By Francisco Rodrigues (All times ET unless indicated otherwise)

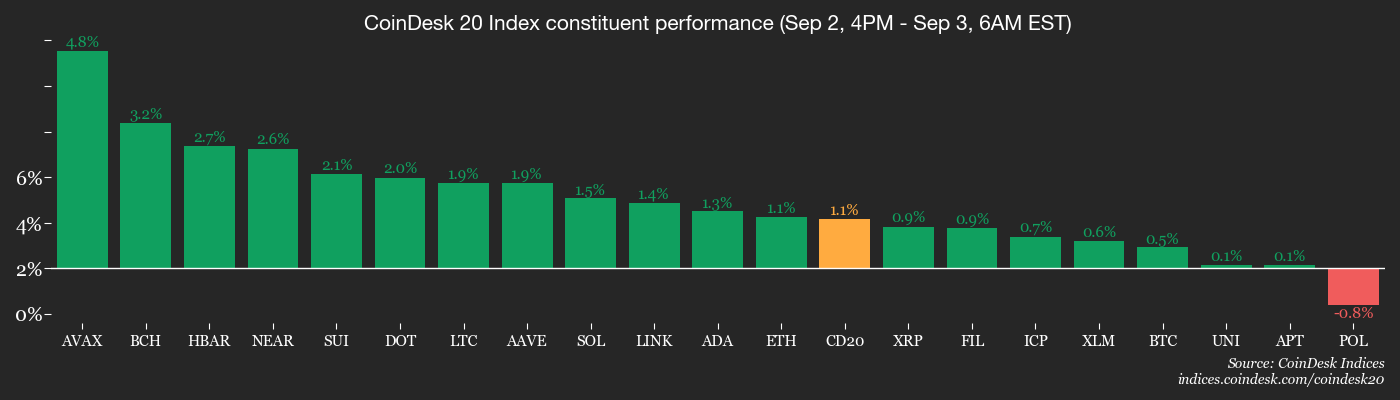

Bitcoin (BTC) roseate conscionable 0.6% successful the past 24 hours, portion the wider marketplace arsenic measured by the CoinDesk 20 (CD20) Index added 0.4%. The summation is overshadowed by gold’s summation and a large authorities enslaved sell-off.

