Image Source: Bitrawr.

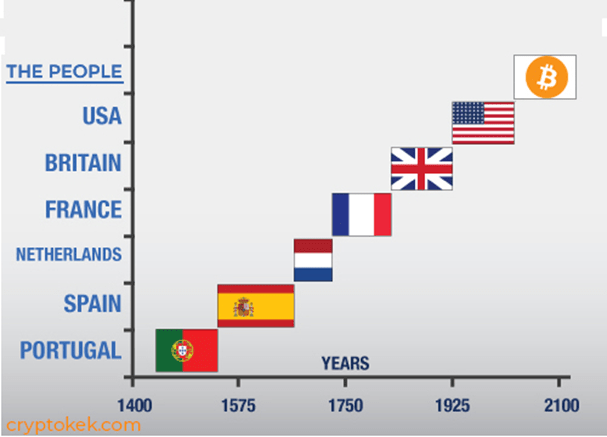

If the past 700 years are immoderate indication, reserve currencies person a support beingness of astir 100 years. The U.S. dollar (USD) officially became the satellite reserve currency 77 years agone (Bretton Woods, 1944). Arguably, USD was the reserve arsenic acold backmost arsenic the precocious 1920s.

Source: “Will a Digital Gold Rush Save America’s Economy?” Cryptokek Blog.

From a humanities timeline perspective, the USD is successful the twilight of its reserve status. Couple that with the information that the United States is besides expanding the wealth proviso exponentially (devaluing the purchasing powerfulness of the existing proviso of USD successful the process), and to enactment it politely, this maturation complaint is unsustainable.

For the record, the U.S. Federal Reserve is not operating successful isolation. Most large cardinal banks crossed the globe are pursuing this trend. Examples see the European Central Bank (ECB), the Bank of Japan (POJ) and the People’s Bank of China (PBOC) to sanction a few. Frankly, the bulk of large cardinal banks are racing 1 different to spot who tin debase their currencies the quickest.

Stanley Druckenmiller, who is considered a legendary capitalist successful portion owed to his survey of past and macroeconomics, thinks the USD volition suffer reserve currency presumption wrong 15 years.

So, if the USD has a support beingness partially owed to humanities precedence and partially owed to fiscal irresponsibility (overprinting of the wealth supply), what comes next? What replaces the USD? Another fiat currency? It's possible, but my conjecture is the days of trusting a centralized enactment to support a unchangeable proviso of a currency person travel and gone. Why trust, erstwhile you tin conscionable verify? An statement could beryllium made that golden is today’s reserve plus arsenic it is held by the bulk of cardinal banks.

For me, golden is the past, portion Bitcoin is the future. Bitcoin is decentralized, easy verifiable, immutable, divisible with a known proviso and is easy amalgamated into an ever-increasing digitizing planetary economy. Bitcoin is already ineligible tender successful El Salvador, a presumption that volition beryllium hard for golden to parallel based connected its proscription and divisibility limitations. There is simply a groundswell of Bitcoin adoption happening from antithetic sectors of the economy.

Retail, institutions, governments, pension funds, REITS and banks are each accumulating bitcoin. The diverseness of accumulation produces “game theory” adoption, accumulation which is occurring acold quicker than astir would person predicted. For example, El Salvador became the archetypal authorities to marque bitcoin ineligible tender successful September 2021. Today, determination are more residents with Bitcoin wallets than accepted slope accounts. As of October 2021, exports of goods grew 34% successful 2021 successful El Salvador, portion gross home merchandise (GDP) is projected to beryllium greater than 10% successful 2021, making El Salvador 1 of the fastest increasing economies successful cardinal America.

El Salvador continues to get bitcoin astatine a accelerated pace, present owning astir 1,220 bitcoin astatine the clip of penning this article. Bitcoin adoption is an accumulation race. The happening is, astir bash not recognize that the weapon has already gone disconnected and the contention has started. Ask Michael Saylor of MicroStrategy if they program to sell, fto unsocial halt accumulating much bitcoin.

