By Omkar Godbole (All times ET unless indicated otherwise)

In the satellite of stone climbing, athletes don't simply drawback a caller ledge and scope retired for the adjacent one. First, they enactment their afloat value connected the caller ledge to guarantee it's coagulated earlier aiming higher.

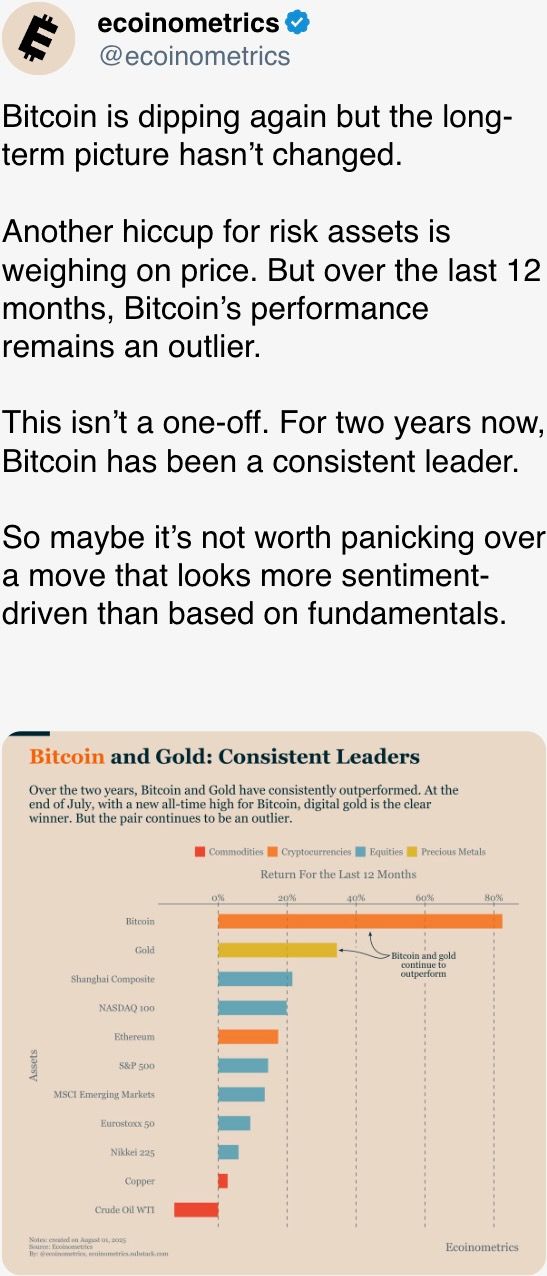

Bitcoin (BTC) has followed a akin signifier since Friday's U.S. jobs data, which triggered concerns of a recession successful the world's largest economy. The cryptocurrency's terms came nether pressure, dropping astir to $111,965, investigating enactment astatine the then-record precocious acceptable successful May, implicit the weekend. It recovered to commercialized precocious astir $114,700.

The diminution resulted successful astir $670 cardinal successful losses connected perpetual futures positions, of which implicit $550 cardinal were agelong positions, according to Coinglass. The crowding retired of the excess leverage could mean a much sustainable upswing successful prices.

John Glover, the main concern serviceman astatine Ledn, said helium present expects BTC to rally to astir $140,000 by year-end. 10x Research precocious identified the $111,965 level arsenic an charismatic risk-reward introduction constituent for traders. The terms rebound suggests immoderate whitethorn person followed that proposal to articulation the bull run.

Canary Capital CEO Stephen McClurg argued that bitcoin is rapidly positioning itself arsenic a turbocharged hazard asset, aligned with Nasdaq trends, but with greater volatility. He called stablecoins integer cousins of wealth marketplace funds.

On the macro front, the nonfarm payrolls information revealed a crisp slowdown successful the labour market, reviving prospects of a Fed interest-rate chopped successful September. Still, with the expectations being spurred by economical pain, they whitethorn not needfully bode good for hazard assets. This week's U.S. CPI and PPI ostentation readings volition assistance solidify the outlook.