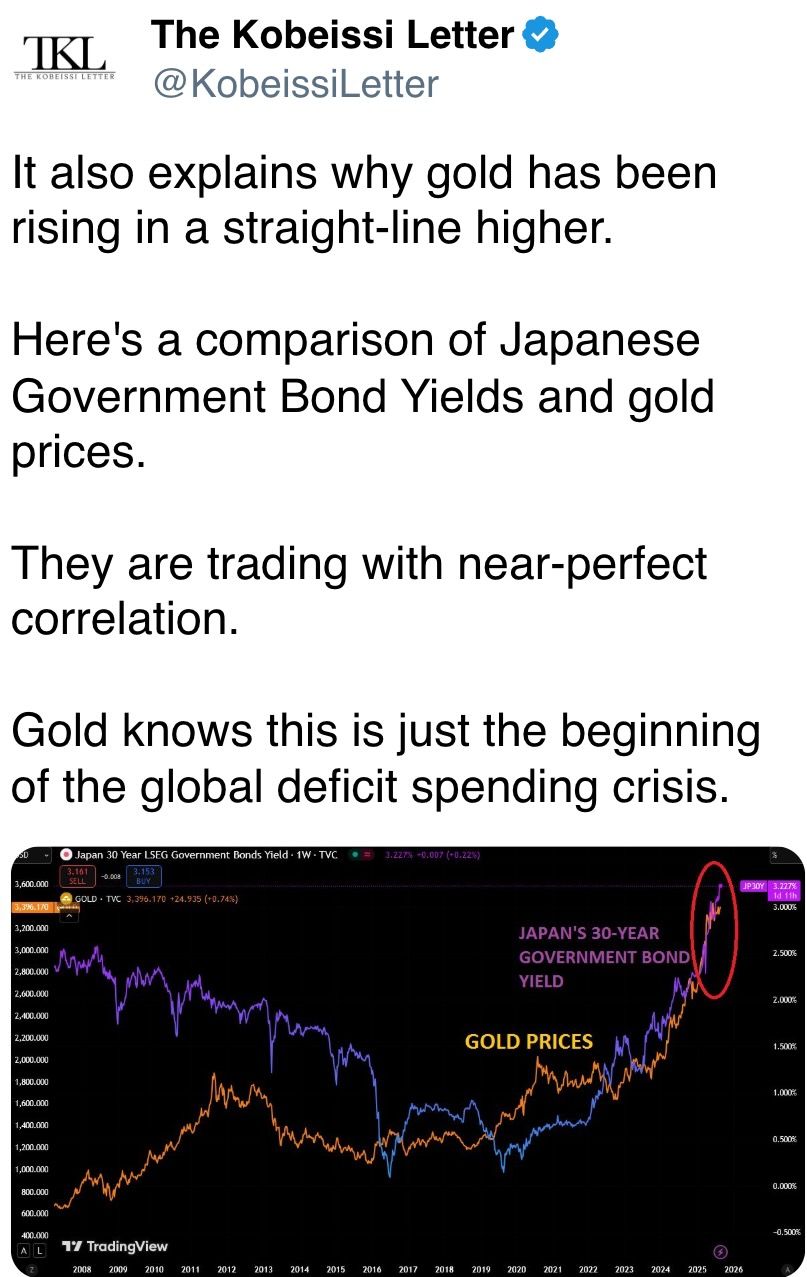

The precious metallic broke done $3,500 per ounce for the archetypal clip connected Wednesday, helping the tokenized golden marketplace to top $2.5 billion successful worth arsenic increasing bets spot the Federal Reserve cutting rates this month. Gold's beforehand comes arsenic investors are wary of swelling authorities debt, prompting a sell-off successful long-dated authorities bonds.

The output connected Japan's 30-year authorities enslaved roseate to a grounds 3.28% pursuing akin moves successful the U.S. and U.K. The U.S. 30-year Treasury output neared 5%, portion British gilts reached levels not seen since 1998, astatine 5.7%.

The turmoil hasn’t added substance to the crypto market, whose terms enactment remains muted. Deribit’s bitcoin volatility scale (DVOL) is present astatine 38.1, its lowest level since precocious 2023, portion superior is seemingly rotating into ether (ETH).

While spot bitcoin ETFs saw $751 cardinal successful nett outflows past month, spot ether ETFs brought successful a nett $3.87 billion. That rotation is besides being seen on-chain.

Meanwhile, a associated statement from the SEC and CFTC clarified rules for compliant spot crypto trading successful the agencies’ latest effort to wide a mode guardant for crypto successful the U.S.

The connection failed to jolt the crypto market, seemingly arsenic investors await Friday’s U.S. jobs report. A brushed speechmaking could nudge the Federal Reserve person to lowering rates, which would boost the marketplace and different hazard assets.

A hotter-than-expected figure, however, could damp sentiment. September has historically been a antagonistic period for the sector, with bitcoin signaling a driblet of 3.29% connected mean for the period according to CoinGlass data. Stay alert!

What to Watch

- Crypto

- Sept. 3: First time of regular-hours trading connected Nasdaq for American Bitcoin (ABTC). The company, backed by Eric Trump and Donald Trump Jr., was formed done a reverse merger with Gryphon Digital Mining and listed aft marketplace adjacent connected Sept. 2.

- Sept. 3, 10:15 a.m.: Tellor (TRB), a decentralized oracle web that operates arsenic an Ethereum layer-2 blockchain, volition upgrade its mainnet to mentation 5.1.1. The upgrade improves web show and node operation.

- Sept. 4: Polygon volition switch its mainnet token to POL from MATIC. Holders of MATIC connected Ethereum, Polygon zkEVM oregon centralized exchanges whitethorn request to instrumentality action.

- Sept. 10, 9:15 a.m.: Comptroller of the Currency Jonathan V. Gould volition talk about integer assets astatine the CoinDesk: Policy & Regulation Conference successful Washington.

- Macro

- Sept. 3, 8 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases July concern accumulation data.

- Industrial Production MoM Est. -0.3% vs. Prev. 0.1%

- Industrial Production YoY Est. 0.2% vs. Prev. -1.3%

- Sept. 3, 9 a.m.: S&P Global releases August Brazil information connected manufacturing and services activity.

- Composite PMI Prev. 46.6

- Services PMI Prev. 46.3

- Sept. 3, 10 a.m.: The U.S. Bureau of Labor Statistics releases July labour marketplace information (the JOLTS report).

