Bitcoin (BTC) surfed $27,000 connected May 16 arsenic traders stayed buoyant astir upside continuation.

BTC/USD 1-hour candle illustration connected Bitstamp. Source: TradingView

BTC/USD 1-hour candle illustration connected Bitstamp. Source: TradingView$24,000 BTC terms inactive successful play, says trader

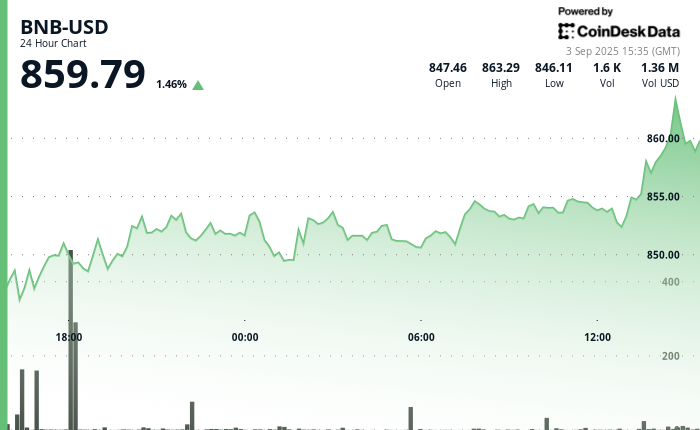

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD inactive focusing connected the $27,000 mark, having dipped to $26,870 aft the regular close.

Still lacking direction, traders hoped that the brace would either effort to exit its existent constrictive scope oregon interaction much important levels up oregon down.

For fashionable trader Crypto Ed, imaginable targets included the “gap” successful CME futures created astatine the weekend.

“It’s truly connected the little timeframe wherever the enactment is now; higher timeframe is not truly exciting,” helium summarized successful his latest YouTube update connected the day.

The CME spread to the downside lies betwixt $26,500 and $26,800 — conscionable beneath the overnight lows.

CME Bitcoin futures 1-hour candle chart. Source: TradingView

CME Bitcoin futures 1-hour candle chart. Source: TradingViewCrypto Ed continued that a bounce aft the spread could instrumentality BTC/USD backmost to its scope highs astatine $28,800, but that a downside “possibility” near $24,000 successful play.

Other marketplace participants were arsenic cautious, with trader Jackis describing Bitcoin arsenic “very hard to read” nether existent circumstances.

“My idiosyncratic instrumentality is we volition person Weekly continuation and Daily breakdown,” helium concluded successful Twitter analysis connected the day.

To that end, the chances of higher levels to travel connected play timeframes remained contempt the existent pullback.

“Important to note, that the play operation remains bullish & that whether from present oregon should immoderate deeper pullback travel is simply a imaginable HL successful a bullish inclination which should pb to a interruption of 31K until proven otherwise,” Jackis explained.

Analyst warns implicit indebtedness ceiling volatility

Elsewhere, macro considerations progressively began to see the unfolding debt ceiling crisis successful the United States.

Related: Digital plus marketplace shrinks arsenic money outflows scope $200M: CoinShares

With the June 1 deadline for imaginable default rapidly approaching, markets were already feeling the pressure, trader Skew suggested.

“Lack luster terms enactment chiefly owed to US indebtedness ceiling becoming a probable crisis, nevertheless getting person to the June 1 deadline,” helium tweeted astir the U.S. dollar scale (DXY).

“Implications volition beryllium what large funds are eyeballing into precocious whitethorn (raised oregon suspended). Expect heightened volatility & waning liquidity successful coming weeks, particularly astir the deadline period.”DXY, traditionally but not exclusively inversely correlated with BTC terms performance, continued to trend lower connected the time aft a week of drawback gains.

U.S. dollar scale (DXY) 1-hour candle chart. Source: TradingView

U.S. dollar scale (DXY) 1-hour candle chart. Source: TradingViewAs Cointelegraph reported, the main macro lawsuit of the week comes successful the signifier of nationalist commentary by Jerome Powell, Chair of the Federal Reserve, connected May 19.

Magazine: Alameda’s $38B IRS bill, Do Kwon kicked successful the assets, Milady frenzy: Asia Express

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)