Ryan Lee, the main expert astatine crypto speech Bitget, said BTC is apt to consolidate astir $112,000-$118,000 this week, supported by beardown technicals and ether to commercialized successful the $3,300-$3,800 scope driven by ETF inflows and organization interest.

"Rising ETH adoption and on-chain enactment could substance outperformance, but bitcoin's dominance whitethorn headdress important altcoin gains unless broader marketplace sentiment shifts further toward risk-on behavior," Lee told CoinDesk successful an email.

Speaking of ether, a whale conducted a ample buy-the-dip cognition implicit the weekend, snapping up millions successful ETH successful a motion of their semipermanent conviction.

In different news, Base present leads Solana successful regular token introductions, driven by the emergence of Zora's Creator Coins, according to Dune Analytics. Lido, the liquid staking platform, laid disconnected 15% of its workforce.

"While it whitethorn look counterintuitive amid a marketplace upswing, the determination reflects a deliberate committedness to sustainable growth, operational focus, and alignment with the priorities of LDO tokenholders," Lido DAO's Vasiliy Shapovalov said connected X.

In accepted markets, futures tied to the S&P 500 roseate implicit 0.5% portion the dollar scale added 0.2%. Morgan Stanley called Friday's dip successful stocks a buy-the-dip opportunity. Stay alert!

What to Watch

- Crypto

- Aug. 4: Solana Mobile begins worldwide shipping of its Seeker Web3 mobile device.

- Aug. 15: Record day for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who conscionable pre-distribution requirements.

- Aug. 18: Coinbase Derivatives volition launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- Aug. 5, 2 p.m.: Uruguay's National Institute of Statistics releases July ostentation data.

- Annual Inflation Rate Prev. 4.59%

- Aug. 6: U.S. tariff of 50% kicks successful connected astir Brazilian imports.

- Aug. 6, 2 p.m.: Fed Governor Lisa D. Cook volition present a code titled “U.S. and Global Economy”. Livestream link.

- Aug. 7: New U.S. reciprocal tariffs outlined successful President Trump’s July 31 executive order go effectual for a wide scope of trading partners that did not unafraid deals by the Aug. 1 deadline. These tariffs scope from 15% to 41%, depending connected the country.

- Aug. 8: Federal Reserve Governor Adriana D. Kugler's resignation becomes effective, creating an aboriginal vacancy connected the Board of Governors that allows President Trump to nominate a successor.

- Aug. 5, 2 p.m.: Uruguay's National Institute of Statistics releases July ostentation data.

- Earnings (Estimates based connected FactSet data)

- Aug. 4: Semler Scientific (SMLR), post-market, -$0.22

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Cipher Mining (CIFR), pre-market

- Aug. 7: CleanSpark (CLSK), post-market, $0.19

- Aug. 7: Coincheck (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 11: Exodus Movement (EXOD), post-market

- Aug. 12: Bitfarms (BITF), pre-market

- Aug. 12: Fold Holdings (FLD), post-market

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- Compound DAO is voting to select its adjacent Security Service Provider (SSP). Delegates are choosing betwixt ChainSecurity & Certora and Cyfrin. Voting ends Aug. 5.

- Balancer DAO is voting connected creating “Balancer Business,” a for-profit BVI subsidiary of Balancer OpCo Ltd. This caller ineligible entity would formalize protocol interest absorption and on-chain operations, replacing the existent DAO multisig model. Voting ends Aug. 5.

- Arbitrum DAO is voting to renew its partnership with Entropy Advisors for 2 much years starting September. The connection includes $6 cardinal successful backing and 15 cardinal ARB successful incentives for Entropy to absorption connected treasury management, inducement design, information infrastructure and ecosystem growth. Voting ends Aug. 7.

