeconomic conditions were markedly antithetic during these periods, we find this to beryllium highly notable nonetheless, showing conscionable however choky the proviso broadside of the bitcoin marketplace presently is.

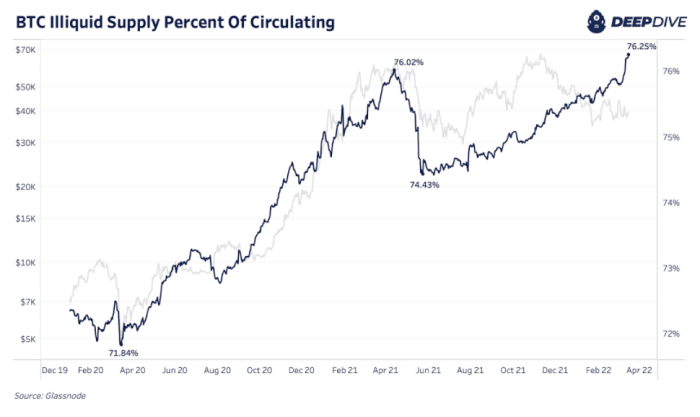

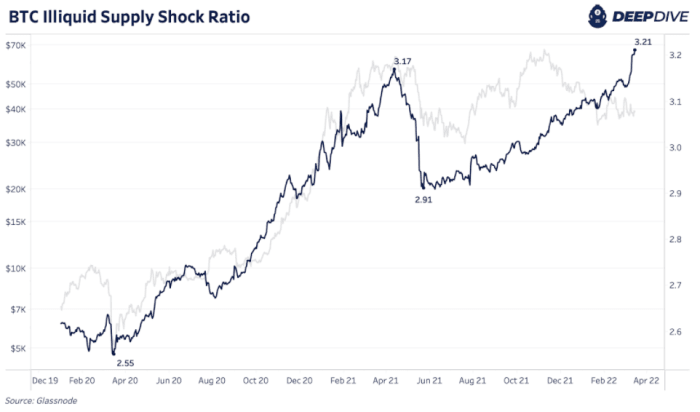

Next, we tin spot that illiquid proviso continues to increase, displaying a akin trend. Even successful this drawdown, illiquid proviso percent of circulating proviso has surpassed 2021’s precocious of 76.02% to 76.25%. Another mode to presumption that dynamic is done the Supply Shock Ratio (illiquid proviso implicit the sum of highly liquid and liquid supply) which continues to amusement the spot of illiquid proviso maturation comparative to the remainder of supply.

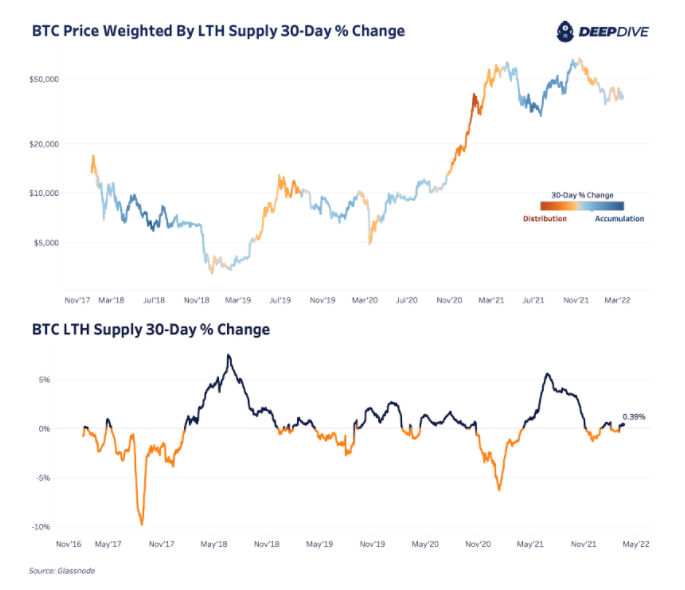

Long-term holders proceed mean accumulation and/or short-term holder proviso has aged into semipermanent holder supply. For context, the accumulation happening contiguous is magnitudes little than the level of accumulation we saw successful June to September 2021. Regardless, it’s inactive a affirmative on-chain motion to spot semipermanent holder proviso neutral-to-rising successful the existent macro environment.

Another mode to look astatine this dynamic is the semipermanent holder nett presumption alteration implicit the past 30 days wherever semipermanent holder proviso has changed small since November 2021. Long-term holder proviso accrued by 52,648 coins implicit the past 30 days comparative to the highest of astir 630,000 coins successful June 2021. That June 2021 play besides follows 1 of the largest semipermanent holder organisation periods (selling into higher prices) successful the past 5 years.

3 years ago

3 years ago

English (US)

English (US)