Bitcoin’s latest pullback whitethorn already beryllium bottoming out, with plus manager Grayscale arguing the marketplace is connected way to interruption the accepted four-year halving rhythm and perchance acceptable caller all-time highs successful 2026.

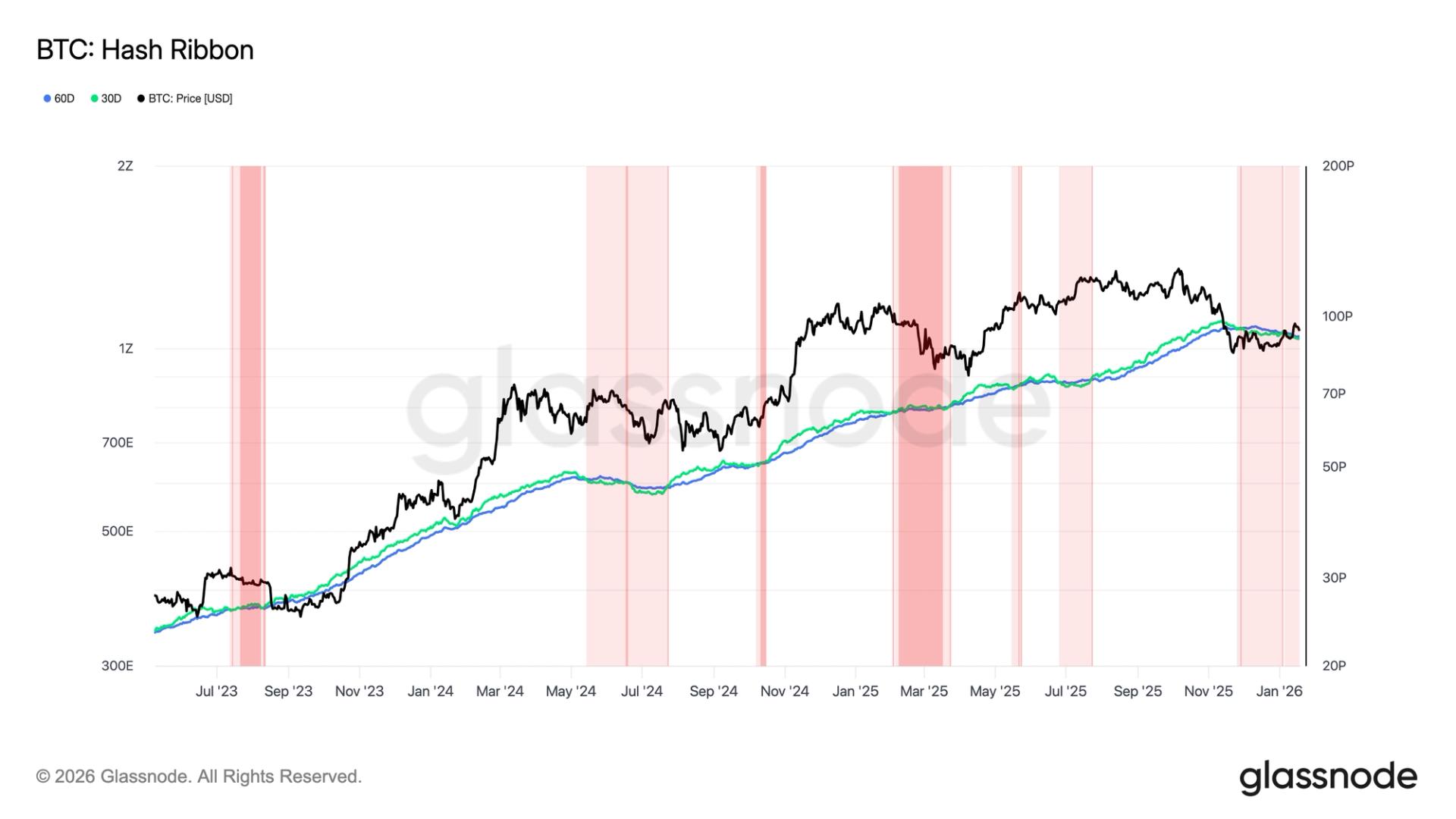

Some indicators are already pointing to a section bottom, not a prolonged drawdown, including Bitcoin’s (BTC) elevated enactment skew rising supra 4, which signals that investors person already hedged “extensively” for downside exposure.

Despite a 32% decline, Bitcoin is connected way to disrupt the accepted four-year halving cycle, wrote Grayscale successful a Monday probe report. “Although the outlook is uncertain, we judge the four-year rhythm thesis volition beryllium to beryllium incorrect, and that Bitcoin’s terms volition perchance marque caller highs adjacent year,” the study states.

Related: Cathie Wood inactive bullish connected $1.5M Bitcoin terms target: Finance Redefined

However, Bitcoin’s short-term betterment remains constricted until immoderate of the main travel indicators signifier a reversal, including futures unfastened interest, exchange-traded money (ETF) inflows and selling from semipermanent Bitcoin holders.

US spot Bitcoin ETFs, 1 of the main drivers of Bitcoin’s momentum successful 2025, added important downside unit successful November, racking up $3.48 cardinal successful nett antagonistic outflows successful their second-worst period connected record, according to Farside Investors.

More recently, though, the tide has started to turn. The funds person present logged 4 consecutive days of inflows, including a humble $8.5 cardinal connected Monday, suggesting ETF purchaser appetite is dilatory returning aft the sell-off.

While marketplace positioning suggests a “leverage reset alternatively than a sentiment break,” the cardinal question is whether Bitcoin tin “reclaim the low-$90,000s to debar sliding toward mid-to-low-$80,000 support,” Iliya Kalchev, dispatch expert astatine integer plus level Nexo, told Cointelegraph.

Related: Strategy unveils caller recognition gauge to calm indebtedness fears aft Bitcoin crash

Fed argumentation and US crypto measure loom arsenic 2026 catalysts

Crypto marketplace watchers present await the largest “swing factor:” the US Federal Reserve’s involvement complaint determination connected Dec. 10. The Fed’s determination and monetary argumentation guidance volition service arsenic a important catalyst for 2026, according to Grayscale.

Markets are pricing successful an 87% accidental of a 25 ground constituent involvement complaint cut, up from 63% a period ago, according to the CME Group’s FedWatch tool.

Later successful 2026, Grayscale said continued advancement toward the Digital Asset Market Structure bill whitethorn enactment arsenic different catalyst for driving “institutional concern successful the industry.” However, for much advancement to beryllium made, crypto needs to stay a “bipartisan issue,” and not crook into a partisan taxable for the midterm US elections, Grayscale said.

That effort efficaciously began with the transition of the CLARITY Act successful the House of Representatives, which moved guardant successful July arsenic portion of the Republicans’ “crypto week” agenda. Senate leaders person said they program to “build on” the House measure nether the banner of the Responsible Financial Innovation Act, aiming to acceptable a broader model for integer plus markets.

The measure is presently nether information successful the Republican-led Senate Agriculture Committee and the Senate Banking Committee. Senate Banking Chair Tim Scott said successful November that the committee planned to person the measure acceptable for signing into instrumentality by aboriginal 2026.

Magazine: Bitcoin to spot ‘one much large thrust’ to $150K, ETH unit builds

1 month ago

1 month ago

English (US)

English (US)