Bitcoin (BTC) continues to summation crushed amid unconfirmed reports suggesting that a instauration focused connected UST, the world's fourth-largest stablecoin, is accumulating the apical cryptocurrency arsenic a reserve asset.

CoinDesk information shows that bitcoin tapped three-week highs of implicit $44,000 during the aboriginal hours of Friday. The cryptocurrency has rallied much than 10% since the U.S. Federal Reserve (Fed) hiked borrowing costs by 25 ground points connected March 16.

The rumor mill is that Singapore-based non-profit enactment Luna Foundation Guard (LFG) purchased bitcoin worthy $125 cardinal (2,840 BTC astatine the existent price) aboriginal this week, delivering connected its month-old promise to adhd BTC arsenic an further furniture of information for UST – Terra's decentralized dollar-pegged stablecoin.

Stablecoin tether (USDT) worthy $125 cardinal was precocious moved from a Gnosis harmless code allegedly owned by Terra, possibly grounds of the purchase, arsenic CoinDesk's Christine Lee noted connected Thursday.

According to Anthony Pompliano, the fashionable crypto evangelist and spouse astatine Morgan Creek Digital, the instauration has go a persistent bitcoin buyer. "They are dilatory purchasing $3 cardinal of bitcoin from the Luna Foundation reserves. This is being done via assertive buying connected terms dips," Pompliano noted successful blogpost published connected March 21.

Per pseudonymous marketplace adept and Anchor Protocol idiosyncratic Duo Nine, who operates the Twitter grip @DU09BTC, LFG has accumulated 18,000 bitcoin worthy implicit $800 million.

The authoritative confirmation of the said purchases is inactive awaited. The instauration announced the determination to physique a $1 cardinal bitcoin reserve past month. Do Kwon, CEO of Terraforma Labs, precocious said that the instauration has plans to increase reserves to $3 billion, with a semipermanent presumption to raising a $10 cardinal fund.

While the assemblage remains retired connected the size of the foundation's caller purchases, the speculation, on with the post-Fed rally successful equities, appears to beryllium boding good for bitcoin.

"[There is] decent bid successful crypto markets driven by excitement implicit organization participation, gathering ETH merge narrative, and (unconfirmed) a $125 cardinal BTC acquisition by Luna Foundation Guard," Illan Solot, a spouse astatine the Tagus Capital Multi-Strategy Fund, said successful an email aboriginal this week.

Analysts stay assured of the near-term prospects. "We are astatine the precocious set of absorption presently arsenic BTC approached 2022 highs. With the spot travel we person been seeing, we are cautiously optimistic that determination volition beryllium a continuation of the medium-term uptrend and a tally to $50,000," Matthew Dibb, COO and co-founder of Stack Funds, said.

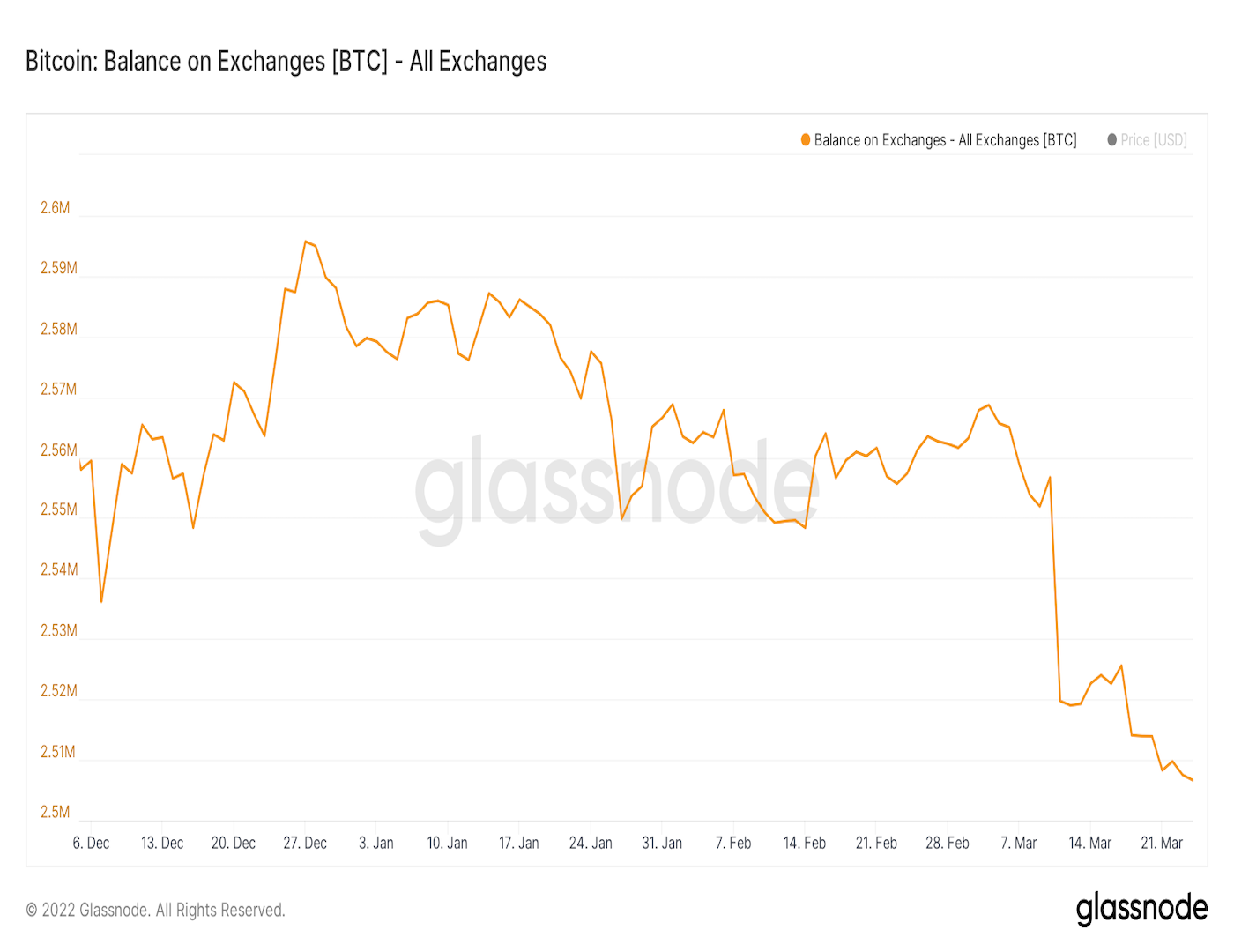

Data tracked by Glassnode shows the fig of coins held connected centralized exchanges has dropped to 2,506,635 BTC, the lowest since September 2018. More than 7,000 coins person near exchanges successful little than a week, offering bullish cues to the market.

Bitcoin was trading adjacent $44,190, representing a 1% summation connected the day.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)