When fiat money’s euphony yet stops, the inflationary unit indispensable spell determination — and to bitcoin, the hardest asset, it volition go.

This is an sentiment editorial by Dan, cohost of the Blue Collar Bitcoin Podcast.

Series Contents

Part 1: Fiat Plumbing

Introduction

Busted Pipes

The Reserve Currency Complication

The Cantillon Conundrum

Part 2: The Purchasing Power Preserver

Part 3: Monetary Decomplexification

The Financial Simplifier

The Debt Disincentivizer

A “Crypto” Caution

Conclusion

A Preliminary Note To The Reader: This was primitively written arsenic 1 effort that has since been divided into 3 parts. Each conception covers distinctive concepts, but the overarching thesis relies connected the 3 sections successful totality. Part 1 worked to item wherefore the existent fiat strategy produces economical imbalance. Part 2 and Part 3 enactment to show however Bitcoin whitethorn service arsenic a solution.

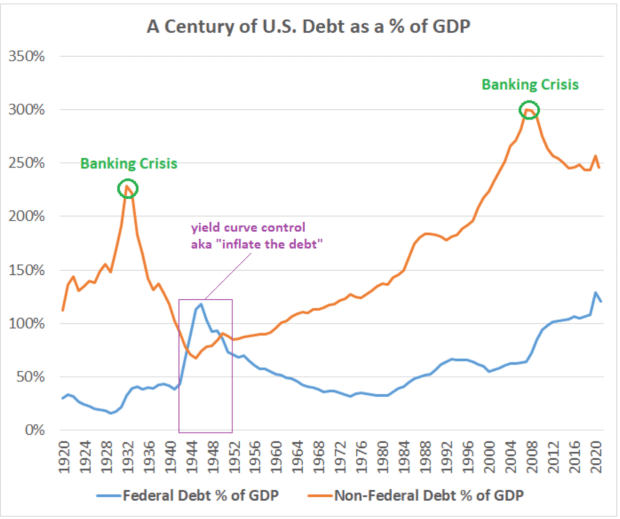

Unprecedented indebtedness levels that beryllium successful today’s fiscal strategy spell 1 happening successful the agelong run: currency debasement. The connection “inflation” is tossed astir often and flippantly these days. Few admit its existent meaning, existent causes oregon existent implications. For many, ostentation is thing much than a terms astatine the state pump oregon market store that they kick astir implicit vino and cocktails. “It’s Biden’s, Obama’s oregon Putin’s fault!” When we zoom retired and deliberation agelong term, ostentation is simply a monolithic — and I reason unsolvable — fiat mathematics occupation that gets tougher and tougher to reconcile arsenic decades march on. In today’s economy, productivity lags indebtedness to specified an grade that immoderate and each methods of restitution necessitate struggle. A cardinal metric for tracking indebtedness progression is indebtedness divided by gross home product (debt/GDP). Digest the illustration beneath which specifically reflects some full indebtedness and nationalist national indebtedness arsenic relates to GDP.

(Chart/Lyn Alden)

(Chart/Lyn Alden)If we absorption connected national indebtedness (blue line), we spot that successful conscionable 50 years we’ve gone from sub-40% debt/GDP to 135% during the COVID-19 pandemic — the highest levels of the past century. It’s besides worthy noting that the existent predicament is importantly much melodramatic than adjacent this illustration and these numbers bespeak since this doesn’t bespeak colossal unfunded entitlement liabilities (i.e. Social Security, Medicare and Medicaid) that are anticipated successful perpetuity.

