In a caller analysis, Stanislas Bernard, the laminitis of Sinz 21st.Capital, delved into the complexities surrounding Hong Kong’s information to o.k. spot Bitcoin ETFs against the backdrop of China’s escalating economical crisis. With the federation grappling with a grounds debt-to-GDP ratio of 288% successful 2023, and witnessing 1 of the astir terrible lodging marketplace collapses successful 3 decades, the fiscal instability has triggered an unprecedented superior formation towards overseas markets.

The Perfect Timing For A Spot Bitcoin ETF?

Amidst these turbulent economical times, Hong Kong’s imaginable support of spot Bitcoin ETFs stands retired arsenic a pivotal improvement that could not lone beryllium a harmless haven for Chinese investors but besides importantly power Bitcoin’s valuation, perchance catapulting it to the elusive $100,000 mark.

China’s economical woes person been intensifying, marked by a towering indebtedness ratio and a plummeting lodging assemblage that has investors scrambling for alternatives. “China presently faces a important economical downturn, exacerbated by soaring indebtedness and malinvestments successful existent estate. The crisis, becoming well-known successful 2021 with the default of Evergrande Group, has present spread, causing a ripple effect that volition apt dilatory down the Chinese system for years to come,” Bernard pointed out.

This backdrop of economical instability has incited a important displacement successful capitalist behavior, notably among Chinese investors who, faced with stringent superior controls, person sought refuge successful ETFs that connection vulnerability to overseas markets. Yet, this avenue has been fraught with its ain challenges.

“Investors are paying premiums arsenic precocious arsenic 43% connected definite US-focused ETFs owed to quota limitations, which speaks volumes astir the desperation to find safer concern harbors,” Bernard notes. Such premiums underscore the pervasive fearfulness and uncertainty that person gripped the Chinese market, driving investors towards seemingly immoderate disposable exit from the volatility of the home market.

The Role Of Hong Kong

Bernard believes that not lone Hong Kongers but besides Chinese mainlanders volition flock to Bitcoin ETFs. “They are beauteous integrated. Mainland is HK’s largest trading partner. Would not beryllium imaginable to o.k. a spot ETF and past adjacent it to mainland. They volition enforce transaction limits instead,” the adept said.

In the midst of these developments, Hong Kong’ Securities and Futures Commission (SFC) is reportedly considering the support of spot Bitcoin ETFs already by the extremity of April, arsenic reported yesterday. This determination is viewed arsenic a strategical effort to seizure a information of the superior flowing into Bitcoin, particularly successful the aftermath of the SEC’s support of akin ETFs successful the US, which saw a meteoric emergence with $12 cardinal of nett flow.

“Hong Kong is scrambling for a change. The support of spot Bitcoin ETFs could unlock a immense reservoir of stranded Chinese superior into Bitcoin, providing a much-needed beingness raft for investors,” Bernard explained.

The anticipated support of spot Bitcoin ETFs by Hong Kong authorities has been met with important enthusiasm wrong the crypto community. Influential figures specified arsenic Bitcoin Munger and Stack Hodler person been vocal astir the imaginable interaction of this improvement connected Bitcoin’s price.

