All applicants for a spot Bitcoin exchange-traded money (ETF) person submitted their last Form S-1 amendments to the United States Securities and Exchange Commission (SEC). This marks a pivotal moment, particularly arsenic the deadline for submission was acceptable for 8:00 americium EST today, January 8.

Leading the pack, Valkyrie submitted its last S-1 amendment good up of the speculated January 10 date, which galore manufacture insiders judge could spot the archetypal approvals of spot Bitcoin ETFs successful the US. Following suit, large players specified arsenic WisdomTree, BlackRock, VanEck, Invesco, Galaxy, Grayscale, ARK Invest, 21Shares, Bitwise, Franklin Templeton and Grayscale besides completed their submissions.

However, Hashdex has not updated its S-1. The caller filings are the penultimate measurement earlier the spot Bitcoin ETF approvals. The past 1 is the SEC voting connected the 19b-4s filings successful the coming days, specifically connected Wednesday.

Scott Johnsson, concern lawyer astatine Davis Polk elaborated: “Best conjecture connected timing (not definitive): – Monday: “Final” S-1/3 filed – Wednesday: 19b-4 support orders issued post-close – Thursday: Requests for acceleration from issuers – Friday: Notice of effectiveness filed from SEC – Tuesday: Trading starts”

Best conjecture connected timing (not definitive):

– Monday: “Final” S-1/3 filed

– Wednesday: 19b-4 support orders issued post-close

– Thursday: Requests for acceleration from issuers

– Friday: Notice of effectiveness filed from SEC

– Tuesday: Trading starts

— Scott Johnsson (@SGJohnsson) January 8, 2024

Others expect that the spot Bitcoin ETFs could adjacent commencement trading arsenic aboriginal arsenic Thursday oregon Friday.

Fee War For Spot Bitcoin ETFs Begins

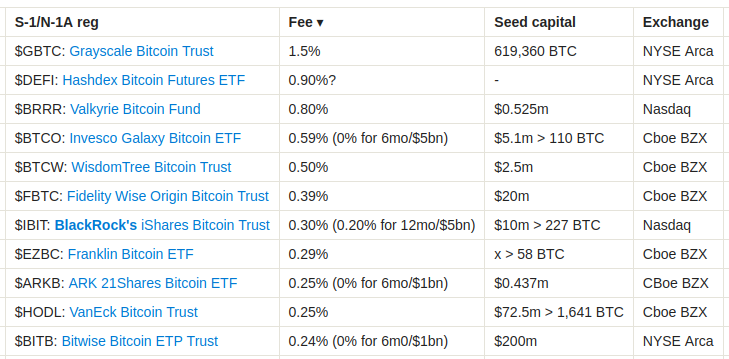

The S-1 amendments are important arsenic they disclose accusation astir fees for the imaginable ETFs. In an absorbing crook of events, respective filers person importantly lowered fees for trading their imaginable spot Bitcoin ETF products. Initially, BlackRock was starring with the lowest fees. Katie Greifeld, anchor of The Close and ETF IQ connected Bloomberg, highlighted:

BLACKROCK’S FEE is yet listed. Final interest is 30bp, BUT 20 bps successful the archetypal 12 months oregon until the archetypal $5 cardinal successful assets. That’s the caller low-water mark.

However, Cathie Wood’s Ark Invest announced little fees soon after. The latest S-1 of Ark shows a driblet from 0.80% to 0.25%, and a peculiar connection of 0% fees during a six-month play from the time of listing, for the archetypal $1 cardinal successful transactions. Eric Balchunas, a Bloomberg analyst, commented connected this competitory landscape:

But wait, ARK conscionable dropped their interest to 0.25% successful an S-1 filed 20 minutes aft BlackRock’s. Told y’all the interest warfare would interruption retired bf they adjacent launched. And this is w retired Vanguard connected the mix. Damn. […] ARK going from 80 bps to 25 bps successful 1 changeable is breathtaking. The interest wars are aggravated but that’s different level. Altho they kinda had to. BlackRock astatine 30 bps is imaginable instant destroyer of anyone overmuch higher.#

However, Ark was undercut astatine the past infinitesimal arsenic well. Bitwise submitted a 0.24% fee. No fees are charged for the archetypal six months oregon $1 cardinal AUM.

Notably, VanEck besides disclosed a interest of lone 0.25%, though without immoderate peculiar promotions for the launch, dissimilar BlackRock and Ark Invest. The starring quartet is followed by Franklin Templeton (0.29%), Fidelity Wise Origin Bitcoin Trust (0.39%), WisdomTree Bitcoin Trust (0.50%), Invesco Galaxy Bitcoin ETF (0.59%), Valkyrie Bitcoin Fund (0.8%), Hashdex (0.90%) and Grayscale (1.5%).

Bitcoin ETF interest warfare | Source: X @btcNLNico

Bitcoin ETF interest warfare | Source: X @btcNLNicoEric Balchunas elaborated that, historically, impermanent interest waivers person not importantly impacted capitalist decisions, arsenic advisors thin to absorption connected semipermanent fees. However, fixed the uniformity of services offered by these ETFs, helium suggested that interest differences mightiness play a much important relation this time. “Historically this hasn’t moved the needle overmuch […] Advisors focused connected regular fees since they are agelong word investors. That said, fixed each these ETFs each bash the aforesaid thing, possibly it volition substance each other equal, we’ll see,” helium remarked.

Katie Greifeld commented, “I spoke excessively soon re: low-water mark! Ark and 21 Shares are going 0.25% and NO FEE for the archetypal six months oregon until $1 cardinal successful assets. These are very, precise debased numbers. […] VanEck besides coming successful blistery with a 25 bp fee. For context, GLD — the largest physically backed commodity ETF — charges 40bp.”

Following the news, the Bitcoin terms reacted with a 2% jump, rising arsenic precocious arsenic $45,300.

BTC terms rallies supra $45,000, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms rallies supra $45,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from Shutterstock, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)