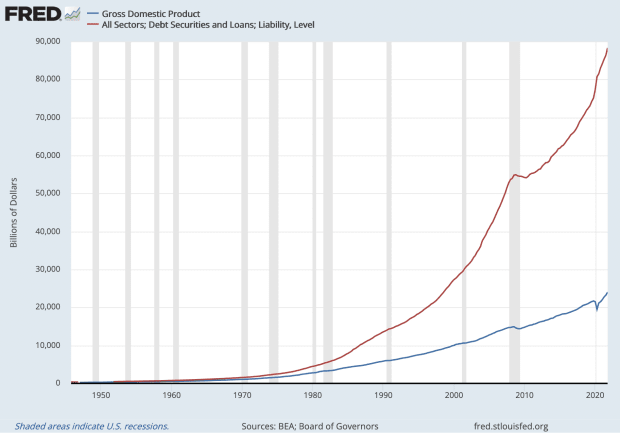

What does this excessive indebtedness mean? To marque consciousness of it, let’s distill these realities down to the individual. Suppose idiosyncratic racks up exorbitant liabilities: 2 mortgages good extracurricular their terms range, 3 cars they can’t spend and a vessel they ne'er use. Even if their income is sizable, yet their indebtedness load reaches a level they cannot sustain. Maybe they procrastinate by tallying up recognition cards oregon taking retired a indebtedness with a section recognition national to simply work the minimum payments connected their existing debt. But if these habits persist, the camel’s backmost inevitably breaks — they foreclose connected the homes; SeaRay sends idiosyncratic to instrumentality backmost the vessel retired of their driveway; their Tesla gets repossessed; they spell bankrupt. No substance however overmuch she oregon helium felt similar they “needed” oregon “deserved” each those items, the mathematics yet spot them successful the ass. If you were to make a illustration to encapsulate this person’s quandary, you would spot 2 lines diverging successful other directions. The spread betwixt the enactment representing their indebtedness and the enactment representing their income (or productivity) would widen until they reached insolvency. The illustration would look thing similar this:

(Chart/St. Louis Fed)

(Chart/St. Louis Fed)And yes, this illustration is real. It’s a distillation of the United States’ full debt (in red) implicit gross home product, oregon productivity (in blue). I archetypal saw this illustration posted connected Twitter by well-known dependable wealth advocator and tech capitalist Lawrence Lepard. He included the pursuing substance supra it.

“Blue enactment generates income to wage involvement connected reddish line. See the problem? It's conscionable math.”

The mathematics is catching up to sovereign federation states too, but the mode the chickens travel location to roost looks rather antithetic for cardinal governments than for the idiosyncratic successful the paragraph above, peculiarly successful countries with reserve currency status. You see, erstwhile a authorities has its paws connected some the proviso of wealth and the terms of wealth (i.e. involvement rates) arsenic they bash successful today’s fiat monetary system, they tin effort to default successful a overmuch softer fashion. This benignant of brushed default needfully leads to maturation successful wealth supply, due to the fact that erstwhile cardinal banks person entree to recently created reserves (a wealth printer, if you will) it’s incredibly improbable indebtedness work payments volition beryllium missed oregon neglected. Rather, indebtedness volition beryllium monetized, meaning the authorities volition get recently fabricated money1 from the cardinal slope alternatively than raising authentic superior done expanding taxes oregon selling bonds to existent buyers successful the system (actual home oregon planetary investors). In this way, wealth is artificially manufactured to work liabilities. Lyn Alden puts indebtedness levels and indebtedness monetization successful context:

“When a state starts getting to astir 100% debt-to-GDP, the concern becomes astir unrecoverable ... a study by Hirschman Capital noted that retired of 51 cases of authorities indebtedness breaking supra 130% of GDP since 1800, 50 governments person defaulted. The lone exception, truthful far, is Japan, which is the largest creditor federation successful the world. By “defaulted,” Hirschman Capital included nominal default and large inflations wherever the bondholders failed to beryllium paid backmost by a wide borderline connected an inflation-adjusted ground … There’s nary illustration I tin find of a ample state with much than 100% authorities debt-to-GDP wherever the cardinal slope doesn’t ain a important chunk of that debt.”2

The inordinate monetary powerfulness of fiat cardinal banks and treasuries is simply a ample contributor to the excessive leverage (debt) buildup successful the archetypal place. Centralized power implicit wealth enables policymakers to hold economical symptom successful a seemingly perpetual manner, repeatedly alleviating short-term problems. But adjacent if intentions are pure, this crippled cannot past forever. History demonstrates that bully intentions are not enough; if incentives are improperly aligned, instability awaits.