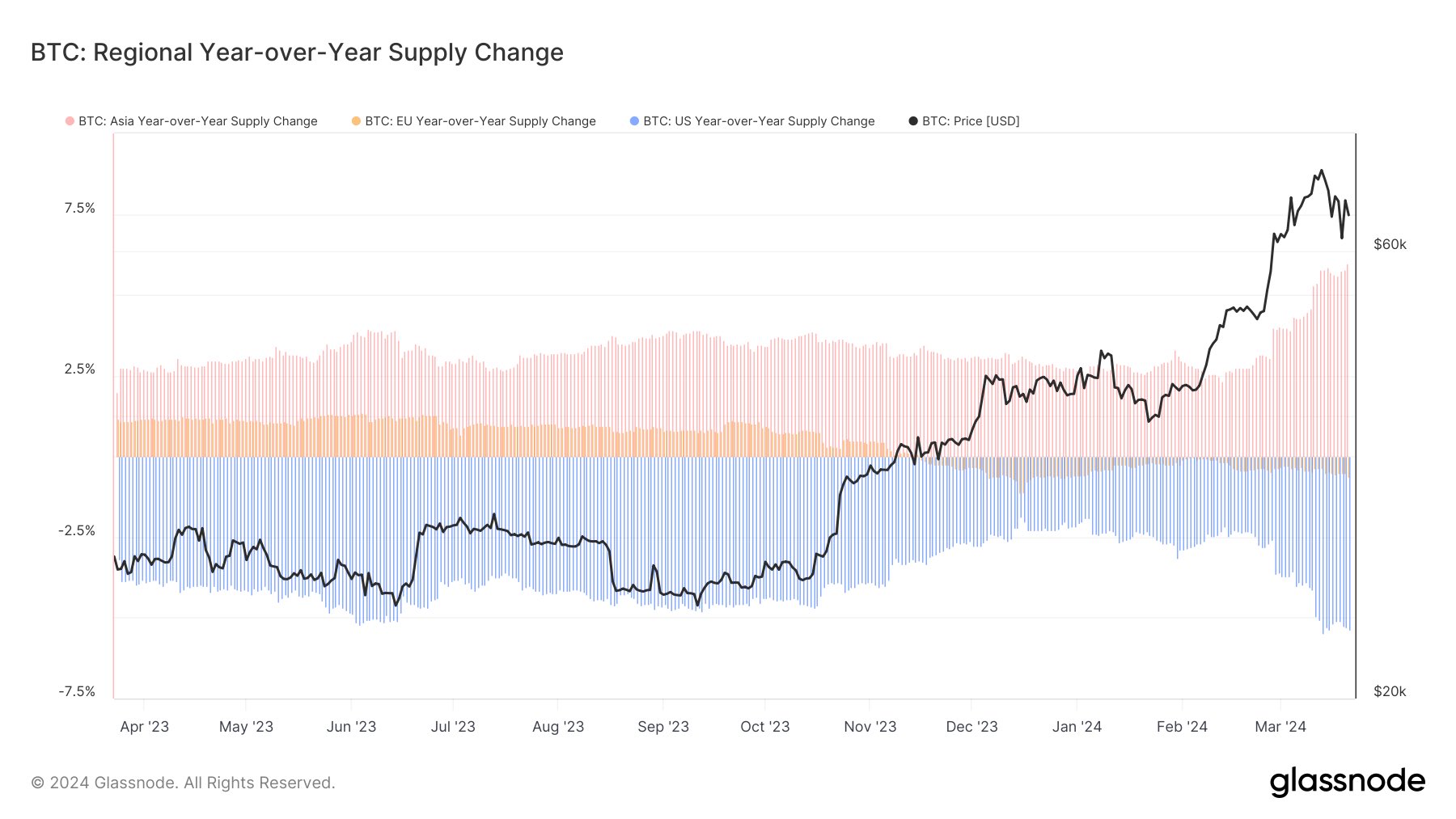

“Hong Kong ETFs support person accelerated to adjacent week. Most accounts connected CT weren’t making a large woody astir them, but they are a large deal. They are going to instrumentality america to $100k+ successful owed time. Tick tock!” stated fashionable Bitcoin expert Bitcoin Munger (@bitcoinmunger). He refers to the determination yearly year-over-year proviso alteration from West to East.

Regional yearly year-over-year proviso alteration | Source: X @bitcoinmunger

Regional yearly year-over-year proviso alteration | Source: X @bitcoinmungerStack Hodler (@stackhodler) further emphasized the urgency among Chinese investors to find unafraid concern avenues extracurricular the accepted system, “Chinese investors were panic-buying a Gold money astatine a 30% premium this period arsenic they effort to get their wealthiness into thing outside the Chinese system. The support of Hong Kong spot ETFs could beryllium the turning point, offering a sanctioned avenue for wealthiness preservation amidst the crumbling existent property market.”

Overall, the imaginable support of spot Bitcoin ETFs successful Hong Kong is poised to beryllium a landmark development, not conscionable for the portion but for the planetary market. By offering a unafraid and regulated transmission for investment, it could service arsenic a catalyst for important superior inflow into Bitcoin, reinforcing its presumption arsenic a viable store of value.