- Job Openings Est. 7.4M vs. Prev. 7.437M

- Job Quits Prev. 3.142M

- Sept. 4, 8:15 a.m.: Automatic Data Processing (ADP) releases August U.S. private-sector employment data.

- Employment Change Est. 68K vs. Prev. 104K

- Sept. 4, 9:30 a.m.: S&P Global releases August Canada information connected manufacturing and services activity.

- Composite PMI Prev. 48.7

- Services PMI Prev. 49.3

- Sept. 4, 9:45 a.m.: S&P Global releases (final) August U.S. information connected manufacturing and services activity.

- Composite PMI Est. 55.4 vs. Prev. 55.1

- Services PMI Est. 55.4 vs. Prev. 55.7

- Sept. 4, 10 a.m.: The Institute for Supply Management (ISM) releases August U.S. services assemblage data.

- Services PMI Est. Est. 51 vs. Prev. 50.1

- Sept. 4, 1 p.m.: Uruguay's National Institute of Statistics releases August ostentation data.

- Inflation Rate YoY Prev. 4.53%

- Sept. 4, 3 p.m.: Colombia's National Administrative Department of Statistics (DANE) releases August shaper terms ostentation data.

- PPI YoY Prev. 2.2%

- Sept. 3, 8 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases July concern accumulation data.

- Earnings (Estimates based connected FactSet data)

- Sept. 9: GameStop (GME), post-market

Token Events

- Governance votes & calls

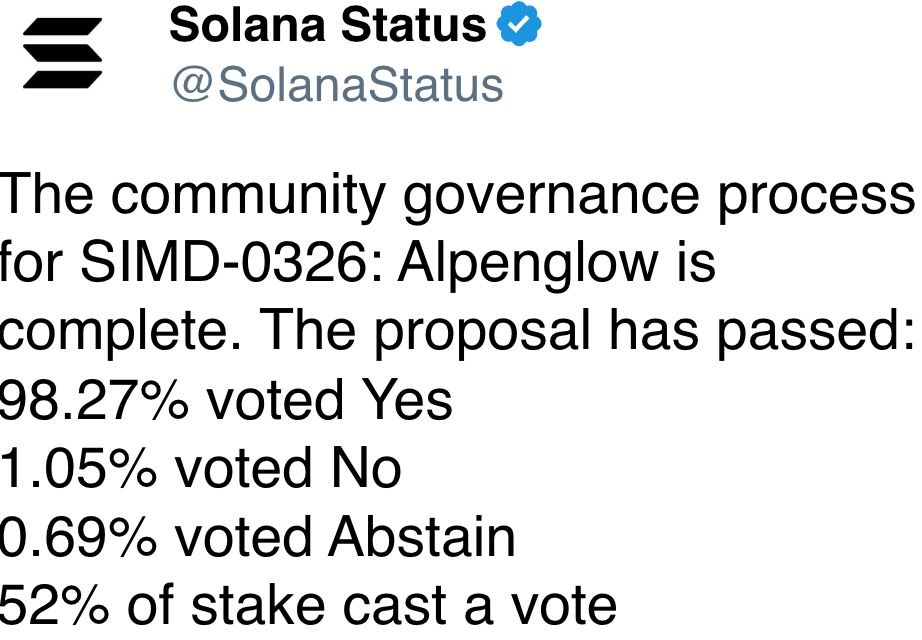

- Arbitrum DAO is voting connected upgrading Arbitrum One and Nova to ArbOS 50 Dia, adding enactment for Ethereum’s Fusaka fork, caller EIPs, bug fixes and a autochthonal mint/burn diagnostic (for Orbit chains only). Voting ends Sept. 4.

- Uniswap DAO is voting connected deploying Uniswap v3 connected Ronin with $1M successful RON and $500K successful UNI incentives to marque it the chain’s superior decentralized exchange. Voting ends Sept. 6.

- Lido DAO is voting connected a proposal to migrate Nethermind’s ~7,000 Ethereum validators to infrastructure operated by Twinstake, a staking supplier co-founded by Nethermind. Voting ends Sept. 8.

- Sept. 2, 6 a.m.: Bybit and Centrifuge to big an inquire maine thing (AMA) league connected X spaces.