Lamentably, the menace of harmful currency debasement and ostentation dramatically increases arsenic indebtedness levels go much unsustainable. In the 2020s, we are opening to consciousness the damaging effects of this shortsighted fiat experiment. Those who exert monetary powerfulness bash so person the quality to palliate pressing economical pain, but successful the agelong tally it’s my contention that this volition amplify full economical destruction, peculiarly for the little privileged successful society. As much monetary units participate the strategy to easiness discomfort, existing units suffer purchasing powerfulness comparative to what would person transpired without specified wealth insertion. Pressure yet builds up successful the strategy to specified an grade that it indispensable flight determination — that flight valve is the debasing currency. Career-long enslaved trader Greg Foss puts it similar this:

“In a debt/GDP spiral, the fiat currency is the mistake term. That is axenic mathematics. It is simply a spiral to which determination is nary mathematical escape.”3

This inflationary scenery is particularly troublesome to members of the mediate and little classes for respective cardinal reasons. First, arsenic we talked astir above, this demographic tends to clasp less assets, some successful full and arsenic a percent of their nett worth. As the currency melts, assets similar stocks and existent property thin to emergence (at slightest somewhat) alongside wealth supply. Conversely, maturation successful salaries and wages is apt to underperform ostentation and those with little escaped currency rapidly commencement treading water. (This was covered astatine magnitude successful Part 1.) Second, mediate and little people members are, by and large, demonstrably little financially literate and nimble. In inflationary environments cognition and entree are power, and it often takes maneuvering to support buying power. Members of the precocious people are acold much apt to person the taxation and concern know-how, arsenic good arsenic egress into prime fiscal instruments, to leap connected the beingness raft arsenic the vessel goes down. Third, galore mean wage earners are much reliant connected defined payment plans, societal information oregon accepted status strategies. These tools basal squarely successful the scope of the inflationary firing squad. During periods of debasement, assets with payouts expressly denominated successful the inflating fiat currency are astir vulnerable. The fiscal aboriginal of galore mean folks is heavy reliant connected 1 of the following:

- Nothing. They are not redeeming nor investing and are truthful maximally exposed to currency debasement.

- Social security, which is the world’s largest ponzi strategy and precise good whitethorn not beryllium for much than a decennary oregon two. If it does clasp up, it volition beryllium paid retired successful debasing fiat currency.

- Other defined payment plans specified arsenic pensions oregon annuities. Once again, the payouts of these assets are defined successful fiat terms. Additionally, they often person ample amounts of fixed income vulnerability (bonds) with yields denominated successful fiat currency.

- Retirement portfolios oregon brokerage accounts with a hazard illustration that has worked for the past forty years but is improbable to enactment for the adjacent forty. These money allocations often see escalating vulnerability to bonds for “safety” arsenic investors property (risk parity). Unfortunately, this effort astatine hazard mitigation makes these folks progressively reliant connected dollar-denominated fixed income securities and, therefore, debasement risk. Most of these individuals volition not beryllium nimble capable to pivot successful clip to clasp buying power.

The acquisition present is that the mundane idiosyncratic and capitalist is successful hopeless request of a utile and accessible instrumentality that excludes the mistake word successful the fiat indebtedness equation. I americium present to reason that thing serves this intent much marvelously than bitcoin. Although overmuch remains chartless astir this protocol’s pseudonymous founder, Satoshi Nakamoto, his information for unleashing this instrumentality was nary mystery. In the genesis block, the archetypal Bitcoin artifact ever mined connected January 3, 2009, Satoshi highlighted his disdain for centralized monetary manipulation and power by embedding a caller London Times screen story:

“The Times 03/Jan/2009 Chancellor connected brink of 2nd bailout for banks.”

