Bitcoin retested enactment levels nether $110,000 arsenic information showed smaller investors buying and whales cooling their extended BTC sell-off.

Key points:

Bitcoin yet sees investors who are consenting to “buy the dip” astatine prices astir $110,000.

Multiple enactment retests proceed to drawback trader attention.

Bulls tin inactive recognize a bullish RSI divergence with a beardown regular close.

Bitcoin (BTC) kept up unit connected cardinal enactment Thursday arsenic purchaser involvement showed signs of a comeback.

BTC terms brings backmost sub-$110,000 levels

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD wicking beneath $110,000 connected Bitstamp.

Exchange order-book liquidity connected either broadside of the terms was targeted, with some section lows and absorption astatine $112,300 present a key focus.

“Time to fastener successful again, 4th clip investigating this request area,” trader Skew wrote astir the erstwhile successful an X post.

Trader and expert Rekt Capital noted that BTC/USD had present filled an outstanding “gap” successful CME Group’s Bitcoin futures market.

— Rekt Capital (@rektcapital) October 16, 2025Addressing the comparative spot scale (RSI), Rekt Capital eyed an “emerging” bullish divergence with terms — a imaginable motion of upside to come.

“Price needs to Daily Close conscionable similar this to crystallise it,” helium added.

Crypto expert and entrepreneur Ted Pillows utilized marketplace sentiment arsenic impervious that the Bitcoin terms was apt establishing a section floor.

“$BTC has been consolidating aft past week’s crash,” helium told X followers.

“Sentiment is astatine an all-time low, radical are panic selling and ‘it's each over’ is connected the timeline. This doesn't hap astatine the top, but alternatively astatine the bottom.”Pillows uploaded a illustration comparing existent BTC terms enactment to that from the COVID-19 cross-market clang successful March 2020.

As Cointelegraph reported, the Crypto Fear and Greed Index has flipped to “fear” this month, matching six-month lows.

Bitcoin dip-buyers yet emerge

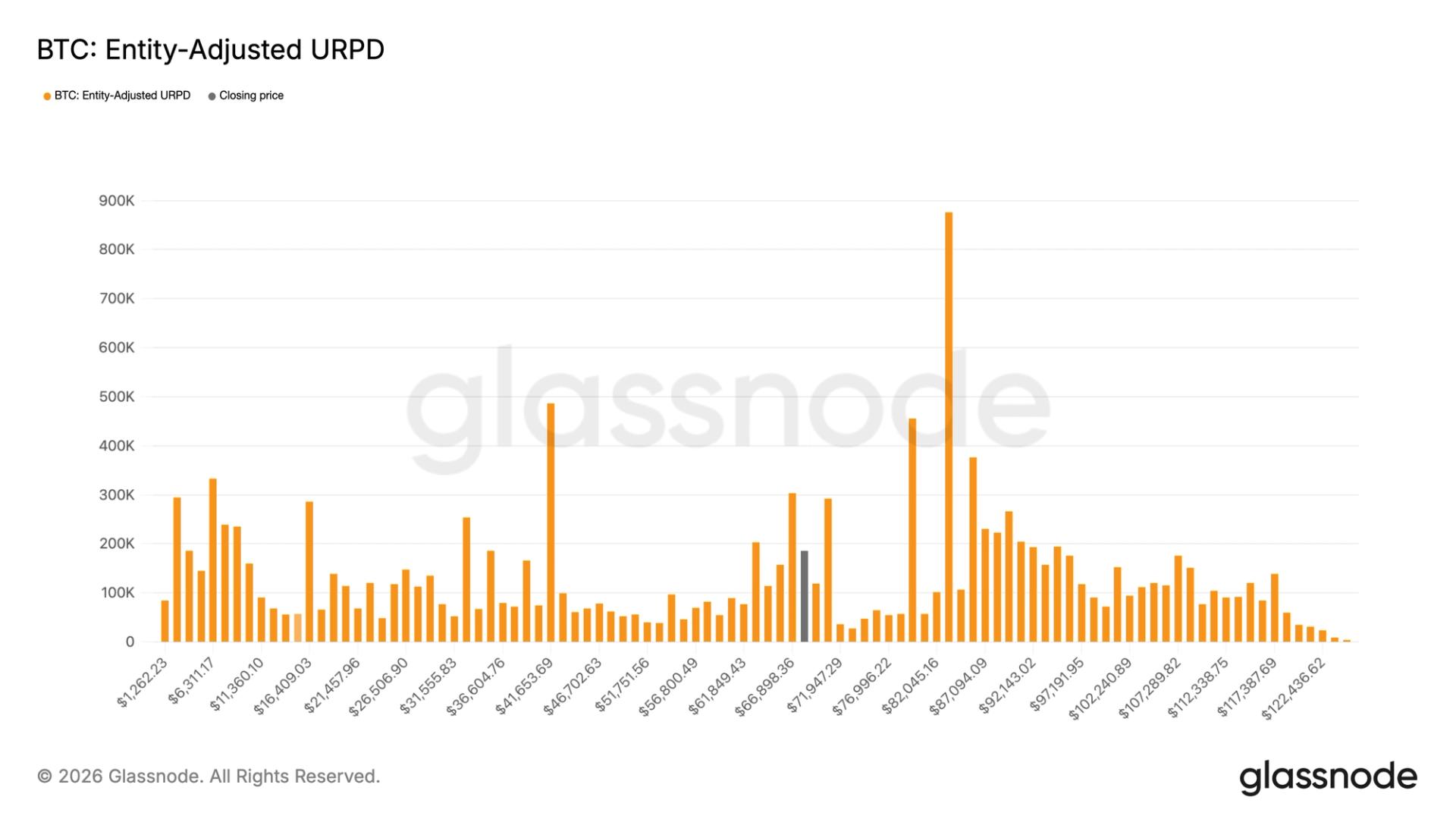

Researching capitalist trends, however, onchain analytics level Glassnode had immoderate bully quality for bulls.

Related: Bitcoin traders fearfulness $102K BTC terms dive adjacent arsenic golden sets caller highs

Entities holding betwixt 1 BTC and 1,000 BTC, it revealed connected the day, were showing “strong accumulation.”

Even whales, who distributed ample amounts of BTC to the marketplace successful caller weeks, were slowing their sales.

Glassnode said that this was “signaling renewed assurance successful spite of the caller shakeout.”

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

4 months ago

4 months ago

English (US)

English (US)