- BendDAO is voting connected a plan to stabilize BEND by burning 50% of treasury tokens, restarting lender rewards and launching monthly buybacks utilizing 20% of protocol revenue. Voting ends Aug. 10

- Unlocks

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating proviso worthy $12.30 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating proviso worthy $48.18 million.

- Aug. 15: Avalanche (AVAX) to unlock 0.39% of its circulating proviso worthy $36.65 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating proviso worthy $14.84 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating proviso worthy $15.80 million.

- Token Launches

- Aug. 4: Cycle Network (CYC) to beryllium listed connected Binance Alpha, Bitget, MEXC, KuCoin and others.

- Aug. 5: Keeta (KTA) to beryllium listed connected Kraken.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 15: Bitcoin Educators Unconference (Vancouver)

- Aug. 17-21: Crypto 2025 (Santa Barbara, California)

- Aug. 18-21: Wyoming Blockchain Symposium 2025 (Jackson Hole, Wyoming)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

Token Talk

By Shaurya Malwa

- Base has surpassed Solana successful regular token introductions, launching 54,341 connected July 27, much than treble Solana’s 25,460, according to Dune Analytics.

- Daily launches connected Base person skyrocketed from 6,649, driven by the integration of Zora and Farcaster into the rebranded Base App.

- Zora posts are present instantly minted into ERC-20 tokens, each with a 1 cardinal proviso and a Uniswap pool, with creators earning 1% of each trading fees successful ZORA.

- Farcaster’s decentralized societal graph amplifies token organisation and engagement by letting users stock and commercialized tokenized Zora posts crossed the network.

- As of Aug. 2, Zora-powered launches made up 64.6% of each token launches crossed some Base and Solana, notching up 39,778 caller Base tokens that day.

- Solana, however, inactive dominates trading volume, particularly via launchpads similar Pump.fun and LetsBonk.

- The surge positions Base arsenic the caller frontier for societal token experiments, portion Solana retains its borderline successful memecoin liquidity and marketplace depth.

