In the crypto market, bold predictions aren’t conscionable speech - they’re backed by existent dollars, often done enactment plays that lucifer lottery tickets offering outsized upside for comparatively tiny costs.

The stand-out arsenic of penning is the Deribit-listed $300,000 onslaught bitcoin telephone enactment expiring connected June 26. Theoretically, this telephone is simply a stake that BTC's spot terms volition triple to implicit $300,000 by the extremity of the archetypal fractional of the year.

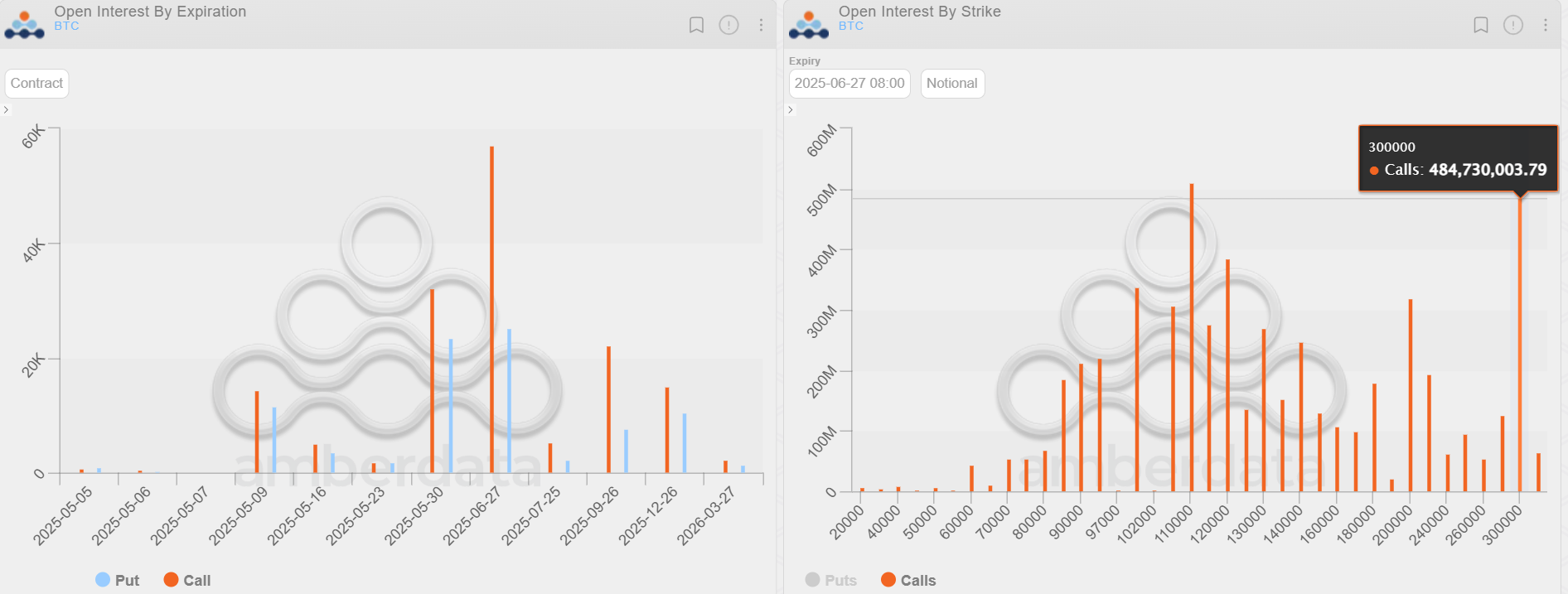

Over 5,000 contracts were progressive successful the June $300K telephone astatine property time, with a notional unfastened involvement of $484 million. That makes it the second-most fashionable enactment stake successful the important June expiry, trailing lone the $110K call.

Deribit is the world's starring crypto options exchange, accounting for implicit 75% of the planetary options activity. On Deribit, 1 options declaration represents 1 BTC. Quarterly expiries, specified arsenic the 1 owed connected June 26, thrust heightened marketplace enactment and volatility, with traders utilizing these deadlines to hedge positions, fastener successful gains, oregon speculate connected the adjacent terms moves.

"Perhaps, radical similar buying lottery tickets. As evidenced by the telephone skew, determination are ever folks that privation the hyperinflation hedge," Spencer Hallarn, a derivatives trader astatine crypto marketplace shaper GSR, said, explaining the precocious unfastened involvement successful the alleged out-of-the-money (OTM) telephone astatine the $300K strike.

Deep OTM calls, besides called wings, necessitate a ample determination successful the underlying asset's terms to go profitable and, hence, are importantly cheaper compared to those person to oregon beneath the asset's going marketplace rate. However, the payoff is immense if the marketplace rallies, which makes them akin to buying lottery tickets with slim likelihood but imaginable for a large payout.

Deribit’s BTC options marketplace has experienced akin flows during erstwhile bull cycles, but those bets seldom gained capable popularity to fertile arsenic the second-most preferred play successful quarterly expiries.

The illustration shows that the June 26 expiry is the largest among each settlements owed this year, and the $300K telephone has the second-highest unfastened involvement buildup successful the June expiry options.

Explaining the chunky notional unfastened involvement successful the $300K call, GSR's Trader Simranjeet Singh said, "I fishy this is mostly an accumulation of comparatively inexpensive wings betting connected broader U.S. reg communicative being pro-crypto and the 'wingy possibility' (no pun intended) of a BTC strategical reserve that was punted astir astatine the commencement of the administration."

On Friday, Senator Cynthia Lummis said successful a code that she's "particularly pleased with President Trump's enactment of her BITCOIN Act.

"The BITCOIN Act is the lone solution to our nation’s $36T debt. I’m grateful for a forward-thinking president who not lone recognizes this, but acts connected it," Lummis said connected X.

Who sold $300K calls?

According to Amberdata's Director of Derivatives, notable selling successful the $300K telephone expiring connected June 26 occurred successful April arsenic portion of the covered telephone strategy, which traders usage to make further output connected apical of their spot marketplace holdings.

"My thought is that the selling measurement connected April 23 came from traders generating income against a agelong position," Magadini told CoinDesk. "Each enactment sold for astir $60 astatine 100% implied volatility."

Selling higher onslaught OTM telephone options and collecting premium portion holding a agelong presumption successful the spot marketplace is simply a fashionable yield-generating strategy successful some crypto and accepted markets.

Read more: Bitcoin May Evolve Into Low-Beta Equity Play Reflexively, BlackRock's Mitchnik Says

7 months ago

7 months ago

English (US)

English (US)