“As we basal astatine the cusp of this historical development, the implications for Bitcoin and the broader cryptocurrency marketplace could beryllium profound. The support of spot Bitcoin ETFs successful Hong Kong could so beryllium the harbinger of a caller era, perchance driving Bitcoin’s worth to caller heights,” concluded Bernard.

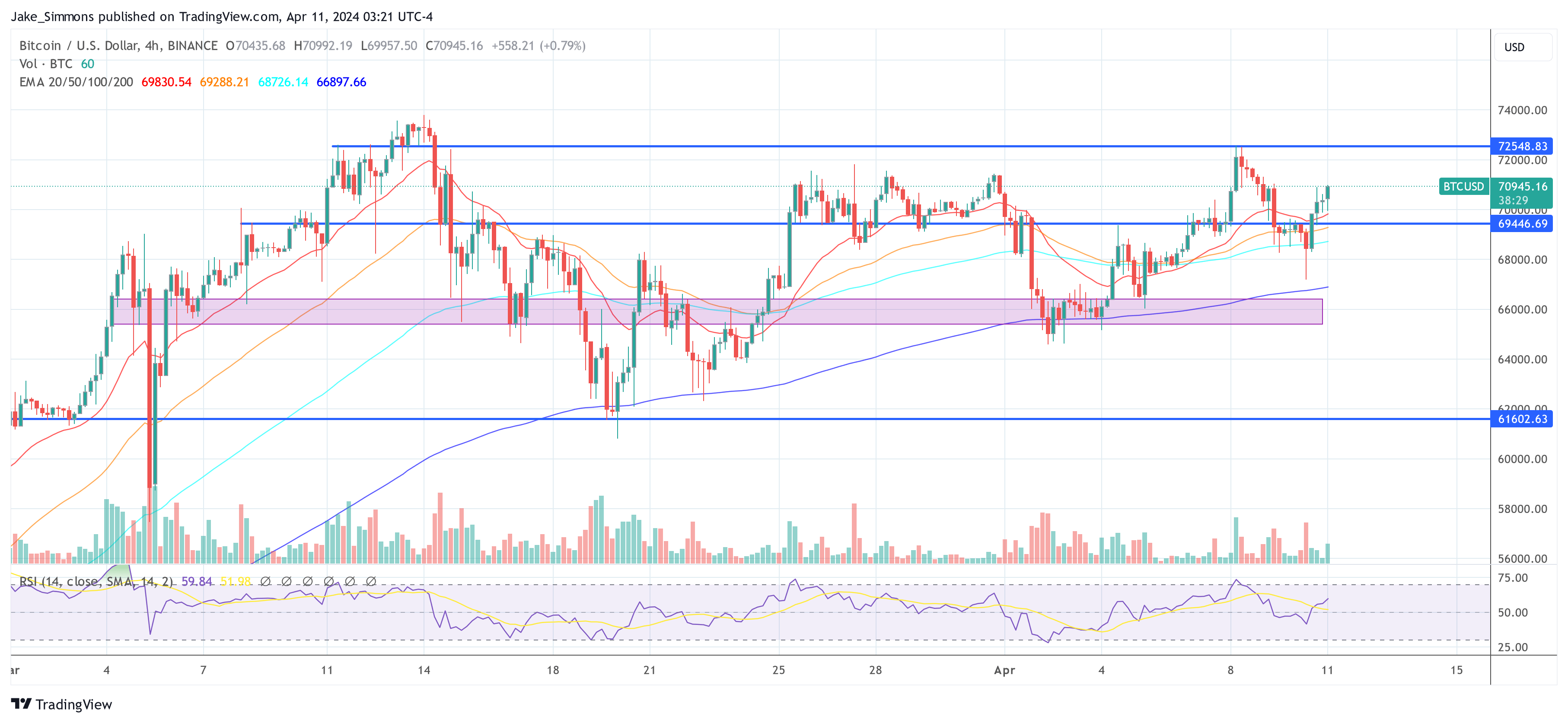

At property time, BTC traded astatine $70,945.

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)