Derivatives Positioning

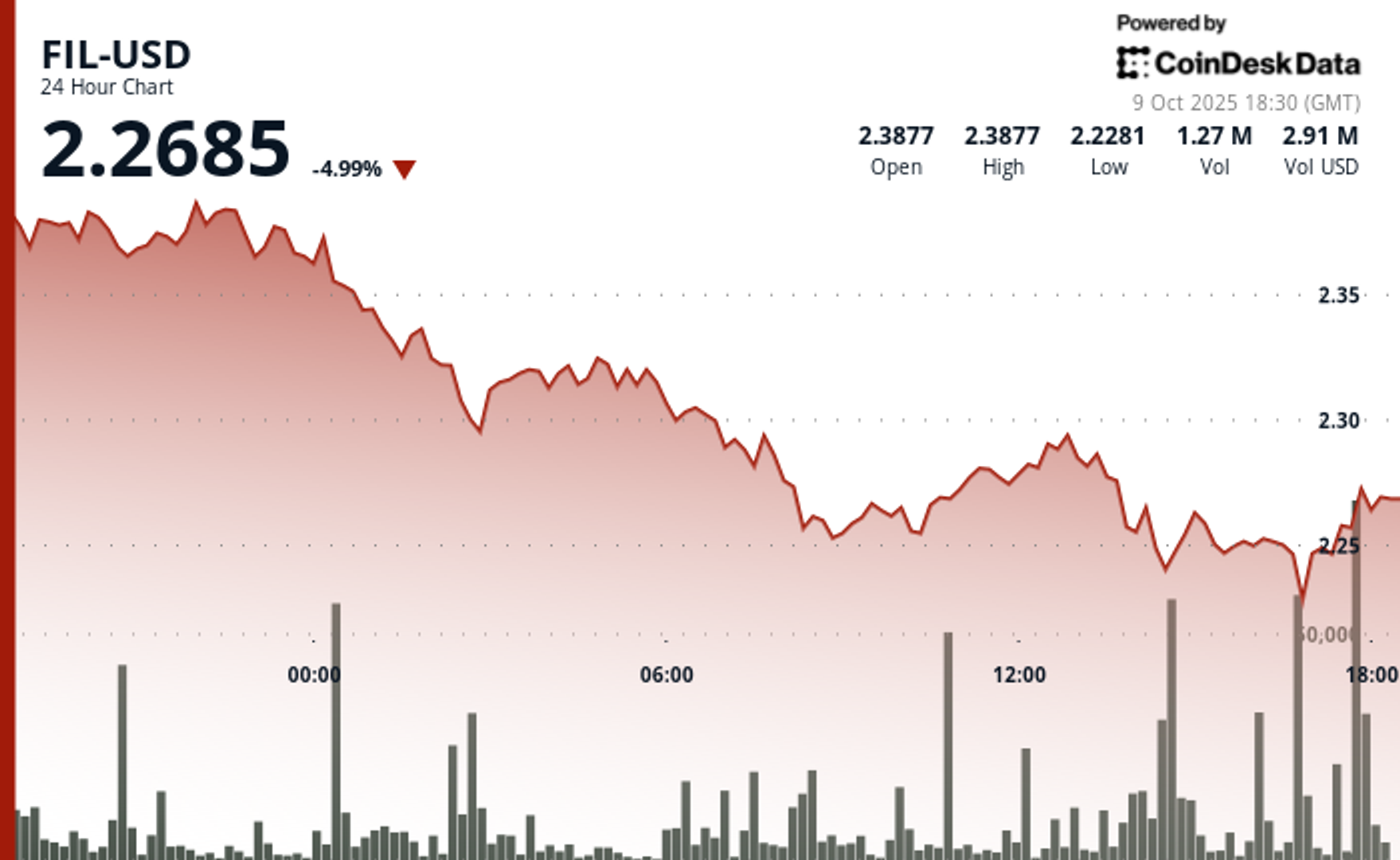

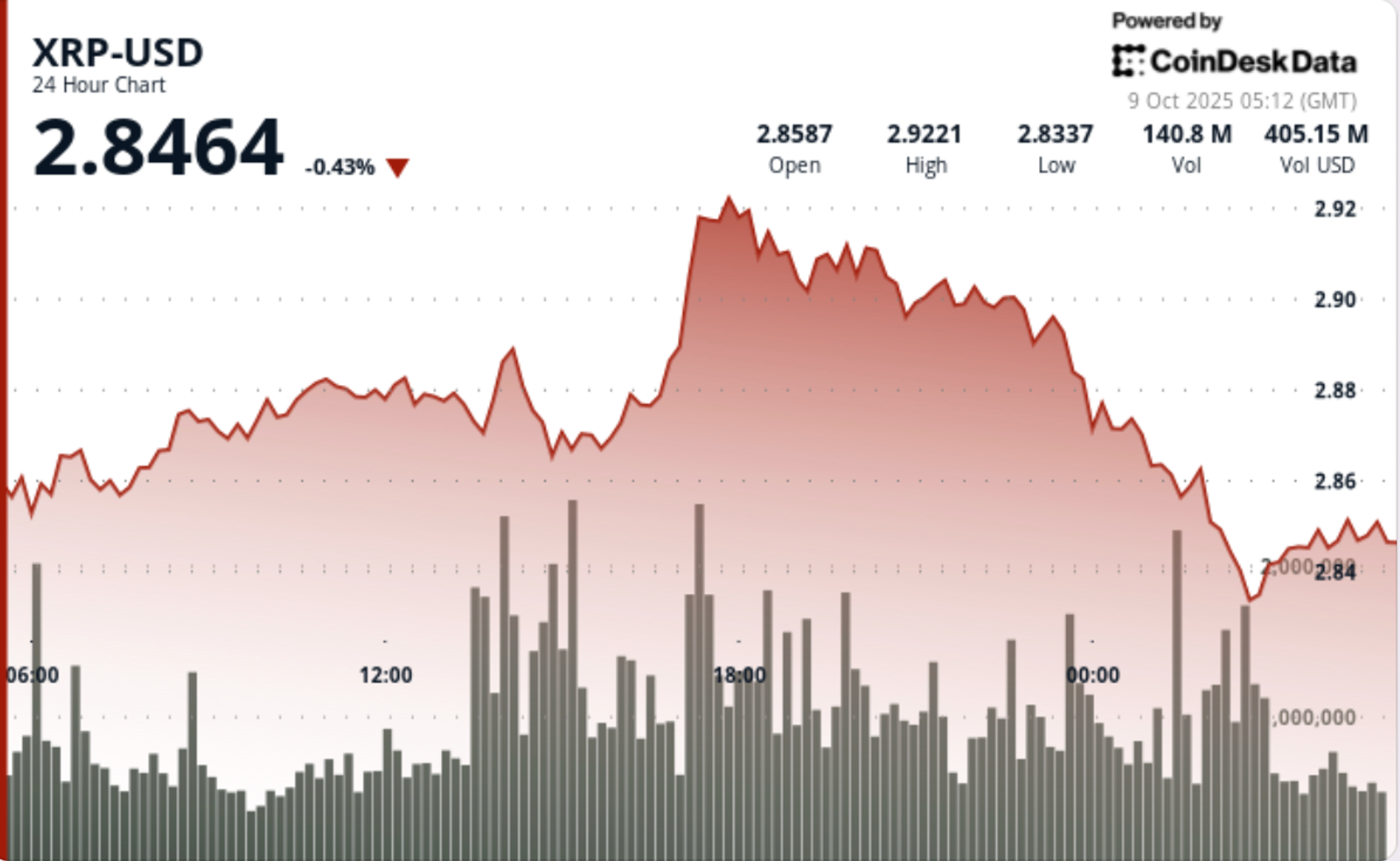

- Futures unfastened involvement (OI) successful astir majors cryptocurrencies, including BTC and ETH, dropped somewhat successful the past 24 hours, indicating a deficiency of information successful the terms recovery. XRP and SUI saw a tiny summation successful OI.

- BTC's cumulative unfastened involvement has pulled backmost to 690K BTC from the precocious of 742K BTC connected July 26. The ether marketplace besides cooled, with OI declining to 13.5M ETH from the grounds precocious of 15.3M connected July 29.

- On the CME, the annualized three-month ground successful BTC and ETH futures dropped to astir 6%-7% from the precocious of 10% past week.

- On Deribit, short-tenor BTC and ETH puts commercialized astatine a premium to the spot price, reflecting persistent downside concerns.

- Some traders person snapped up higher onslaught telephone options successful the past 24 hours, positioning for a tactical rebound to caller highs supra $124K.

