On-chain information shows the Bitcoin speech whale ratio has spiked recently, thing that could pb to further downside successful the asset’s value.

Bitcoin Exchange Whale Ratio Has Sharply Surged Recently

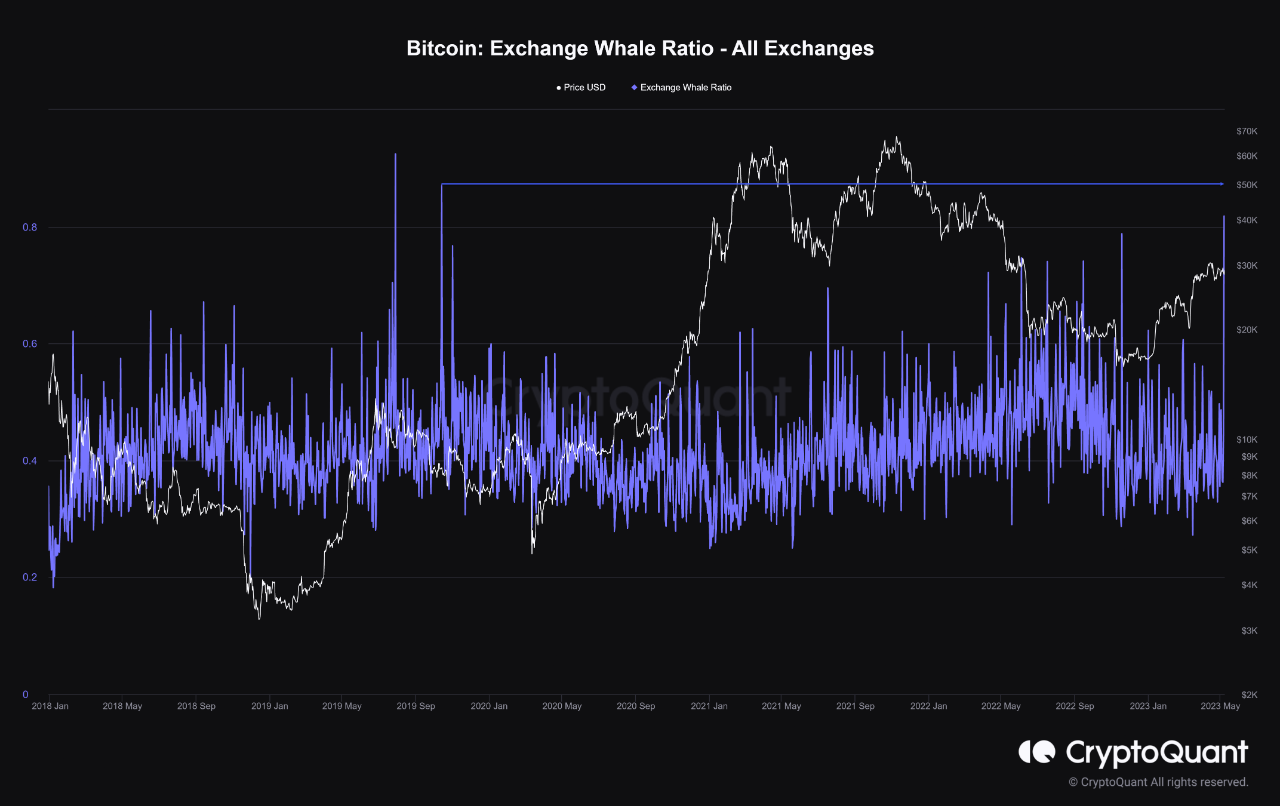

As pointed retired by an expert successful a CryptoQuant post, the speech whale ratio is presently astatine its highest level since September 2019. The “exchange whale ratio” is an indicator that measures the ratio betwixt the sum of the apical 10 inflows to exchanges and the full speech inflows.

An “exchange inflow” is immoderate question of Bitcoin towards the wallets of centralized exchanges from addresses extracurricular specified platforms (like self-custodial wallets).

The apical 10 inflows present notation to the 10 largest inflow transactions going towards these platforms. Generally, these largest transfers are coming from the whales, truthful the speech whale ratio tin archer america however the inflow enactment of the whales presently compares with that of the full marketplace (the full inflows).

When this indicator has a precocious value, it means these humongous holders are making up a ample portion of the full inflows currently. As 1 of the main reasons wherefore investors determination their coins to exchanges is for selling-related purposes, this benignant of inclination tin beryllium a motion that whales are selling close now.

On the different hand, debased values of the metric connote this cohort isn’t making excessively galore inflows comparative to the remainder of the market. Such a inclination tin beryllium either neutral oregon bullish for the cryptocurrency’s price, depending connected immoderate different marketplace conditions.

Now, present is simply a illustration that shows the inclination successful the Bitcoin speech whale ratio implicit the past fewer years:

As displayed successful the supra graph, the Bitcoin speech whale ratio has observed a beauteous ample spike recently. This suggests that whales are making up a alternatively ample portion of the full speech inflows currently.

The metric has crossed the worth of 0.8 successful this spike, implying that much than 80% of the inflows are coming from these humongous investors close now. This level of ratio hasn’t been seen successful the marketplace since mode backmost successful 2019.

This erstwhile spike of akin standard occurred arsenic the terms was winding down from the April 2019 rally, and soon aft it took place, Bitcoin registered an hold successful its drawdown.

An adjacent larger spike successful the ratio was besides observed earlier successful the aforesaid year, astir erstwhile the aforementioned April 2019 rally topped out. The timings of these 2 spikes whitethorn suggest that it was the dumping from the whales that influenced the marketplace and caused the terms to spell down.

If these erstwhile instances of whale inflow enactment of akin levels are thing to spell by, past the Bitcoin terms whitethorn look a bearish diminution successful the adjacent word owed to the existent imaginable selling unit from this cohort.

The drawdown whitethorn person perchance besides already started, arsenic the cryptocurrency’s terms has taken a dive beneath the $28,000 people today.

BTC Price

At the clip of writing, Bitcoin is trading astir $27,900, down 2% successful the past week.

Featured representation from Thomas Lipke connected Unsplash.com, charts from TradingView.com, CryptoQuant.com

2 years ago

2 years ago

English (US)

English (US)