The once-sizzling crypto marketplace continues to sputter, with Bitcoin, the undisputed king of the integer realm, starring the retreat.

After a euphoric ascent that saw it breach the $73,000 level earlier this year, Bitcoin has shed its royal cloak, plummeting to caller lows and dragging the full crypto ecosystem into a play of frosty uncertainty.

Exodus From The Empire: Investors Pull Billions

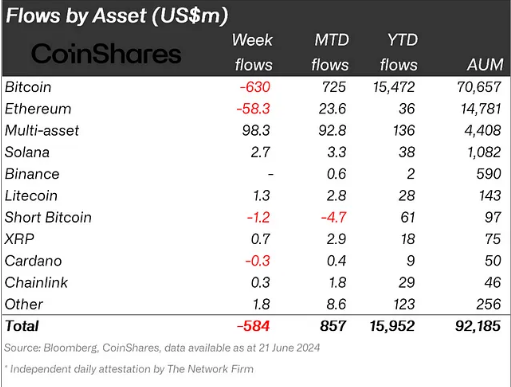

The past weeks person been marked by a wide exodus from Bitcoin. Investors, spooked by the prolonged terms slump, person been fleeing the flagship cryptocurrency successful droves. A caller study by CoinShares paints a bleak picture, revealing a staggering $630 cardinal outflow from Bitcoin conscionable past week.

This follows a likewise hefty outflow of $631 cardinal the week prior, marking a brutal two-week agelong for Bitcoin. The hemorrhaging extends beyond Bitcoin, with different salient cryptocurrencies similar Ethereum experiencing their ain capitalist flight.

Source: CoinShares

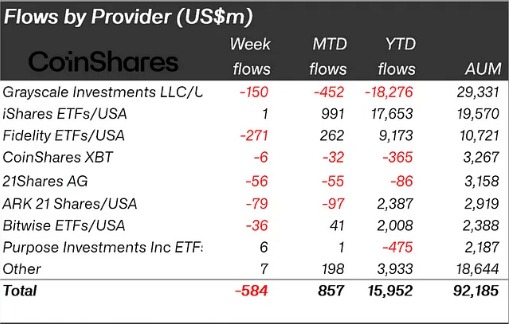

Source: CoinSharesThe sell-off isn’t confined to idiosyncratic holdings. Bitcoin exchange-traded funds (ETFs), which let accepted investors to dabble successful crypto without straight owning it, person besides been deed hard.

Major issuers similar Fidelity and Grayscale person witnessed a six-day consecutive outflow, with hundreds of millions of dollars vanishing from their coffers. This wide exodus from some Bitcoin and Bitcoin ETFs paints a wide picture: investors are losing faith, seeking structure from the crypto storm.

Source: CoinShares

Source: CoinSharesA Chink In The Armor? Not Quite

While the wide sentiment is undeniably bearish, determination are a fewer glimmers of anticipation amidst the gloom. Short positions, which fundamentally stake connected a terms decrease, person seen a astonishing diminution of $1.2 million.

This could beryllium interpreted arsenic a alteration successful bearish bets, hinting astatine a imaginable displacement successful capitalist sentiment. Additionally, immoderate altcoins similar Solana, Litecoin, and Polygon person defied the downward trend, registering steadfast gains. This suggests that not each bets are disconnected the table, and immoderate investors mightiness beryllium seeking opportunities successful different corners of the crypto market.

A Crypto Winter Thaw Or Avalanche?

The crypto marketplace is nary alien to melodramatic fluctuations. Bitcoin itself has a past of epic boom-and-bust cycles. However, the existent downturn raises concerns astir a prolonged “crypto winter” – a play of sustained decline.

Meanwhile, the much-anticipated support of an Ethereum ETF, initially viewed arsenic a imaginable marketplace catalyst, seems to beryllium doing small to dispel the existent chill.

Will investors regain their appetite for integer assets, starring to a Bitcoin-fueled thaw? Or volition the existent outflow snowball into a full-blown avalanche, burying the crypto marketplace nether a broad of red? The unfolding of this crypto wintertime remains to beryllium seen.

Featured representation from Silktide, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)