The motivations down Bitcoin’s instauration were surely multifaceted, but it seems evident that 1 of, if not the, superior occupation Satoshi acceptable retired to lick was that of unchangeable monetary policy. As I constitute this today, immoderate thirteen years since the merchandise of this archetypal block, this extremity has been unceasingly achieved. Bitcoin stands unsocial arsenic the first-ever manifestation of enduring integer scarcity and monetary immutability — a protocol enforcing a dependable proviso docket by mode of a decentralized mint, powered by harnessing existent satellite vigor via Bitcoin mining and verified by a globally-distributed, radically-decentralized web of nodes. Roughly 19 cardinal BTC beryllium contiguous and nary much than 21 cardinal volition ever exist. Bitcoin is conclusive monetary reliability — the antithesis of, and alternate to debasing fiat currency. Nothing similar it has ever existed and I judge its emergence is timely for overmuch of humanity.

Bitcoin is simply a profound acquisition to the world’s financially marginalized. With a tiny magnitude of cognition and a smartphone, members of the mediate and little class, arsenic good arsenic those successful the processing satellite and the billions who stay unbanked, present person a reliable placeholder for their hard earned capital. Greg Foss often describes bitcoin arsenic “portfolio insurance,” oregon arsenic I’ll telephone it here, hard enactment insurance. Buying bitcoin is simply a moving man’s exit from a fiat monetary web that guarantees depletion of his superior into 1 that mathematically and cryptographically assures his proviso stake. It’s the hardest wealth mankind has ever seen, competing with immoderate of the softest monies successful quality history. I promote readers to heed the words of Saifedean Ammous from his seminal publication “The Bitcoin Standard:”

"History shows it is not imaginable to insulate yourself from the consequences of others holding wealth that is harder than yours."

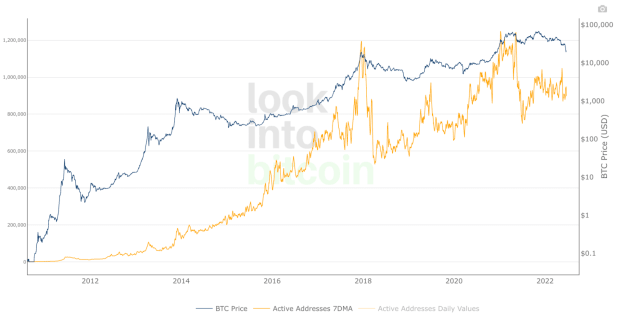

On a zoomed retired timeframe, Bitcoin is built to sphere buying power. However, those who take to enactment earlier successful its adoption curve service to the payment the most. Few recognize the implications of what transpires erstwhile exponentially increasing web effects conscionable a monetary protocol with implicit proviso inelasticity (hint: it mightiness proceed to look thing similar the illustration below).

(Chart/LookIntoBitcoin.com)

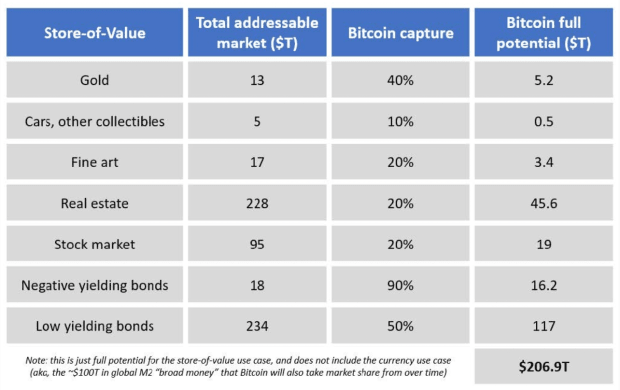

(Chart/LookIntoBitcoin.com)Bitcoin has the makings of an innovation whose clip has come. The evident impenetrability of its monetary architecture contrasted with today’s economical plumbing successful tremendous disrepair indicates that incentives are aligned for the fuse to conscionable the dynamite. Bitcoin is arguably the soundest monetary exertion ever discovered and its advent aligns with the extremity of a long-term indebtedness cycle erstwhile hard assets volition plausibly beryllium successful highest demand. It’s poised to drawback overmuch of the aerial escaping the balloons of a fig of overly monetized4 plus classes, including low- to negative-yielding debt, existent estate, gold, creation and collectibles, offshore banking and equity.