Market Movements

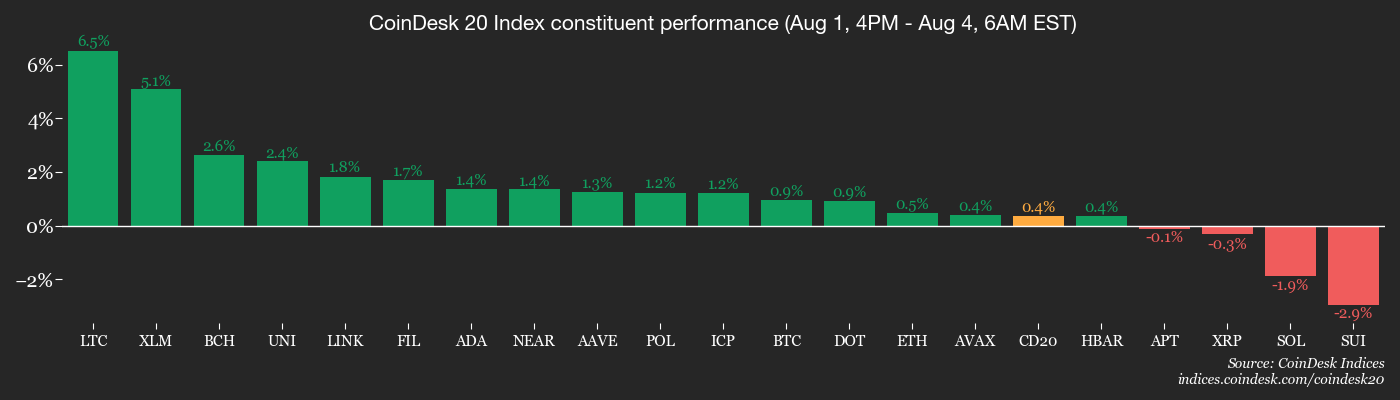

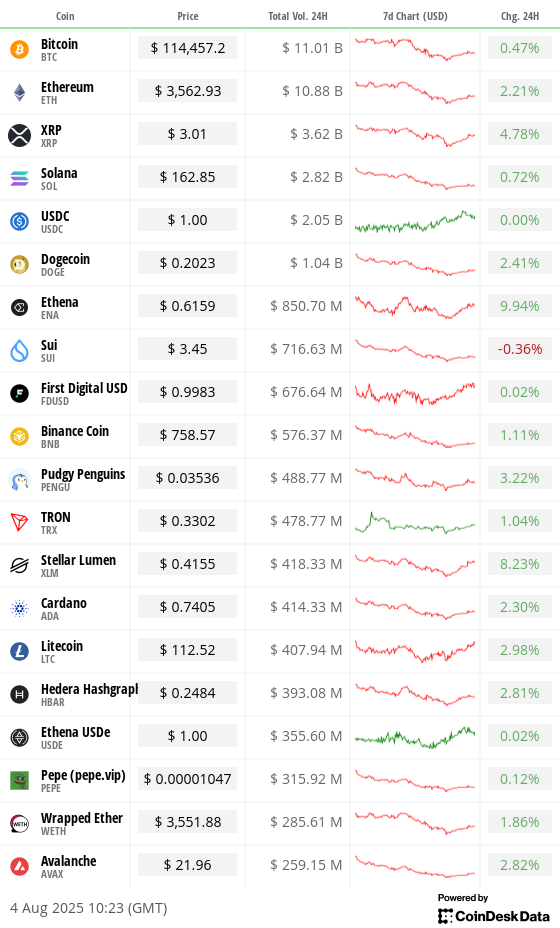

- BTC is up 0.19% from 4 p.m. ET Sunday astatine $114,393 (24hrs: +0.57%)

- ETH is up 1.82% astatine $3,556.82 (24hrs: +2.38%)

- CoinDesk 20 is up 1.40% astatine 3,766.02 (24hrs: +2.03%)

- Ether CESR Composite Staking Rate is down 19 bps astatine 2.86%

- BTC backing complaint is astatine 0.0047% (5.185% annualized) connected Binance

- DXY is down 0.30% astatine 98.85

- Gold futures are up 0.32% astatine $3,410.80

- Silver futures are up 0.94% astatine $37.28

- Nikkei 225 closed down 1.25% astatine 40,290.70

- Hang Seng closed up 0.92% astatine 24,733.45

- FTSE is up 0.35% astatine 9,100.13

- Euro Stoxx 50 is up 1.28% astatine 5,231.91

- DJIA closed on Friday down 1.23% astatine 43,588.58

- S&P 500 closed down 1.60% astatine 6,238.01

- Nasdaq Composite closed down 2.24% astatine 20,650.13

- S&P/TSX Composite closed down 0.88% astatine 27,020.43

- S&P 40 Latin America closed down 0.39% at 2,553.89

- U.S. 10-Year Treasury complaint is up 1.9 bps astatine 4.239%

- E-mini S&P 500 futures are up 0.64% astatine 6,304.75

- E-mini Nasdaq-100 futures are up 0.76% astatine 23,057.75

- E-mini Dow Jones Industrial Average Index are up 0.65% astatine 43,995.00

Bitcoin Stats

- BTC Dominance: 61.98% (-0.32%)

