Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a caller work titled The Mustard Seed, Joe Burnett—Director of Market Research astatine Unchained—outlines a thesis that envisions Bitcoin reaching $10 cardinal per coin by 2035. This inaugural quarterly letter takes the agelong view, focusing connected “time arbitrage” arsenic it surveys wherever Bitcoin, technology, and quality civilization could basal a decennary from now.

Burnett’s statement revolves astir 2 main transformations that, helium contends, are mounting the signifier for an unprecedented migration of planetary superior into Bitcoin: (1) the “Great Flow of Capital” into an plus with implicit scarcity, and (2) the “Acceleration of Deflationary Technology” arsenic AI and robotics reshape full industries.

A Long-Term Perspective On Bitcoin

Most economical commentary zooms successful connected the adjacent net study oregon the contiguous terms volatility. In contrast, The Mustard Seed announces its ngo clearly: “Unlike astir fiscal commentary that fixates connected the adjacent 4th oregon adjacent year, this missive takes the agelong view—identifying profound shifts earlier they go consensus.”

At the halfway of Burnett’s outlook is the reflection that the planetary fiscal system—comprising astir $900 trillion successful full assets—faces ongoing risks of “dilution oregon devaluation.” Bonds, currencies, equities, gold, and existent property each person expansionary oregon inflationary components that erode their store-of-value function:

- Gold ($20 trillion): Mined astatine astir 2% annually, expanding proviso and dilatory diluting its scarcity.

- Real Estate ($300 trillion): Expands astatine astir 2.4% per twelvemonth owed to caller development.

- Equities ($110 trillion): Company profits are perpetually eroded by contention and marketplace saturation, contributing to devaluation risk.

- Fixed Income & Fiat ($230 trillion): Structurally taxable to inflation, which reduces purchasing powerfulness implicit time.

Burnett describes this improvement arsenic superior “searching for a little imaginable vigor state,” likening the process to h2o cascading down a waterfall. In his view, each pre-Bitcoin plus classes were efficaciously “open bounties” for dilution oregon devaluation. Wealth managers could administer superior among existent estate, bonds, gold, oregon stocks, but each class carried a mechanics by which its existent worth could erode.

Enter Bitcoin, with its 21-million-coin hard cap. Burnett sees this integer plus arsenic the archetypal monetary instrumentality incapable of being diluted oregon devalued from within. Supply is fixed; demand, if it grows, tin straight construe into terms appreciation. He cites Michael Saylor’s “waterfall analogy”: “Capital people seeks the lowest imaginable vigor state—just arsenic h2o flows downhill. Before bitcoin, wealthiness had nary existent flight from dilution oregon devaluation. Wealth stored successful each plus people acted arsenic a marketplace bounty, incentivizing dilution oregon devaluation.”

As soon arsenic Bitcoin became wide recognized, says Burnett, the crippled changed for superior allocation. Much similar discovering an untapped reservoir acold beneath existing h2o basins, the planetary wealthiness proviso recovered a caller outlet—one that cannot beryllium augmented oregon diluted.

To exemplify Bitcoin’s unsocial proviso dynamics, The Mustard Seed draws a parallel with the halving cycle. In 2009, miners received 50 BTC per block—akin to Niagara Falls astatine afloat force. As of today, the reward dropped to 3.125 BTC, reminiscent of halving the Falls’ travel repeatedly until it is importantly reduced. In 2065, Bitcoin’s recently minted proviso volition beryllium negligible compared to its full volume, mirroring a waterfall reduced to a trickle.

Though Burnett concedes that attempts to quantify Bitcoin’s planetary adoption trust connected uncertain assumptions, helium references 2 models: the Power Law Model which projects $1.8 cardinal per BTC by 2035 and Michael Saylor’s Bitcoin exemplary which suggests $2.1 cardinal per BTC by 2035.

He counters that these projections mightiness beryllium “too conservative” due to the fact that they often presume diminishing returns. In a satellite of accelerating technological adoption—and a increasing realization of Bitcoin’s properties—price targets could overshoot these models significantly.

The Acceleration Of Deflationary Technology

A 2nd large catalyst for Bitcoin’s upside potential, per The Mustard Seed, is the deflationary question brought connected by AI, automation, and robotics. These innovations rapidly summation productivity, little costs, and marque goods and services much abundant. By 2035, Burnett believes planetary costs successful respective cardinal sectors could acquisition melodramatic reductions.