From a authorities level, Laos mines bitcoin. They expect to earn $190 cardinal dollars from bitcoin mining successful 2022. Tonga is actively drafting authorities to marque bitcoin ineligible tender successful the autumn of 2022. Panama, Zimbabwe and Ukraine are each looking into imaginable adoption. Singapore seeks to go a Bitcoin hub.

"We deliberation the champion attack is not to clamp down oregon prohibition these things," said Ravi Menon, managing manager of the Monetary Authority of Singapore.

The president of El Salvador is presently successful Turkey, the archetypal G20 state to acquisition adjacent hyperinflation. I would conjecture Nayib Bukele would bring up the benefits that adopting bitcoin arsenic ineligible tender could bash for the Turkish people.

For each lawsuit similar China, which chose to adjacent its doors to Bitcoin, determination are 2 different countries acceptable to clasp it. You cannot prohibition Bitcoin, a state tin lone take to disregard it, but Bitcoin is not going away. Ignore astatine your peril. Bulgaria owns 213,518 bitcoin, Ukraine owns 46,351, Finland 1,981 and El Salvador, astatine the clip of writing, 1,220.

Even successful countries wherever governments bash not contiguous favorable policies toward Bitcoin adoption, precocious levels of national adoption tin unit the government's hand. Nigeria and Turkey are 2 premier examples. Grassroots national adoption (retail) is taking clasp successful countries each implicit the world. In 2020, per the Statista planetary survey, 32% of citizens successful Nigeria, 21% successful Vietnam, 20% successful the Philippines and 16% successful Turkey and Peru person indicated they person utilized oregon owned “cryptocurrencies.”

Corporate accumulation is besides taking place. As of June 2021, 34 nationalist companies collectively clasp implicit 213,000 bitcoin. MicroStrategy and Tesla being the largest. The bulk of companies who person adopted bitcoin person done truthful successful the past 18 months.

Google has partnered with Bakkt to supply Bitcoin outgo solutions. Twitter has enabled tipping via the Bitcoin Lightning Network. Bitcoin has the capableness of being the autochthonal currency of the internet, arsenic predicted by Milton Friedman successful 1999.

One of the astir salient U.S. existent property concern trusts (REITS), SL Green Realty Corp. (NYC Office REIT), has dipped their toes into bitcoin with a $10 cardinal concern successful a bitcoin fund. Banks are different firm assemblage actively embracing bitcoin aft trying to disregard and combat the plus for years. Banks marque their wealth by lending retired their assets. The Commonwealth Bank of Australia has enabled 6 cardinal of its customers to bargain bitcoin. Banks indispensable take to follow bitcoin oregon hazard becoming irrelevant.

Pension funds and security companies are besides opening to summation vulnerability to bitcoin. The Houston Firefighters Relief and Retirement Fund (HFRRF) successful concern with NYDIG has purchased $25 cardinal successful bitcoin (and ether) successful October 2021. MassMutual besides purchased $100 cardinal successful bitcoin successful December 2020.

The crushed wherefore pension funds and insurances are drawn to bitcoin is due to the fact that they request to save their monetary vigor (purchasing power) for the future. With ostentation levels astatine decennary highs, currency savings (in fiat) are being devalued. These funds are forced to instrumentality connected riskier investments successful hunt of higher yields, to support their purchasing powerfulness that is being devalued done inflation.

Holding bitcoin is simpler, arsenic bitcoin enables the quality to prevention owed to its deflationary nature.

The toothpaste (Bitcoin adoption) can't spell backmost successful the tube. Adoption has grown to a saturation level (in presumption of standard and diversity) which makes a aboriginal bitcoin modular for the satellite inevitable. The bulk of the satellite has blinders connected and cannot spot this oregon the groundswell of adoption and accumulation taking place.

Paul Tudor Jones says it best, “Bitcoin has this tremendous contingent of really, really, astute blase radical who judge successful it…. You’ve got this radical — which by the mode is crowdsourced each implicit the satellite — that are dedicated to seeing Bitcoin win successful becoming a commonplace store of worth and transactional to boot.”

It mightiness marque consciousness to get some, successful the lawsuit that the complaint of adoption continues to accelerate.

This is simply a impermanent station by Drew MacMartin. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)