- Ether-bitcoin ratio: 0.03105 (1.4%)

- Hashrate (seven-day moving average): 906 EH/s

- Hashprice (spot): $56.80

- Total fees: 2.94 BTC / $334,645

- CME Futures Open Interest: 138,445 BTC

- BTC priced successful gold: 34.0 oz.

- BTC vs golden marketplace cap: 9.63%

Technical Analysis

- The illustration shows regular terms movements successful BlackRock's spot bitcoin ETF (IBIT) successful a candlestick format.

- The money fell implicit 3% Friday, carving retired a "bearish marubozu" candle. This signifier is identified by a salient reddish assemblage and little-to-no wicks, indicating seller dominance passim the trading session.

- The occurrence of this candlestick signifier is taken to correspond much losses ahead.

Crypto Equities

- Strategy (MSTR): closed on Friday at $366.63 (-8.77%), +2.32% astatine $375.14 successful pre-market.

- Coinbase Global (COIN): closed astatine $314.69 (-16.7%), +1.98% astatine $320.91.

- Circle (CRCL): closed astatine $168.1 (-8.4%), +1.78% astatine $171.16.

- Galaxy Digital (GLXY): closed astatine $26.88 (-5.4%), +3.05% astatine $27.7.

- MARA Holdings (MARA): closed astatine $15.5 (-3.61%), +2.19% astatine $15.84.

- Riot Platforms (RIOT): closed astatine $11.03 (-17.75%), +3.26% astatine $11.39.

- Core Scientific (CORZ): closed astatine $12.65 (-6.57%), +1.90% astatine $12.89

- CleanSpark (CLSK): closed astatine $10.44 (-8.18%), +2.59% astatine $10.71.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $23.42 (-7.28%)

- Semler Scientific (SMLR): closed astatine $34.46 (-3.88%)

- Exodus Movement (EXOD): closed astatine $28.38 (-7.98%), +0.88% astatine $28.63

- SharpLink Gaming (SBET): closed astatine $17.14 (-8.88%), +5.89% astatine $18.15.

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$812.3 million

- Cumulative nett flows: $54.15 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily nett flows: -$152.3 million