Adidas’ “Speedfactories” chopped sneaker accumulation from months to days. The scaling of 3D printing and AI-driven assembly lines could slash manufacturing costs by 10x. 3D-printed homes already spell up 50x faster astatine acold little costs. Advanced supply-chain automation, combined with AI logistics, could marque prime lodging 10x cheaper. Autonomous ride-hailing tin perchance trim fares by 90% by removing labour costs and improving efficiency.

Burnett underscores that, nether a fiat system, earthy deflation is often “artificially suppressed.” Monetary policies—like persistent ostentation and stimulus—inflate prices, masking technology’s existent interaction connected lowering costs.

Bitcoin, connected the different hand, would fto deflation “run its course,” expanding purchasing powerfulness for holders arsenic goods go much affordable. In his words: “A idiosyncratic holding 0.1 BTC contiguous (~$10,000) could spot its purchasing powerfulness summation 100x oregon much by 2035 arsenic goods and services go exponentially cheaper.”

To exemplify however proviso maturation erodes a store of worth implicit time, Burnett revisits gold’s performance since 1970. Gold’s nominal terms from $36 per ounce to astir $2,900 per ounce successful 2025 appears substantial, but that terms summation was continuously diluted by the yearly 2% summation successful gold’s wide supply. Over 5 decades, the planetary banal of golden astir tripled.

If gold’s proviso had been static, its terms would person deed $8,618 per ounce by 2025, according to Burnett’s calculations. This proviso constraint would person bolstered gold’s scarcity, perchance pushing request and terms adjacent higher than $8,618.

Bitcoin, by contrast, incorporates precisely the fixed proviso information that golden ne'er had. Any caller request volition not spur further coin issuance and frankincense should thrust the terms upward much directly.

Burnett’s forecast for a $10 cardinal Bitcoin by 2035 would connote a full marketplace headdress of $200 trillion. While that fig sounds colossal, helium points retired that it represents lone astir 11% of planetary wealth—assuming planetary wealthiness continues to grow astatine a ~7% yearly rate. From this vantage point, allocating astir 11% of the world’s assets into what The Mustard Seed calls “the champion semipermanent store of worth asset” mightiness not beryllium far-fetched. “Every past store of worth has perpetually expanded successful proviso to conscionable demand. Bitcoin is the archetypal that cannot.”

A cardinal portion of the puzzle is the information fund for Bitcoin: miner revenue. By 2035, Bitcoin’s artifact subsidy volition beryllium down to 0.78125 BTC per block. At $10 cardinal per coin, miners could gain $411 cardinal successful aggregate gross each year. Since miners merchantability the Bitcoin they gain to screen costs, the marketplace would person to sorb $411 cardinal of recently mined BTC annually.

Burnett draws a parallel with the planetary vino market, which was valued astatine $385 cardinal successful 2023 and is projected to scope $528 cardinal by 2030. If a “mundane” assemblage similar vino tin prolong that level of user demand, an manufacture securing the world’s starring integer store of worth reaching akin scale, helium argues, is good wrong reason.

Despite nationalist cognition that Bitcoin is becoming mainstream, Burnett highlights an underreported metric: “The fig of radical worldwide with $100,000 oregon much successful bitcoin is lone 400,000… that’s 0.005% of the planetary population—just 5 successful 100,000 people.”

Meanwhile, studies mightiness amusement astir 39% of Americans person immoderate level of “direct oregon indirect” Bitcoin exposure, but this fig includes immoderate fractional ownership—such arsenic holding shares of Bitcoin-related equities oregon ETFs done communal funds and pension plans. Real, important adoption remains niche. “If Bitcoin is the champion semipermanent savings technology, we would expect anyone with important savings to clasp a important magnitude of bitcoin. Yet today, virtually nary 1 does.”

Burnett emphasizes that the roadworthy to $10 cardinal does not necessitate Bitcoin to supplant each wealth worldwide—only to “absorb a meaningful percent of planetary wealth.” The strategy for forward-looking investors, helium contends, is elemental but non-trivial: disregard short-term noise, absorption connected the multi-year horizon, and enactment earlier planetary consciousness of Bitcoin’s properties becomes universal. “Those who tin spot past the short-term volatility and absorption connected the bigger representation volition admit bitcoin arsenic the astir asymmetric and overlooked stake successful planetary markets.”

