On-chain information shows the Bitcoin taker buy/sell ratio has been incapable to springiness immoderate existent awesome precocious arsenic the request has remained debased successful the market.

Bitcoin Taker Buy/Sell Ratio Hasn’t Been Able To Catch Any Momentum Recently

As pointed retired by an expert successful a CryptoQuant post, the taker buy/sell ratio hasn’t moved overmuch supra oregon beneath 1 since August 2022. The “Bitcoin taker buy/sell ratio” is an indicator that measures the ratio betwixt the taker bargain measurement and the taker merchantability volume.

When the worth of this metric is greater than one, it means the bargain oregon the “long” measurement is higher successful the marketplace close now. Basically, this means that determination are much buyers consenting to acquisition BTC astatine a higher terms currently, and frankincense the buying unit is stronger.

On the different hand, values of the indicator nether the threshold suggest the taker merchantability measurement is much ascendant astatine the moment. Such values connote a bearish sentiment is shared by the bulk of the investors currently.

Naturally, the ratio being precisely adjacent to 1 indicates the taker bargain and taker merchantability volumes are precisely adjacent close now, and truthful the marketplace is evenly divided betwixt bullish and bearish mentalities.

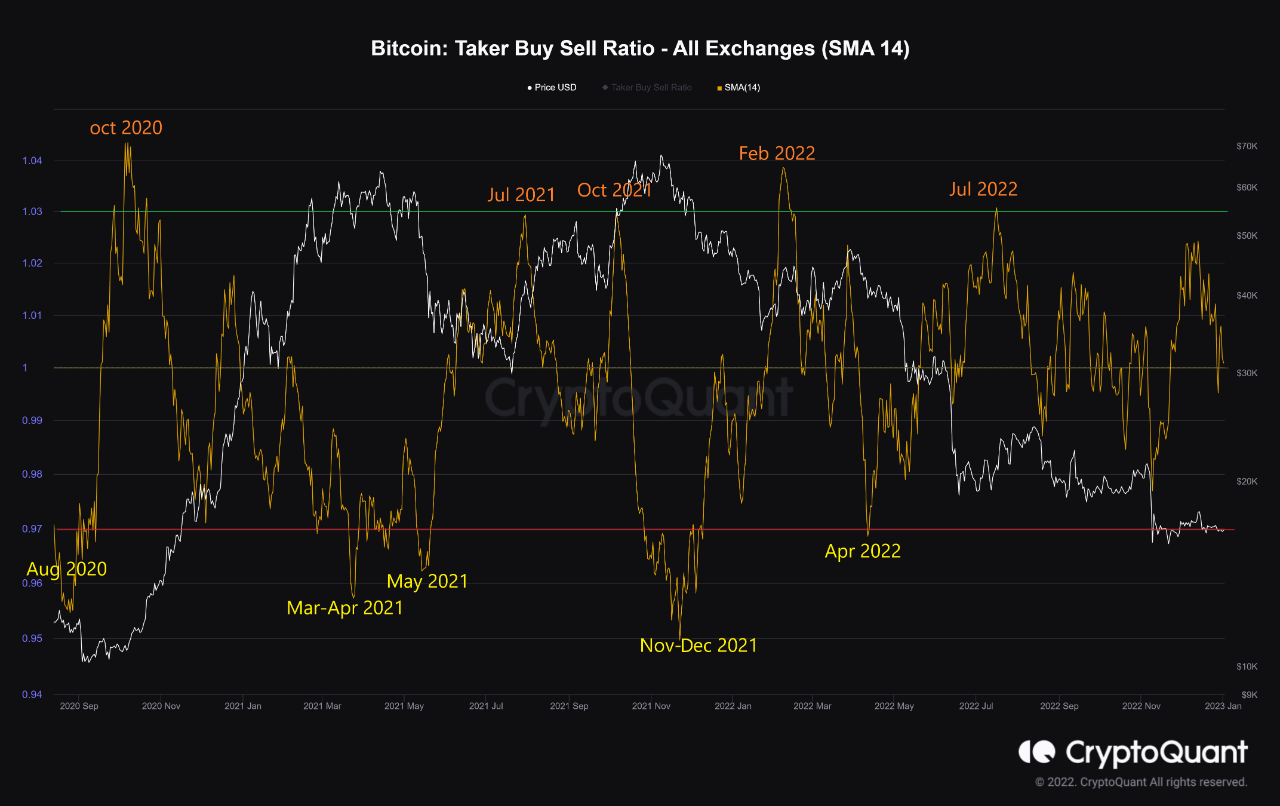

Now, present is simply a illustration that shows the inclination successful the 14-day elemental moving mean (SMA) Bitcoin taker buy/sell ratio implicit the past fewer years:

As you tin spot successful the supra graph, the quant has marked the applicable points of the inclination for the 14-day SMA Bitcoin taker buy/sell ratio. It looks similar whenever the indicator has crossed the 1.03 level, BTC has observed immoderate bullish momentum soon after.

On the contrary, whenever the ratio dipped beneath the 0.97 level, a bearish inclination followed the crypto’s price. The past clip this awesome formed was backmost successful April 2022, earlier the marketplace observed the LUNA and 3AC collapses.

The bullish awesome was past seen successful July 2022, arsenic the crypto built up towards its archetypal alleviation rally of the carnivore market. Since then, however, determination person been nary different breaches of either of these levels, arsenic is evident from the chart.

In the play betwixt past and now, the taker buy/sell ratio has been oscillating astir 1, but the metric has conscionable not been capable to summon capable momentum to spell each the mode successful either direction. “We cannot expect Bitcoin to determination overmuch arsenic agelong arsenic assurance – and subsequently request – does not instrumentality to the market,” explains the analyst.

BTC Price

At the clip of writing, Bitcoin is trading astir $16,700, down 1% successful the past week.

Featured representation from Kanchanara connected Unsplash.com, charts from TradingView.com, CryptoQuant.com

2 years ago

2 years ago

English (US)

English (US)