Bitcoin broke implicit the $46,000 level doubly successful the past 24 hours for the archetypal clip since the support of spot Bitcoin ETFs by the SEC, signaling a bullish instrumentality into astir cryptocurrencies spearheaded by BTC. In particular, Bitcoin investors look to beryllium gearing up for enactment arsenic the adjacent Bitcoin halving approaches with an absorbing clip of withdrawal from exchanges.

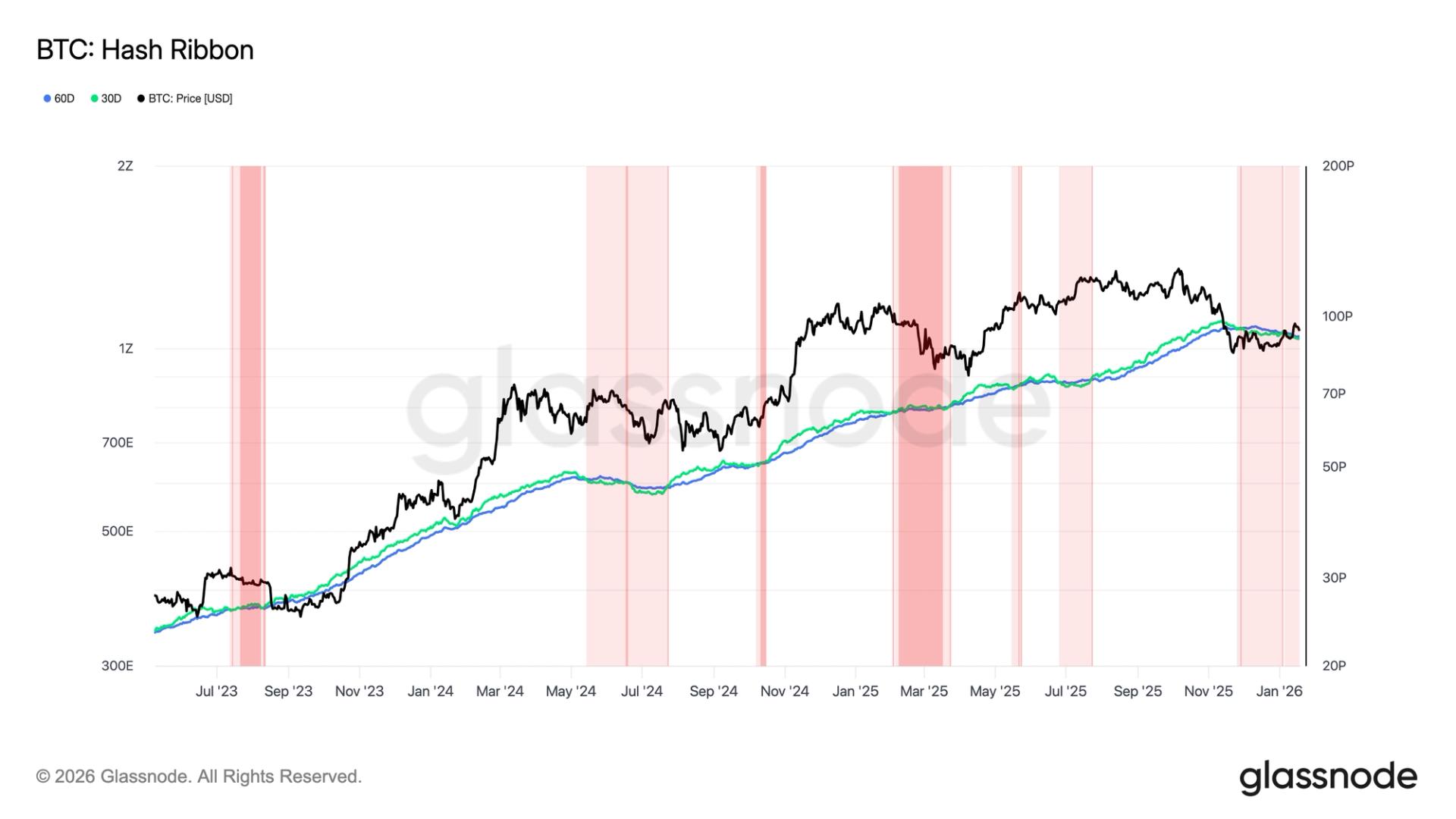

Serious wealth has been connected the determination from exchanges successful the past 30 days, arsenic shown by on-chain data. As a result, the Bitcoin equilibrium crossed assorted exchanges has seen a drastic driblet to the lowest level successful six years.

Percentage Of Bitcoin Supply On Exchanges Drops To Lowest Level Since 2017

A ample information of Bitcoin holders person been holding onto their coins for the agelong haul. According to IntoTheBlock data, astir 69% of Bitcoin holders person been holding their coins for longer than 1 year.

Data from the on-chain analytics level Santiment besides showed that the proviso of Bitcoin connected exchanges precocious dropped to 5.3% of the full circulating proviso for the archetypal clip since December 2017, indicating 94.7% of the proviso is presently successful backstage custody. This metric is peculiarly interesting, considering BTC’s full circulating proviso has grown by 2.84 cardinal since December 2017.

As shown successful Santiment’s chart, the proviso connected exchanges has been connected a escaped autumn since January 10, astir erstwhile the archetypal spot Bitcoin ETFs went unrecorded successful the US. This isn’t surprising, arsenic the sentiment astir Bitcoin turned afloat bullish during this play contempt a prolonged terms struggle.

📈 #Bitcoin‘s terms dominance has continued to turn implicit #altcoins, arsenic its marketplace worth surged arsenic precocious arsenic $45.5K today. Traders stay skeptical toward the plus for a 3rd consecutive week. This is the lowest ratio of $BTC connected exchanges since December, 2017. https://t.co/XC3UK258lM pic.twitter.com/4MwvXE28RC

— Santiment (@santimentfeed) February 8, 2024

In a akin manner, whale transaction tracker Whale Alerts has disclosed ample bouts of BTC exiting crypto exchanges to backstage wallets successful the past month. Notably, Bitcoin’s dominance implicit altcoins has gained ground, with the organization request for Bitcoin post-ETF support besides surging.

🚨 🚨 🚨 1,150 #BTC (51,452,847 USD) transferred from #Coinbase to chartless wallethttps://t.co/bQl4vCkifM

— Whale Alert (@whale_alert) February 8, 2024

This wide BTC exodus from crypto exchanges signals that semipermanent holders feel much comfortable keeping their coins successful self-custody alternatively than connected exchanges.

The full Bitcoin withdrawals from exchanges successful the past 7 days were to the tune of $8.64 billion, outpacing a $8.42 cardinal inflow by $220 million. Wallets holding much than 1,000 BTC have besides accumulated 1.03% of the full circulating proviso successful the past month.

Withdrawals from exchanges are mostly a bully improvement for crypto assets, arsenic they trim the magnitude of cryptocurrencies readily disposable for sale. Fewer BTC disposable means little selling unit and the accidental for the worth to spell up based connected proviso and demand.

At the clip of writing, Bitcoin is trading astatine $46,250, up by 4% successful the past 24 hours and 7.15% successful the past 7 days. The cryptocurrency is currently aiming for the $50,000 mark, which it tin scope precise soon if the accumulation strategy continues.

Featured representation from Forbes, illustration from Tradingview.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)