Bitcoin yet sees immoderate alleviation aft a commencement of 2022 with relentless selling pressure. The archetypal crypto by marketplace headdress trades astatine $36,815 with a 9.6% nett successful 24 hours.

BTC trends to the downside successful the 4-hour chart. Source: BTCUSD Tradingview

BTC trends to the downside successful the 4-hour chart. Source: BTCUSD TradingviewRelated Reading | Bitcoin Supply Shock: Only 12% Of BTC Supply Is On Exchanges Now

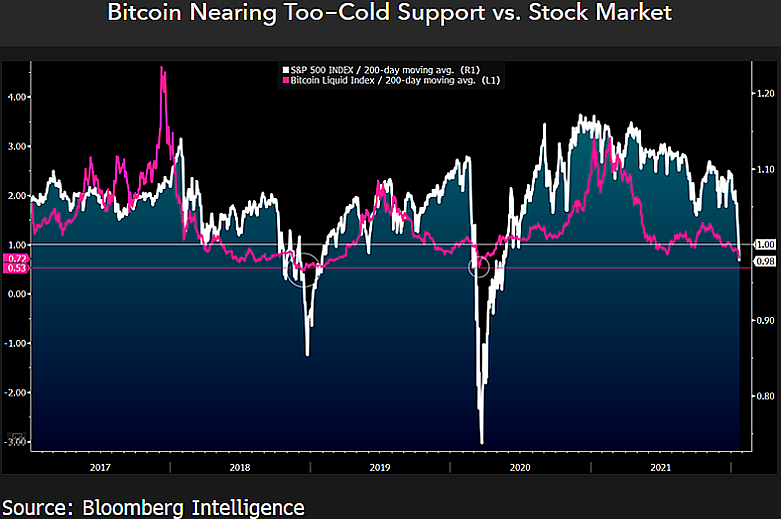

Bitcoin is moving towards a 1:1 correlation to the U.S. Stock Market, successful the abbreviated term, according to Bloomberg Intelligence’s Senior Commodity Analyst Mike McGlone. The crypto marketplace has been reacting to the imaginable displacement successful the U.S. Federal Reserve monetary policy.

The fiscal instauration has hinted astatine an summation successful its involvement rates to, astatine least, a 0.25% successful 2022’s Q1 and a tapering of their plus purchase. The extremity is to halt ostentation arsenic the CPI stands astatine a 40 twelvemonth high. This has translated into a selloff which begun successful Q4, 2021.

In addition, investors look to beryllium trying to get up of a imaginable hike successful involvement rates, a thesis which could person confirmation time during the FED’s Federal Open Market Committee (FOMC). If the instauration hints a tougher shift, Bitcoin could retest its captious enactment level astatine $33,000.

In anticipation of this and different events, investors could beryllium sitting successful cash, waiting to bid connected BTC erstwhile the economical outlook looks clearer. In different words, the request is debased for hazard assets and could stay arsenic specified for the adjacent future.

Analyst John Nash believes the FOMC gathering is already priced successful with a “too early” reversal successful Bitcoin and different cryptocurrencies. However, Nash expects to spot a stronger bounce towards $40,000, earlier BTC’s terms dives backmost into the $25,000 to $28,000 range.

At present, Bitcoin indispensable flip $36,000 and $38,000 from section absorption into enactment to proceed it moves towards $40,000. After, Nash believes investors should travel the aged adagio but with a twist: “Buy successful May and spell away”.

Bitcoin To Come On Top In 2022?

On this note, helium seems to concur with McGlone. The Bloomberg adept has been bullish connected Bitcoin and cryptocurrencies connected existent marketplace conditions. In fact, helium expects the upcoming economical displacement to supply the integer plus sector, astatine slightest for BTC and ETH, with legitimacy. He wrote:

Price reversion successful cryptos is apt to dispersed successful 2022, aft the assets were a poster kid of speculative inflationary excess successful 2021, but Bitcoin stands to travel retired ahead.

Source: Bloomberg Intelligence via Mike McGlone

Source: Bloomberg Intelligence via Mike McGloneRelated Reading | TA: Ethereum Turns Red, What Could Trigger Steady Recovery

Other analysts expect immoderate akin with BTC tracking the accepted market, but progressively decoupling arsenic it shows much spot during times of weakness for stocks. Recently, arsenic pointed by pseudonyms expert MacroScope, the archetypal crypto by marketplace headdress has concisely decouple from banal futures. The expert said:

No concealed BTC has go a risk-on plus intimately linked to stocks. But arsenic stocks instrumentality a hit, support ticker for a imaginable decoupling. Could beryllium gradual oregon sharp. A fewer scenarios are imaginable (longer tweet). If it happens, would beryllium “shot heard ’round the world” for macro managers.

3 years ago

3 years ago

English (US)

English (US)