On-chain information shows the magnitude of Bitcoin proviso successful nonaccomplishment has present reached levels akin to during the COVID clang and the 2018 carnivore marketplace bottom.

Bitcoin Supply In Loss Spikes Up Following The Latest Crash

As pointed retired by an expert successful a CryptoQuant post, the BTC proviso successful nonaccomplishment has acceptable a caller grounds for this twelvemonth pursuing the FTX disaster.

The “supply successful loss” is an indicator that measures the full magnitude of Bitcoin that’s presently being held astatine immoderate loss.

This metric works by looking astatine the on-chain past of each coin successful the circulating proviso to spot what terms it was past moved at.

If this erstwhile terms for immoderate coin was much than the existent BTC value, past that peculiar coin is successful immoderate unrealized nonaccomplishment close now, and the indicator accounts for it.

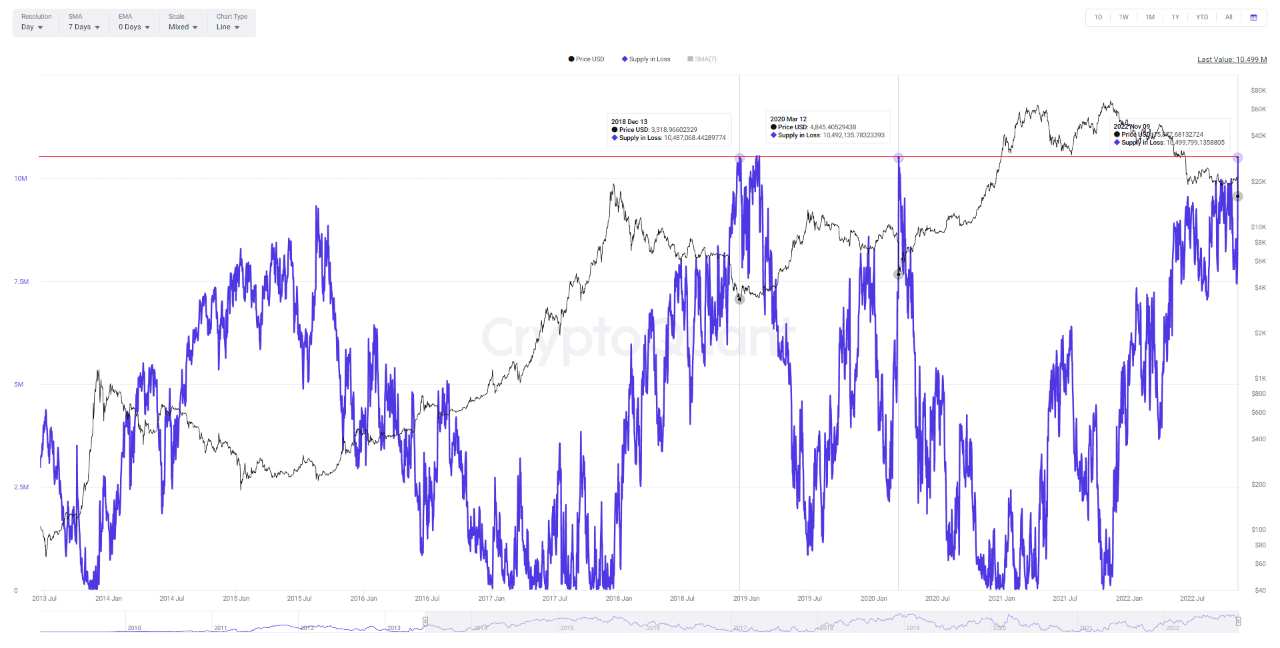

Now, present is simply a illustration that shows the inclination successful the 7-day moving mean Bitcoin proviso successful nonaccomplishment implicit the past of the crypto:

As you tin spot successful the supra graph, the Bitcoin proviso successful nonaccomplishment has sharply risen up implicit the past mates of days arsenic the terms of the crypto has observed a heavy crash.

The existent nonaccomplishment worth is simply a caller grounds for the 2022 carnivore market, and is besides successful information the highest the indicator has been since the COVID achromatic swan lawsuit backmost successful 2020.

Notably, the magnitude of underwater proviso successful the marketplace was besides astatine akin levels backmost successful precocious 2018, erstwhile the carnivore marketplace of that rhythm acceptable its bottom.

If the aforesaid inclination arsenic successful those erstwhile bottoms follows present arsenic well, past the latest precocious nonaccomplishment values whitethorn connote the marketplace has present declined heavy capable for a bottom.

However, adjacent if the signifier does follow, it doesn’t mean symptom mightiness beryllium implicit for the investors. As is evident from the chart, successful the 2018-19 carnivore the marketplace moved mostly sideways aft the bottom, and besides formed different highest of akin nonaccomplishment values, earlier immoderate bullish upwind returned to Bitcoin.

BTC Price

At the clip of writing, Bitcoin’s price floats astir $16.4k, down 18% successful the past week. Over the past month, the crypto has mislaid 15% successful value.

The beneath illustration shows the inclination successful the terms of the coin implicit the past 5 days.

3 years ago

3 years ago

English (US)

English (US)