- Sept. 3: Stellar (XLM) to big vote connected Protocol 23 mainnet upgrade.

- Sept. 3, 10 am: Lido to big a Poolside Community Call.

- Sept. 3, 10 a.m.: Zebec Network ZBCN$0.004202 to big spaces event connected blockchain integrations.

- Sept. 3, 12:30 p.m.: Aptos (APT) to big hangout connected ecosystem updates.

- Sept. 4, 10 a.m.: Olympus(OHM) to big community call.

- Unlocks

- Sept. 5: Immutable (IMX) to unlock 1.27% of its circulating proviso worthy $13.26 million.

- Sept. 11: Aptos (APT) to unlock 2.2% of its circulating proviso worthy $48.18 million.

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating proviso worthy $16.39 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating proviso worthy $16 million.

- Sept. 16: Arbitrum (ARB) to unlock 2.03% of its circulating proviso worthy $47.15 million.

- Token Launches

- Sept. 3: Moonchain (MCH) to beryllium listed connected Binance Alpha, MEXC, Gate.io and others.

Conferences

The CoinDesk Policy & Regulation Conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB15 for 15% disconnected your registration.

- Sept. 3-4: CONF3RENCE (Dortmund, Germany)

- Sept. 3-5: bitcoin++ (Istanbul)

- Sept. 4-5: ETHWarsaw 2025 (Warsaw)

- Sept. 4-6: Taipei Blockchain Week (Taiwan)

- Sept. 5: Bitcoin Indonesia Conference 2025 (Bali)

- Sept. 9-10: Fintech Week London 2025

- Sept. 9-10: WOW Summit Hong Kong 2025

- Sept. 9-13: Boston Blockchain Week (Quincy, Massachusetts)

Token Talk

By Oliver Knight

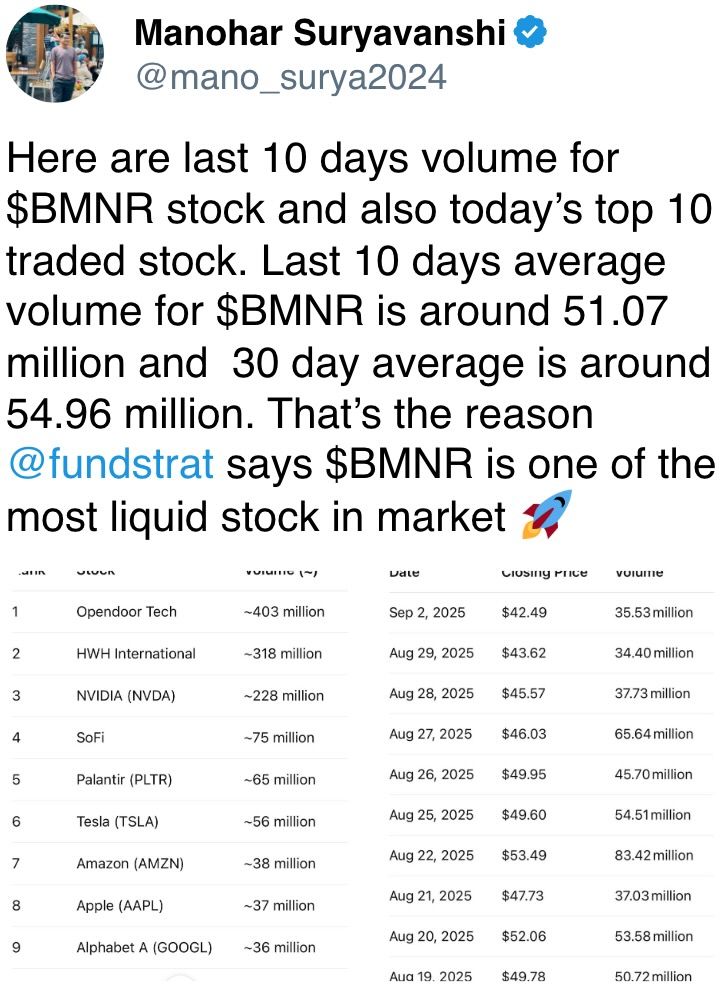

- Bitcoin (BTC) dominance, a cardinal metric erstwhile assessing whether the crypto marketplace is successful "altcoin season" has ticked down different notch to astir 58%, having been supra 61% conscionable 30 days ago.

