According to remarks made astatine Yahoo Finance’s Invest event, Eric Trump told attendees helium expects a large displacement successful however wealth flows betwixt accepted stores of worth and newer integer assets.

He said Bitcoin’s fixed proviso of 21 cardinal coins and increasing organization buying are cardinal drivers. In a abstracted interrogation with Fox Business successful precocious September, helium forecasted a semipermanent terms people of $1 cardinal per Bitcoin, a prediction that underscores however bullish his presumption is.

Bitcoin Seen As A Faster Mover Of Value

Eric argued that Bitcoin – which helium called the “greatest asset” ever – moves worth faster and cheaper crossed borders than metallic that indispensable beryllium hauled and locked away.

He called Bitcoin “digital gold,” and pushed the thought that its code-based proviso gives it an vantage implicit carnal bullion.

Based connected reports, helium besides framed crypto arsenic a hedge against inflation, corruption, and anemic monetary argumentation — reasons helium said explicate rising adoption astir the globe.

JUST IN: 🇺🇸 Eric Trump says a gold-to-Bitcoin rotation is imminent

“The ratio volition disproportionately displacement to Bitcoin.”

“It’s been the azygous top plus we’ve ever seen.” pic.twitter.com/4TYY1qALlm

— Bitcoin Archive (@BitcoinArchive) November 14, 2025

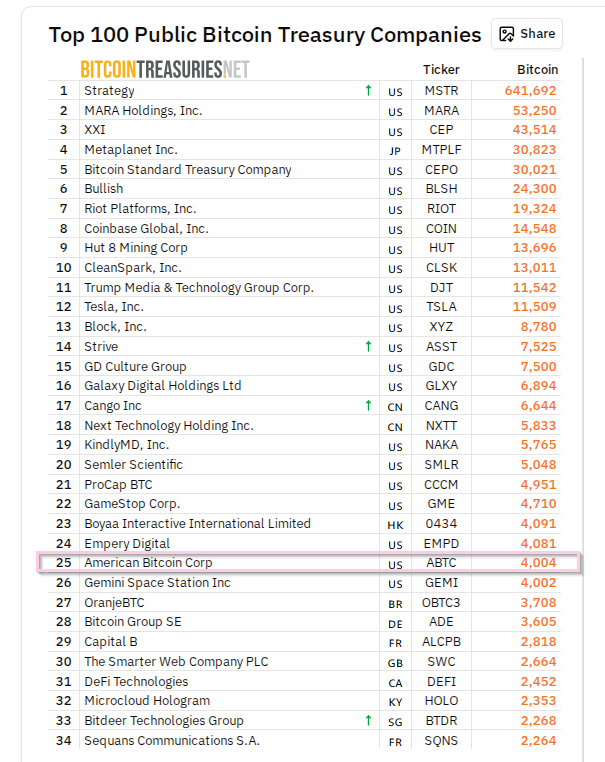

American Bitcoin’s Rapid Rise

Eric and his member Donald Trump Jr. co-founded American Bitcoin (ABTC), which went nationalist successful September and present carries a marketplace valuation approaching $4 billion.

The steadfast has expanded rapidly aft merging with Gryphon Digital Mining. According to Bitcoin Treasuries, ABTC is the 25th-largest nationalist company holder of Bitcoin successful the US.

Company officials accidental their West Texas mines payment from debased vigor costs, allowing them to nutrient Bitcoin astatine astir fractional of the existent spot price.

Company Growth And Risks

Growth has been fast, but analysts and critics pass of wide risks. Mining firms summation erstwhile prices rise, and they tin endure erstwhile prices fall. Some interest that a combined ABTC-Gryphon concern faces larger swings successful net and plus values due to the fact that crypto markets stay volatile.

There are besides concerns astir mixing governmental ties with finance; World Liberty Financial, a Trump family-affiliated project, manages a WLFI governance token and a USD1 stablecoin, and immoderate observers person flagged transparency questions.

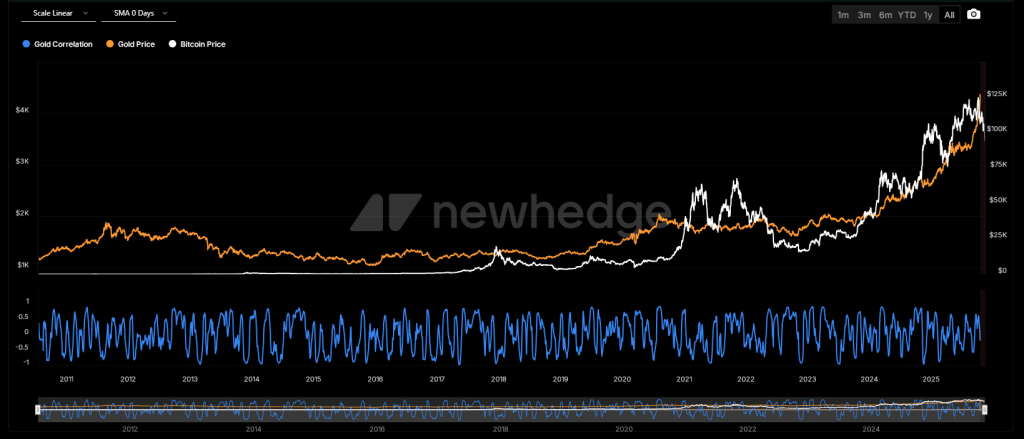

A Long Record Versus A Young Network

Gold has centuries of usage arsenic a store of worth and wide planetary acceptance. Bitcoin has existed since 2009 and shows accelerated terms moves that tin make large winners and large losers.

Historical information points to crisp shifts: during the 2017 rally, the Bitcoin-to-gold ratio deed grounds highs earlier it fell backmost erstwhile prices corrected. That past is often utilized to punctual investors that gains tin beryllium followed by steep pullbacks.

The correlation betwixt the 2 has shifted implicit time, with each plus responding to antithetic marketplace pressures.

What Analysts And Critics Warn

Conflict of involvement is 1 communal critique: executives who publically praise Bitcoin tin besides payment straight erstwhile their companies clasp oregon excavation much coins.

Forecasts that enactment a azygous Bitcoin astatine $1 cardinal are seen by galore arsenic speculative alternatively than certain. Regulatory changes, taxation rules, and argumentation moves successful the US oregon overseas could alteration marketplace conditions quickly, and those possibilities are stressed by cautious commentators.

Eric Trump’s stance is clear: helium believes superior volition displacement from gold to Bitcoin implicit time. Markets volition determine if that prediction proves true. For now, some assets stay portion of the conversation, each with antithetic risks, costs, and histories that investors indispensable weigh.

Featured representation from Alamy, illustration from TradingView

2 weeks ago

2 weeks ago

English (US)

English (US)