Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin dipped to $103,450 yesterday, wiping retired astir $1 cardinal successful leveraged bets implicit the past 24 hours. Many traders hurried to sell, but the autumn was short-lived.

Bitcoin recovered its footing and climbed backmost to $104,400 by the clip this study was filed. According to a caller investigation by crypto researcher Klarch, this pullback was expected and mightiness conscionable beryllium a pit halt earlier different tally to caller highs.

Recurring Cycle Patterns

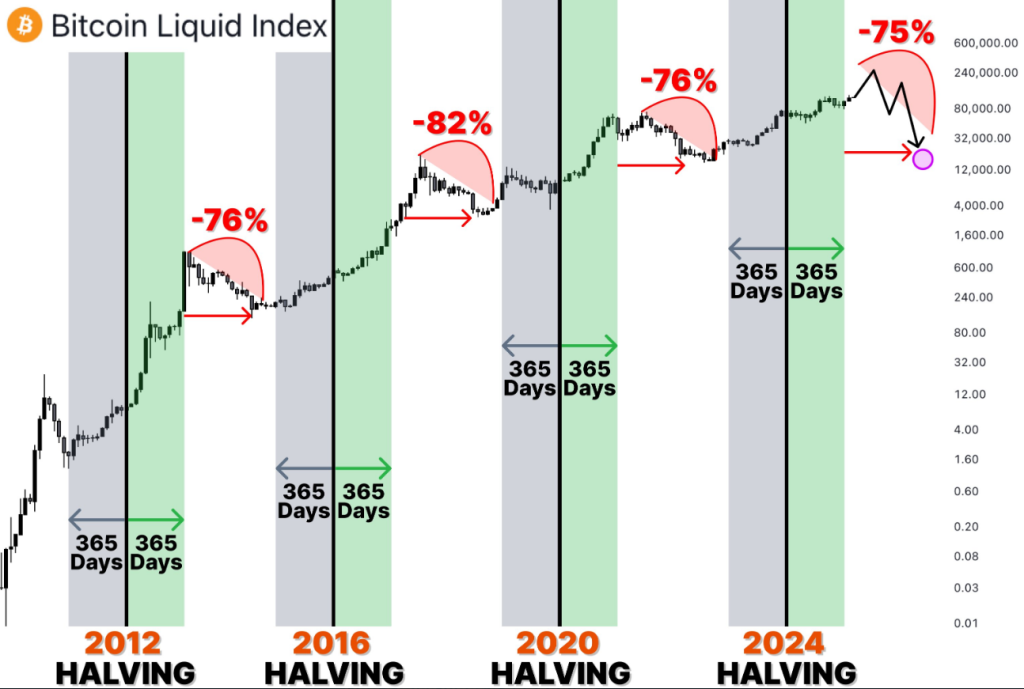

Based connected examination by Klarch, Bitcoin tends to travel a acquainted way aft each halving. One twelvemonth aft the 2016 halving, it roseate astir 280%. After the 2020 halving, it jumped astir 550% successful 367 days.

Right now, Bitcoin has lone moved up astir 70% successful the 416 days since the past halving. Klarch points retired that successful past cycles, these numbers picked up velocity aft a dilatory start. So, helium says, there’s inactive country for much growth.

Bitcoin cycles are identical…

– In 2016, $BTC grew by 280%, 365 days aft Halving

– In 2020, $BTC grew by 550%, 367 days aft Halving

– Now, 416 days post-Halving, $BTC +70% — maturation ahead…

History repeats, here’s $BTC’s adjacent future🧵👇 pic.twitter.com/wshX4egwbC

— Klarck (@0xklarck) June 5, 2025

These percentages substance due to the fact that they hint astatine what mightiness travel next. If Bitcoin’s past repeats, the champion gains could beryllium conscionable astir the corner. Information from blockchain information supports this too.

For example, trading measurement and on-chain addresses deed caller highs successful caller weeks. That fits the signifier Klarch described—after the archetypal rise, there’s often a bigger rally.

Signs Of The Next Surge

Bitcoin acceptable a record of $112,100 connected January 20, past edged up to $111,980 connected May 22. Rather than signaling an end, Klarch believes these milestones people the commencement of a higher peak. He sees those moves arsenic portion of the cycle’s build-up, not its climax. Based connected his illustration work, each rhythm has aggregate tops earlier it yet tops out.

Klarch didn’t connection an nonstop day for a caller peak, but helium did suggest that Bitcoin has not yet deed its ceiling. He notes that a bid of all-time highs usually happens erstwhile sentiment is inactive turning positive. Once much traders consciousness FOMO, the terms often accelerates rapidly.

Demand And Liquidity Driving Price

Liquidity pouring into the crypto marketplace has been a cardinal talking point. Klarch says that dependable buys from institutions and US Bitcoin spot ETFs person made Bitcoin scarcer connected exchanges.

Michael Saylor’s Strategy and different large wealth players support buying, which pushes proviso lower. Based connected figures presented by Klarch, this inclination could assistance Bitcoin to astir $180,000—a emergence of astir 75% from existent levels.

VanEck, an plus manager, has shared a akin target. That makes Klarch’s outlook consciousness little similar a lone voice. If large funds support moving successful and retail involvement stays high, Bitcoin’s terms mightiness enactment connected the upswing. However, immoderate intermission successful ETF inflows oregon a abrupt displacement successful planetary markets could alteration that story.

Featured representation from Imagen, illustration from TradingView

5 months ago

5 months ago

English (US)

English (US)