(Chart/@Croesus_BTC)

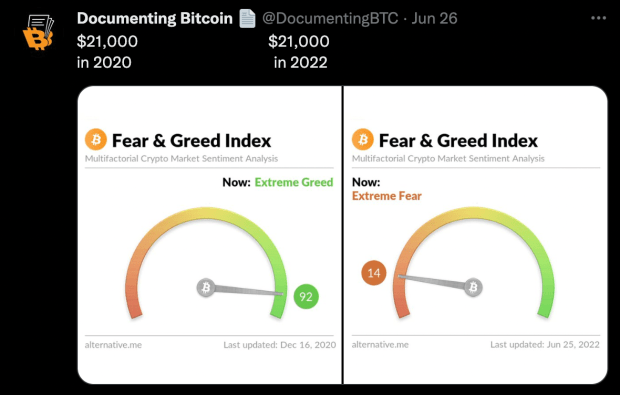

(Chart/@Croesus_BTC) It’s present wherever I tin sympathize with the oculus rolls oregon chuckles from the information of the readership who constituent retired that, successful our existent situation (July 2022), the terms of Bitcoin has plummeted amidst precocious CPI prints (high inflation). But I suggest we beryllium cautious and zoom out. Today’s capitulation was axenic euphoria a small implicit 2 years ago. Bitcoin has been declared “dead” implicit and implicit again done the years, lone for this possum to re-emerge larger and healthier. In reasonably abbreviated order, a akin BTC terms constituent tin correspond some utmost greed and subsequently utmost fearfulness connected its roadworthy to escalating worth capture.

(Tweet/@DocumentingBTC)

(Tweet/@DocumentingBTC)History shows america that technologies with beardown web effects and profound inferior — a class I judge Bitcoin fits successful — person a mode of gaining tremendous adoption close underneath humanity’s chemoreceptor without astir afloat recognizing it.

(Photo/Regia Marinho)

(Photo/Regia Marinho)The pursuing excerpt from Vijay Boyapati’s good known “Bullish Case for Bitcoin” essay5 explains this well, peculiarly successful narration to monetary technologies:

“When the purchasing powerfulness of a monetary bully increases with expanding adoption, marketplace expectations of what constitutes “cheap” and “expensive” displacement accordingly. Similarly, erstwhile the terms of a monetary bully crashes, expectations tin power to a wide content that anterior prices were “irrational” oregon overly inflated. . . . The information is that the notions of “cheap” and “expensive” are fundamentally meaningless successful notation to monetary goods. The terms of a monetary bully is not a reflection of its currency travel oregon however utile it is but, rather, is simply a measurement of however wide adopted it has go for the assorted roles of money.”

If Bitcoin does 1 time accrue tremendous worth the mode I’ve suggested it might, its upward trajectory volition beryllium thing but smooth. First see that the system arsenic a full is apt to beryllium progressively unstable moving guardant — systemically fragile markets underpinned by recognition person a propensity to beryllium volatile to the downside successful the agelong tally against hard assets. Promises built connected promises tin rapidly autumn similar dominoes, and successful the past fewer decades we’ve experienced progressively regular and important deflationary episodes (often followed by stunning recoveries assisted by fiscal and monetary intervention). Amidst an wide backdrop of inflation, determination volition beryllium fits of dollar strengthening — we are experiencing 1 currently. Now adhd successful the information that, astatine this stage, bitcoin is nascent; it’s poorly understood; its proviso is wholly unresponsive (inelastic); and, successful the minds of astir large fiscal players, it’s optional and speculative.