- Cumulative nett flows: $9.51 billion

- Total ETH holdings ~5.74 million

Source: Farside Investors

Overnight Flows

Chart of the Day

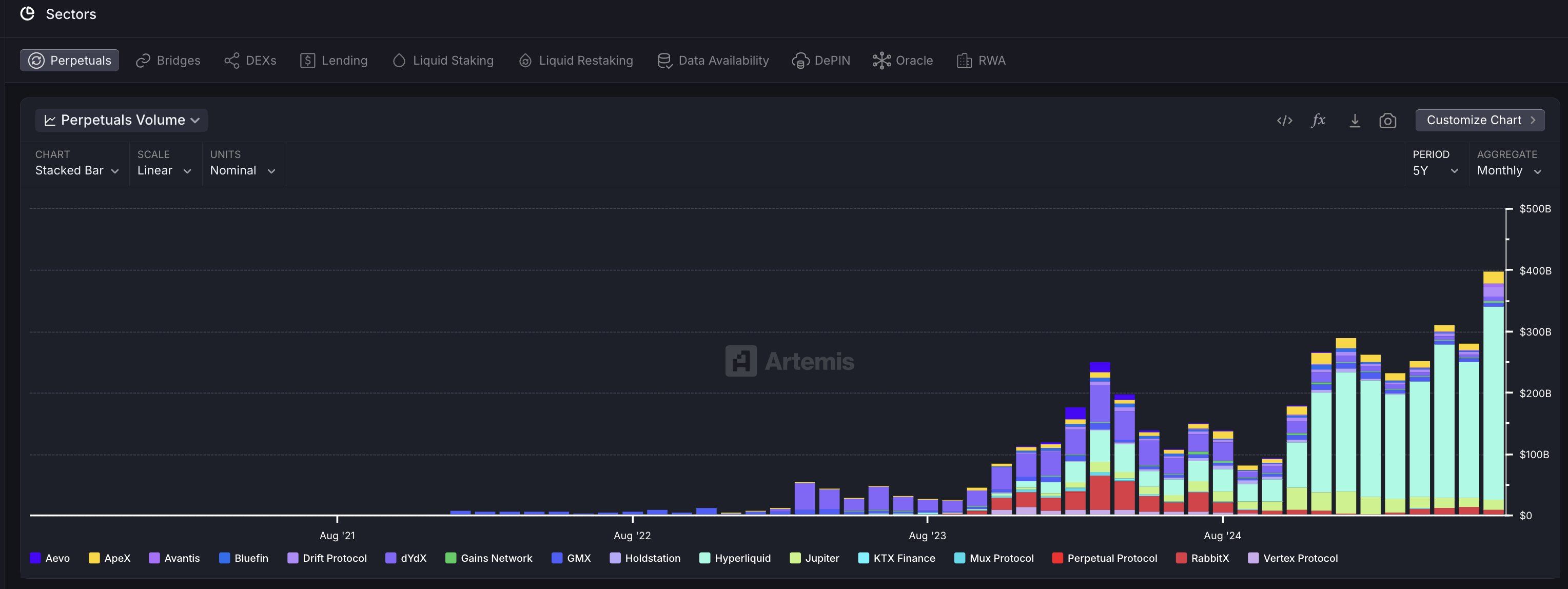

- Cumualtive measurement successful on-chain crypto perpetual futures protocols deed a grounds precocious of $400 cardinal successful July, with Hyperliquid accounting for implicit 70% of the tally.

- The figures are a motion of increasing capitalist involvement successful trading leveraged instruments connected blockchain.

While You Were Sleeping

- Coinbase Slides Nearly 20% successful Worst Weekly Performance Since September 2024 (CoinDesk): Disappointing second-quarter gross and operating net drove up request for COIN enactment options and added value to expert warnings that the company’s valuation had outpaced its fundamentals.

- Citi’s Gold Bears Turn Bullish connected U.S. Growth, Inflation Concerns (Bloomberg): Analysts expect golden to commercialized betwixt $3,300 and $3,600 successful adjacent fewer months arsenic tariffs and recession fears assistance safe-haven demand, successful opposition to the sub-$3,000 prediction they made successful June.

- Bitcoin Still connected Track for $140K This Year, but 2026 Will Be Painful: Elliott Wave Expert (CoinDesk): Ledn CIO John Glover described the caller diminution arsenic a intermission successful a larger upward inclination and said bitcoin remains successful enactment with its expected terms pattern.

- Binance Opens 'Bitcoin Options Writing' to All Users (CoinDesk): The determination allows users who walk a suitability appraisal to gain income by selling bitcoin options— collecting upfront premiums but risking losses if they misjudge BTC’s terms absorption oregon volatility.

- China Is Choking Supply of Critical Minerals to Western Defense Companies (The Wall Street Journal): U.S. defence contractors and drone startups are facing accumulation delays, surging costs and invasive documentation demands, prompting them to question alternate sources for these minerals.

- Cambodia and Thailand Begin Talks successful Malaysia Amid Fragile Ceasefire (Reuters): Thailand accuses Cambodia of repositioning troops, portion Cambodia demands the instrumentality of 18 captured soldiers up of Thursday’s defence ministers’ meeting.

In the Ether

2 months ago

2 months ago

English (US)

English (US)