In a recently released capitalist note, 1 of the oldest US concern banks H.C. Wainwright & Co. —established successful 1868—is projecting important upswing for the Bitcoin price. According to the note, the instauration has revised its erstwhile Bitcoin terms people for the extremity of 2025 from $145,000 to $225,000, underpinned by a confluence of humanities trends, macroeconomic indicators, and emerging regulatory and organization factors.

“We estimation BTC volition scope a rhythm precocious of $225,000 by YE2025,” stated the firm, referencing some marketplace cycles and the imaginable for a much supportive digital-asset regulatory scenery successful the United States successful 2025 nether a caller administration.

Why Bitcoin Could $225,000 By Year End

H.C. Wainwright’s investigation highlights respective pivotal forces propelling Bitcoin’s maturation trajectory. One important catalyst is the wider availability of spot Bitcoin exchange-traded funds (ETFs) successful the US, a improvement that could unlock caller waves of organization capital. The steadfast besides cites “accelerating organization capitalist and firm adoption” arsenic a large contributor to its bullish outlook.

On apical of that, the concern bank’s models presume an wide marketplace backdrop that improves successful tandem with planetary liquidity and that immoderate regulatory overhang volition abate. H.C. Wainwright is cautious to enactment that the forecast is delicate to macroeconomic conditions, peculiarly measured by M2 wealth supply, which has trended downward since October.

Though projecting a lofty six-figure terms by 2025, H.C. Wainwright acknowledged that Bitcoin’s way toward $225,000 is improbable to beryllium a creaseless ride. In the report, the slope cautioned: “~20-30% drawdowns during bull markets are not uncommon […] We estimation BTC could retrace backmost down to the mid-$70,000 scope successful aboriginal 1Q25 earlier resuming its uptrend.”

They property these imaginable pullbacks to Bitcoin’s humanities volatility and its correlation with planetary liquidity trends.

If Bitcoin reaches $225,000 per coin, H.C. Wainwright projects a full Bitcoin marketplace capitalization of astir $4.5 trillion—around 25% of gold’s existent $18 trillion marketplace cap. This script translates to a 113% summation implicit existent levels. However, the enactment adds a striking script that is not yet factored into its halfway forecast:

“Our caller 2025 terms people does not origin successful the imaginable for the US authorities to officially follow BTC arsenic a treasury reserve plus astatine the national level adjacent year. If implemented, we judge it is plausible that BTC could importantly transcend our basal lawsuit terms target.”

The institution’s investigation besides extends to the broader crypto market. Historically, Bitcoin’s dominance (its stock of full crypto marketplace cap) tends to autumn during marketplace peaks, and it dipped into the debased 40% scope adjacent the past bull rhythm highest successful November 2021.

Looking forward, H.C. Wainwright expects Bitcoin’s dominance to diminution to 45% by the extremity of 2025, down from astir 56% currently. Under that assumption, the steadfast sees the full crypto marketplace swelling from $3.6 trillion contiguous to astir $10 trillion by year’s extremity 2025.

H.C. Wainwright’s sum beingness of publically traded Bitcoin mining companies stands to payment from the anticipated terms surge. “If our predictions are correct, determination is the imaginable for important upward estimation revisions for our sum beingness implicit the people of adjacent year.”

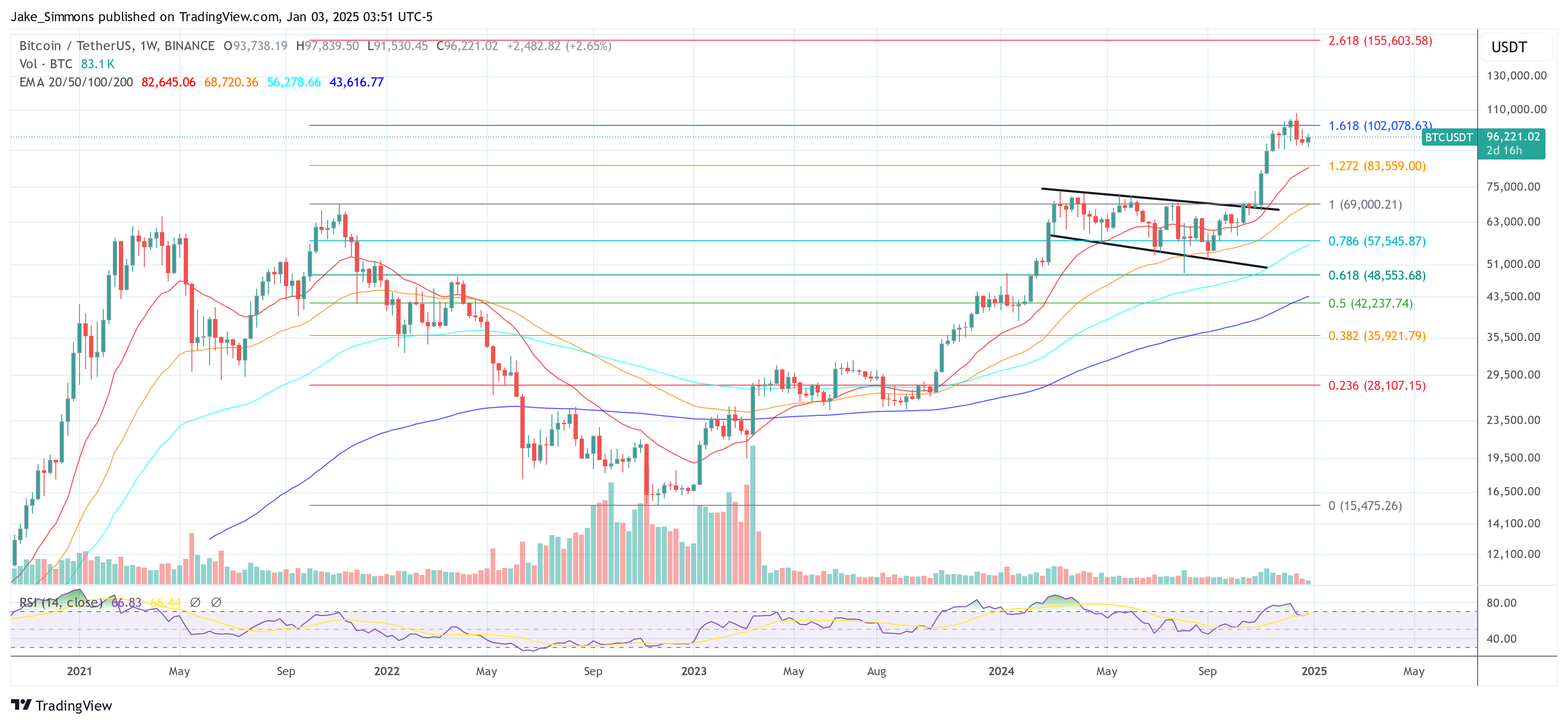

At property time, BTC traded astatine $96,221.

Bitcoin price, 1-week illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-week illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

11 months ago

11 months ago

English (US)

English (US)