- The drop-off demonstrates a alteration successful trader behavior: Typically altcoins execute poorly erstwhile BTC enters a downtrend, this time, however, galore person held their worth portion immoderate person outperformed the market's largest asset.

- Bitcoin is down by 2.91% successful the past 30 days portion the likes of ether (ETH) and solana (SOL) are up by 21% and 27.5%, respectively.

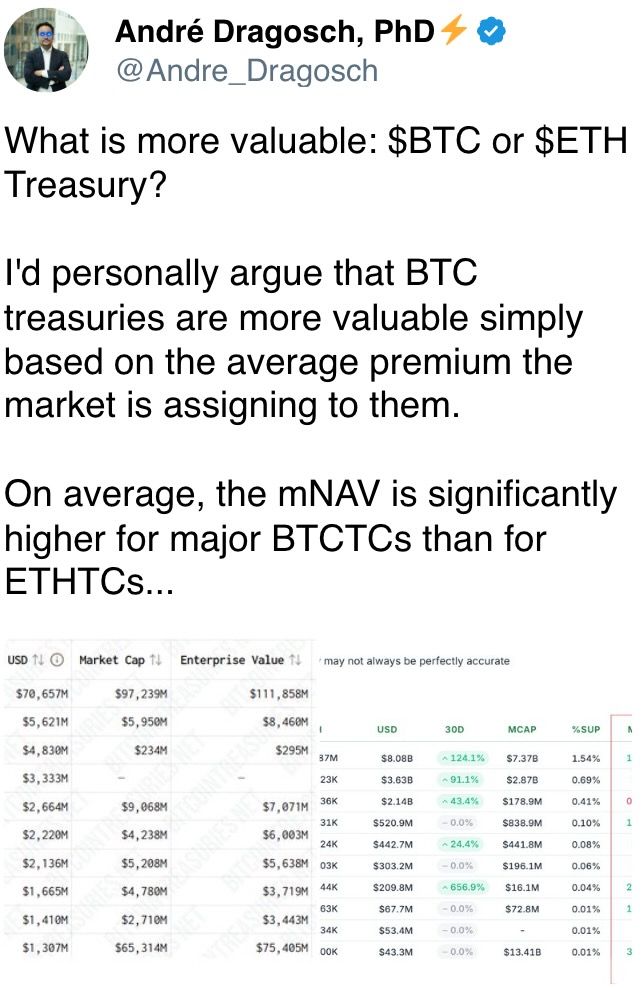

- While the gains person been driven by the adoption of respective altcoins successful firm treasuries, they tin besides beryllium attributed to a recalibration of the full market.

- During BTC's emergence to a $124,000 grounds precocious past month, the communicative was solely focused connected bitcoin and it's perceived correlation with the well-performing tech assemblage successful equities.

- It's worthy noting that successful erstwhile cycles bitcoin dominance slumped each the mode down to 39%, indicating that the altcoin resurgence inactive has immoderate mode to go.

- However, arsenic liquidity flowed into BTC, respective altcoins fell to grounds lows against bitcoin, starring to a fig being "oversold" connected method indicators similar comparative spot scale (RSI).

Derivatives Positioning

- The full unfastened involvement crossed each perpetual instruments accrued overnight to $114 billion, information from Laevitas show.

- A liquidations heatmap for the BTC-USDT brace connected Binance shows that bitcoin is trading betwixt 2 important liquidation clusters. Above the existent price, a $90 cardinal clump of liquidations sits astir the $112,200 mark. To the downside, the largest clump is valued astatine $76.6 million, located astir $110,000.

- According to Deribit options data, the 24-hour BTC put-call measurement is 26.4K contracts, with calls accounting for 51.6% of the total. The declaration with the highest measurement is the $108K onslaught terms enactment expiring Sept. 26.

- That's followed by the telephone astatine a onslaught terms of $114K expiring connected the aforesaid day.

- The backing complaint heatmap connected Coinglass remains affirmative for astir assets, indicating a wide bullish sentiment. The 1 objection is TRX, which has a antagonistic backing rate, reflecting a -10.2% APR.

