Bitcoin’s terms downtrend whitethorn not beryllium arsenic short-lived arsenic galore holders anticipate, says crypto expert Benjamin Cowen.

“Bitcoin’s apt going to support bleeding against the banal market,” Cowen said successful a video connected Thursday, adding that beardown expectations of a “massive rotation” from metals similar golden and metallic into crypto whitethorn beryllium misplaced.

The prices of golden and metallic person precocious surged to all-time highs of $5,608.33 and $121.64, respectively, according to Trading Economics.

Citi predicts metallic won’t dilatory down

Citi predicted connected Tuesday that metallic could ascent to $150 wrong the adjacent 3 months, driven by Chinese request and the US dollar hitting four-year lows.

However, Cowen emphasized that the rotation to Bitcoin is “probably not going to happen” successful the abbreviated term.

Bitcoin is down 6.12% implicit the past 30 days. Source: CoinMarketCap

Bitcoin is down 6.12% implicit the past 30 days. Source: CoinMarketCapMany successful the crypto marketplace are betting that golden and metallic hitting caller all-time highs is simply a awesome that past volition repetition and Bitcoin volition yet follow.

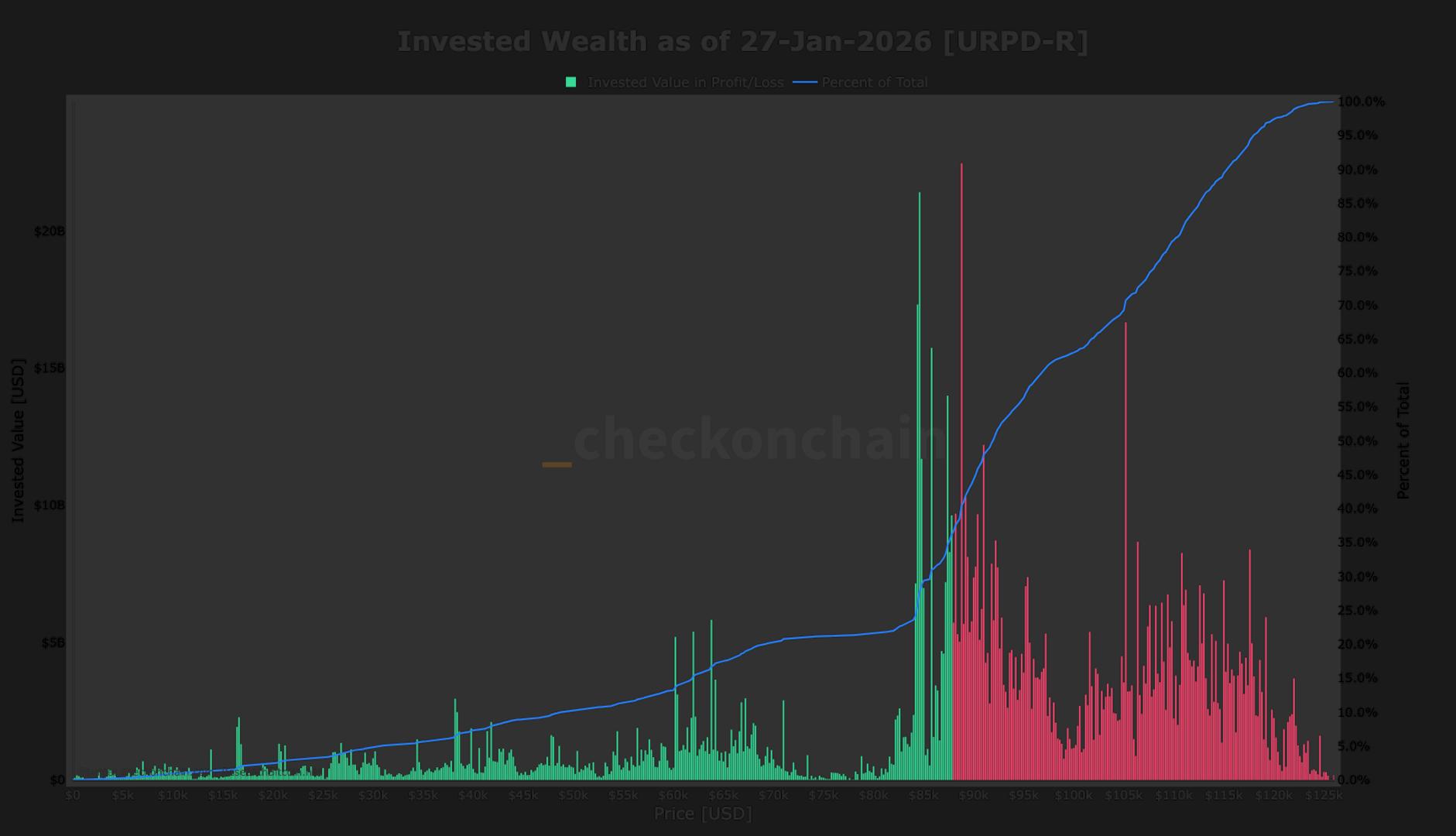

Bitcoin is trading astatine $82,859 astatine the clip of publication, down 7.78% implicit the past 7 days, according to CoinMarketCap.

It comes arsenic sentiment crossed the broader crypto marketplace has been waning. The Crypto Fear & Greed Index, which measures wide crypto marketplace sentiment, posted an “extreme fear” people of 16, indicating that investors are importantly cautious astir the crypto market.

Other analysts are much optimistic

Swyftx pb expert Pav Hundal told Cointelegraph that the marketplace whitethorn beryllium adjacent a turning point, saying, “We're close connected the cusp of wherever we'd traditionally expect to spot re-risking backmost into Bitcoin.”

Related: Bybit made ‘slow but dependable comeback’ successful 2025 aft monolithic hack: CoinGecko

“Bitcoin bottoms person historically lagged gold’s comparative spot by astir 14 months,” Hundal explained, adding that helium anticipates the rotation volition hap successful February oregon March.

“If past repeats, and it is simply a large if, the gold-Bitcoin dynamic points to a imaginable BTC bottommost forming implicit the adjacent 40 days,” Hundal said.

Hundal emphasized that golden typically leads during periods of macro stress, and past Bitcoin follows erstwhile hazard appetite returns.

"If that exemplary isn’t broken, the portion should commencement to look little fragile by the extremity of the quarter,” helium said.

Meanwhile, Bitwise Europe caput of research, Andre Dragosch, said successful an X station connected Jan. 19 that Bitcoin “is trading astatine a steep discount to Gold connected a comparative basis.”

“These asymmetric setups are precise rare,” helium said, adding that “if flows turn, Q1 2026 could beryllium the inflection point.”

Magazine: 6 weirdest devices radical person utilized to excavation Bitcoin and crypto

Cointelegraph is committed to independent, transparent journalism. This quality nonfiction is produced successful accordance with Cointelegraph’s Editorial Policy and aims to supply close and timely information. Readers are encouraged to verify accusation independently. Read our Editorial Policy https://cointelegraph.com/editorial-policy

3 hours ago

3 hours ago

English (US)

English (US)