The Bitcoin proviso successful nett has seen a crisp diminution amid the latest crypto marketplace crash. This has raised concerns that BTC could endure a further crash, arsenic holders who are successful the reddish whitethorn determination to offload their coins.

Bitcoin Supply In Profit Drops Amid Market Crash

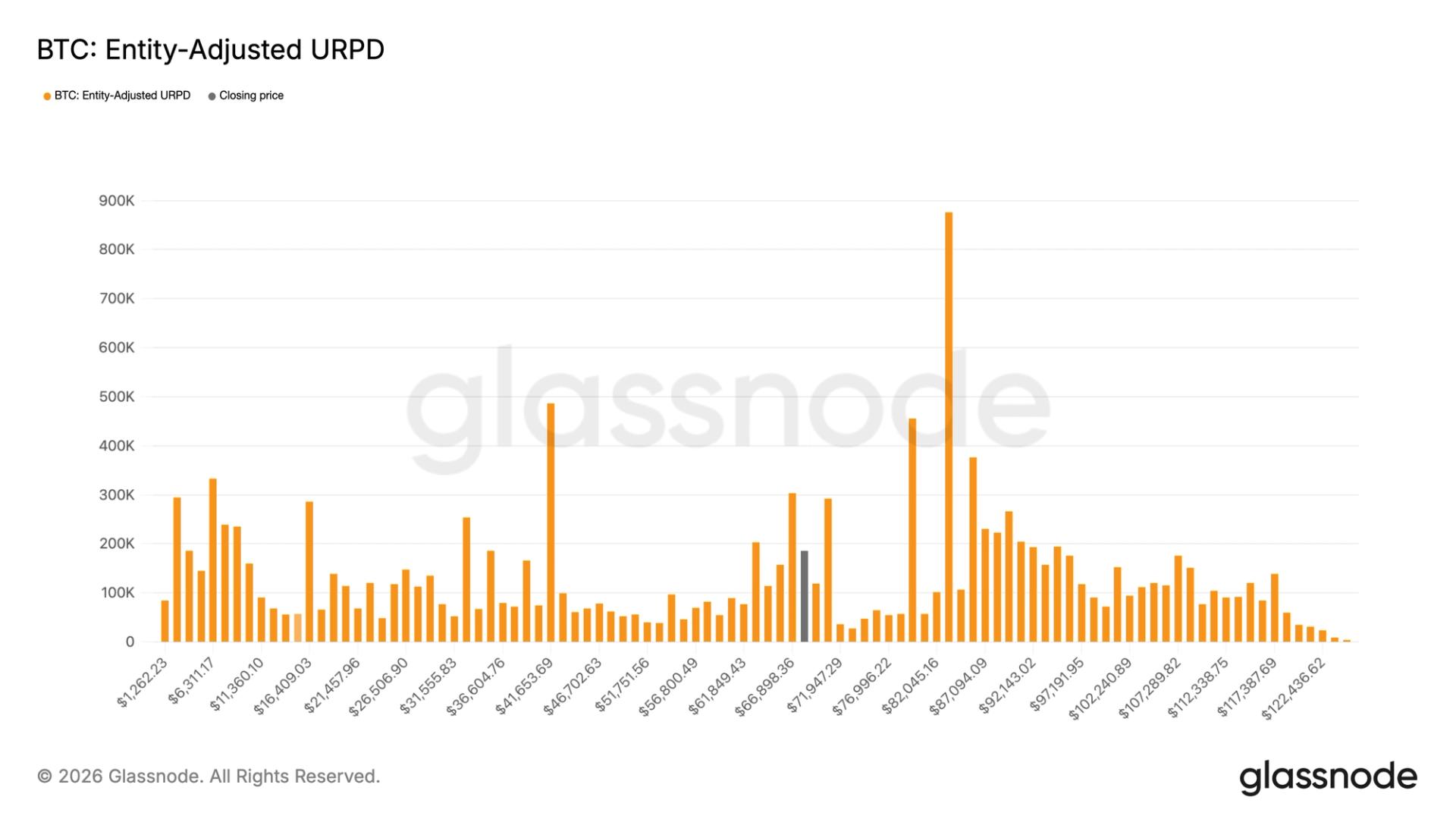

On-chain analytics level Glassnode revealed successful a report that the Bitcoin proviso successful nett has historically dropped to astir 85%, with 15% of the proviso sitting astatine a loss. This has occurred whenever the BTC terms breaks down from a caller all-time precocious (ATH) and trades astir the short-term holders’ outgo basis, arsenic is happening now.

Glassnode noted that this marks a pivotal signifier for Bitcoin, arsenic this is wherever the marketplace tests the condemnation of investors who had bought adjacent recent highs. This signifier is said to beryllium playing retired for the 3rd clip successful this existent cycle. The on-chain analytics level warned that if BTC fails to retrieve supra the $113,100 range, a deeper contraction could nonstop a larger stock of the Bitcoin proviso into loss.

Source: Chart from Glassnode connected X

Source: Chart from Glassnode connected XGlassnode further stated that this deeper contraction could amplify the accent among caller Bitcoin buyers, which could acceptable the signifier for a broader capitulation crossed the market. The level besides alluded to the Supply Quantile Cost Basis to explicate wherefore it is indispensable for BTC to reclaim the short-term holders’ outgo ground supra $113,000.

Bitcoin is said to beryllium struggling to clasp supra the 0.85 quantile astatine $108,600. Failure to clasp this has historically indicated structural marketplace weakness and often preceded deeper corrections toward the 0.75 quantile, which present aligns adjacent $97,500. This puts BTC astatine hazard of dropping beneath $100,000 for the archetypal clip since May.

A Longer Consolidation Phase May Be Necessary

Glassnode stated that from a macro perspective, the repeated request exhaustion suggests that Bitcoin whitethorn necessitate a longer consolidation phase to rebuild strength. This exhaustion is said to beryllium clearer with the Long-Term Holder Spend Volume. These semipermanent holders person accrued their spending with the 30D-SMA rising from the 10,000 BTC baseline to implicit 22,000 BTC regular since the marketplace highest successful July.

Glassnode noted that specified persistent organisation indicates profit-taking from seasoned investors, which has contributed to the existent Bitcoin weakness. Bitcoin OGs person continued to offload their coins astatine an unprecedented rate, putting important selling unit connected BTC. Onchain Lens precocious revealed that a peculiar whale moved 3,003 BTC to Binance, apt successful a bid to sell, portion besides shorting BTC with a presumption worthy $227 million.

At the clip of writing, the Bitcoin terms is trading astatine astir $108,800, up successful the past 24 hours, according to data from CoinMarketCap.

Featured representation from Pixabay, illustration from Tradingview.com

4 months ago

4 months ago

English (US)

English (US)