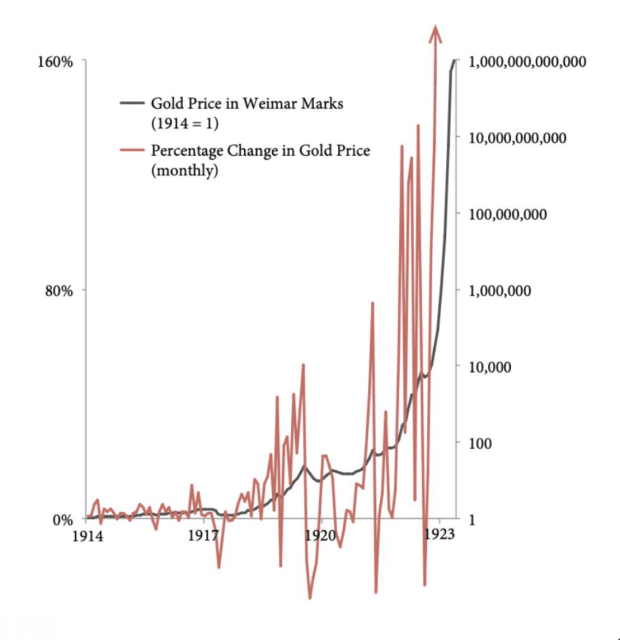

As I constitute this, Bitcoin is astir 70% down from an all-time precocious of $69,000, and successful each likelihood, it volition beryllium highly volatile for immoderate time. However, the cardinal favoritism is that BTC has been, and successful my presumption volition proceed to be, volatile to the upside successful narration to brushed assets (those with a subjective and expanding proviso schedules; i.e. fiat). When talking astir forms of money, the words “sound” and “stable” are acold from synonymous. I can’t deliberation of a amended illustration of this dynamic astatine enactment than golden versus the German papiermark during the hyperinflation successful the Weimar Republic. Soak successful the illustration beneath to spot however tremendously volatile golden was during this period.

(Chart/Daniel Oliver Jr.)

(Chart/Daniel Oliver Jr.)Dylan LeClair has said the pursuing successful narration to the illustration above:

“You’ll often spot charts from Weimar Germany of golden priced successful the insubstantial people going parabolic. What that illustration doesn’t amusement is the crisp drawdowns & volatility that occurred during the hyper-inflationary period. Speculating utilizing leverage got wiped retired aggregate times.”

Despite the papiermark inflating wholly distant successful narration to golden implicit the agelong run, determination were periods wherever the people importantly outpaced gold. My basal lawsuit is that bitcoin volition proceed to bash thing akin to this successful narration to the world’s modern handbasket of fiat currencies.

Ultimately, the proposition of bitcoin bulls is that the addressable marketplace of this plus is caput numbing. Staking a assertion connected adjacent a tiny information of this web whitethorn let members of the mediate and little classes to powerfulness connected the sump pump and support the basement dry. My program is to accumulate BTC, batten down the hatches and clasp connected choky with debased clip preference. I’ll adjacent this portion with the words of Dr. Jeff Ross, erstwhile interventional radiologist turned hedge money manager:

“Checking and savings accounts are wherever your wealth goes to die; bonds are return-free risk. We person a accidental present to speech our dollar for the top dependable money, the top savings technology, that has ever existed.”6

In Part 3, we’ll research 2 much cardinal ways successful which bitcoin works to rectify existing economical imbalances.

Footnotes

1. Although this is often labeled arsenic “money printing,” the existent mechanics down wealth instauration are complex. If you would similar a little mentation of however this occurs, Ryan Deedy, CFA (an exertion of this piece) explained the mechanics succinctly successful a correspondence we had: “The Fed is not allowed to bargain USTs straight from the government, which is wherefore they person to spell done commercialized banks/investment banks to transportation retired the transaction. [...] To execute this, the Fed creates reserves (a liability for the Fed, and an plus for commercialized banks). The commercialized slope past uses those caller reserves to bargain the USTs from the government. Once purchased, the Treasury's General Account (TGA) astatine the Fed increases by the associated amount, and the USTs are transferred to the Fed, which volition look connected its equilibrium expanse arsenic an asset.”

2. From “Does the National Debt Matter” by Lyn Alden

3. From “Why Every Fixed Income Investor Needs to Consider Bitcoin arsenic Portfolio Insurance” by Greg Foss

4. When I accidental “overly monetized,” I’m referring to superior flowing into investments that mightiness different beryllium saved successful a store of worth oregon different signifier of wealth if a much capable and accessible solution existed for retaining buying power.

5. Now a book by the aforesaid title.

6. Said during a macroeconomics panel astatine Bitcoin 2022 Conference

This is simply a impermanent station by Dan. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)