In different words, it is astir “front-running the superior migration” portion Bitcoin’s idiosyncratic basal is inactive comparatively minuscule and the immense bulk of accepted wealthiness remains successful bequest assets.

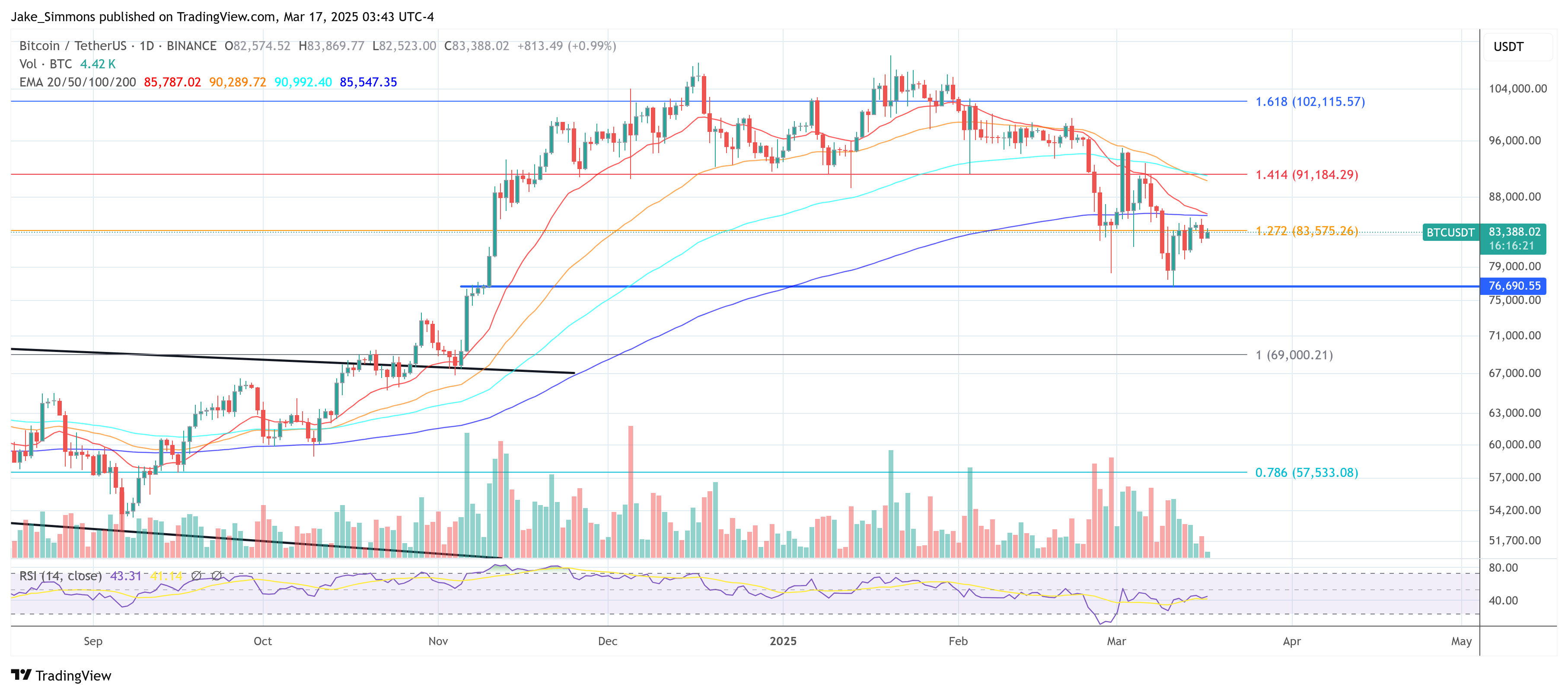

At property time, BTC traded astatine $83,388.

BTC terms stalls beneath cardinal resistance, 1-day illustration | Source: BTCUSDT connected TradingView.com

BTC terms stalls beneath cardinal resistance, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

6 months ago

6 months ago

English (US)

English (US)