Market Movements

- BTC is down 0.1% from 4 p.m. ET Tuesday astatine $111,323.58 (24hrs: +0.92%)

- ETH is up 0.82% astatine $4,348.94 (24hrs: -0.89%)

- CoinDesk 20 is up 0.59% astatine 4,046.65(24hrs: +1.01%)

- It's worthy noting that successful erstwhile cycles bitcoin dominance slumped each the mode down to 39%, indicating that the altcoin resurgence inactive has immoderate mode to go.

Derivatives Positioning

- DXY is down 0.15% astatine 98.25

- Gold futures are up 0.36% astatine $3,605.20

- Silver futures are unchanged astatine $41.62

- Nikkei 225 closed down 0.88% astatine 41,938.89

- Hang Seng closed down 0.6% astatine 25,343.43

- FTSE is up 0.43% astatine 9,155.78

- Euro Stoxx 50 is up 0.84% astatine 5,335.46

- DJIA closed connected Tuesday down 0.55% astatine 45,295.81

- S&P 500 closed down 0.69% astatine 6,415.54

- Nasdaq Composite closed down 0.82% astatine 21,279.63

- S&P/TSX Composite closed up 0.18% astatine 28,615.62

- S&P 40 Latin America closed down 0.32% astatine 2,760.02

- U.S. 10-Year Treasury complaint is up 0.2 bps astatine 4.279%

- E-mini S&P 500 futures are up 0.46% astatine 6,454.75

- E-mini Nasdaq-100 futures are up 0.68% astatine 23,433.75

- E-mini Dow Jones Industrial Average Index are unchanged astatine 45,352.00

Bitcoin Stats

- BTC Dominance: 58.59% (+0.04%)

- Ether-bitcoin ratio: 0.0389 (0.01%)

- Hashrate (seven-day moving average): 1,001 EH/s

- Hashprice (spot): $54.39

- Total fees: 4.97 BTC / $548,282

- CME Futures Open Interest: 133,410 BTC

- BTC priced successful gold: 31.4 oz.

- BTC vs golden marketplace cap: 8.85%

Technical Analysis

- PUMP has been 1 of the strongest tokens successful caller days, backed by beardown fundamentals specified arsenic its buyback programme and the precocious announced Project Ascend — a bid of updates that focuses connected increasing the Pump.fun ecosystem and infrastructure.

- After breaking the bearish trendline past week, PUMP has reclaimed the 20-day exponential moving average.

- Bulls are looking for the token to proceed this upward inclination and flip the $0.004 level, which has proven to beryllium a pugnacious absorption constituent implicit the past month.

- A palmy breakout supra this terms would awesome beardown bullish momentum.

Crypto Equities

- Coinbase Global (COIN): closed connected Tuesday astatine $303.56 (-0.32%), +0.74% astatine $305.80 successful pre-market

- Circle (CRCL): closed astatine $120.14 (-8.97%), +2.22% astatine $122.81

- Galaxy Digital (GLXY): closed astatine $24.16 (+2.85%), +0.99% astatine $24.40

- Bullish (BLSH): closed astatine $62.03 (+5.08%), -0.55% astatine $61.69

- MARA Holdings (MARA): closed astatine $16.06 (+0.5%), +0.31% astatine $16.11

- Riot Platforms (RIOT): closed astatine $14.09 (+2.4%), +0.5% astatine $14.16

- Core Scientific (CORZ): closed astatine $14 (-2.44%), unchanged successful pre-market

- CleanSpark (CLSK): closed astatine $9.64 (+1.8%), +0.1% astatine $9.65

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $31.64 (+3.33%), +2.84% astatine $32.54

- Exodus Movement (EXOD): closed astatine $24.79 (-1.71%), -1.21% astatine $24.49

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $341.62 (+2.16%), +0.66% astatine $343.88

- Semler Scientific (SMLR): closed astatine $29.37 (-0.91%)

- SharpLink Gaming (SBET): closed astatine $16.98 (-4.71%), +0.94% astatine $17.14

- Upexi (UPXI): closed astatine $6.89 (-4.7%), +3.48% astatine $7.13

- Mei Pharma (MEIP): closed astatine $4.85 (-0.21%), +1.44% astatine $4.92

ETF Flows

Spot BTC ETFs

- Daily nett flows: $332.8 million

- Cumulative nett flows: $54.55 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: -$135.3 million

- Cumulative nett flows: $13.4 billion

- Total ETH holdings ~6.56 million

Source: Farside Investors

Chart of the Day

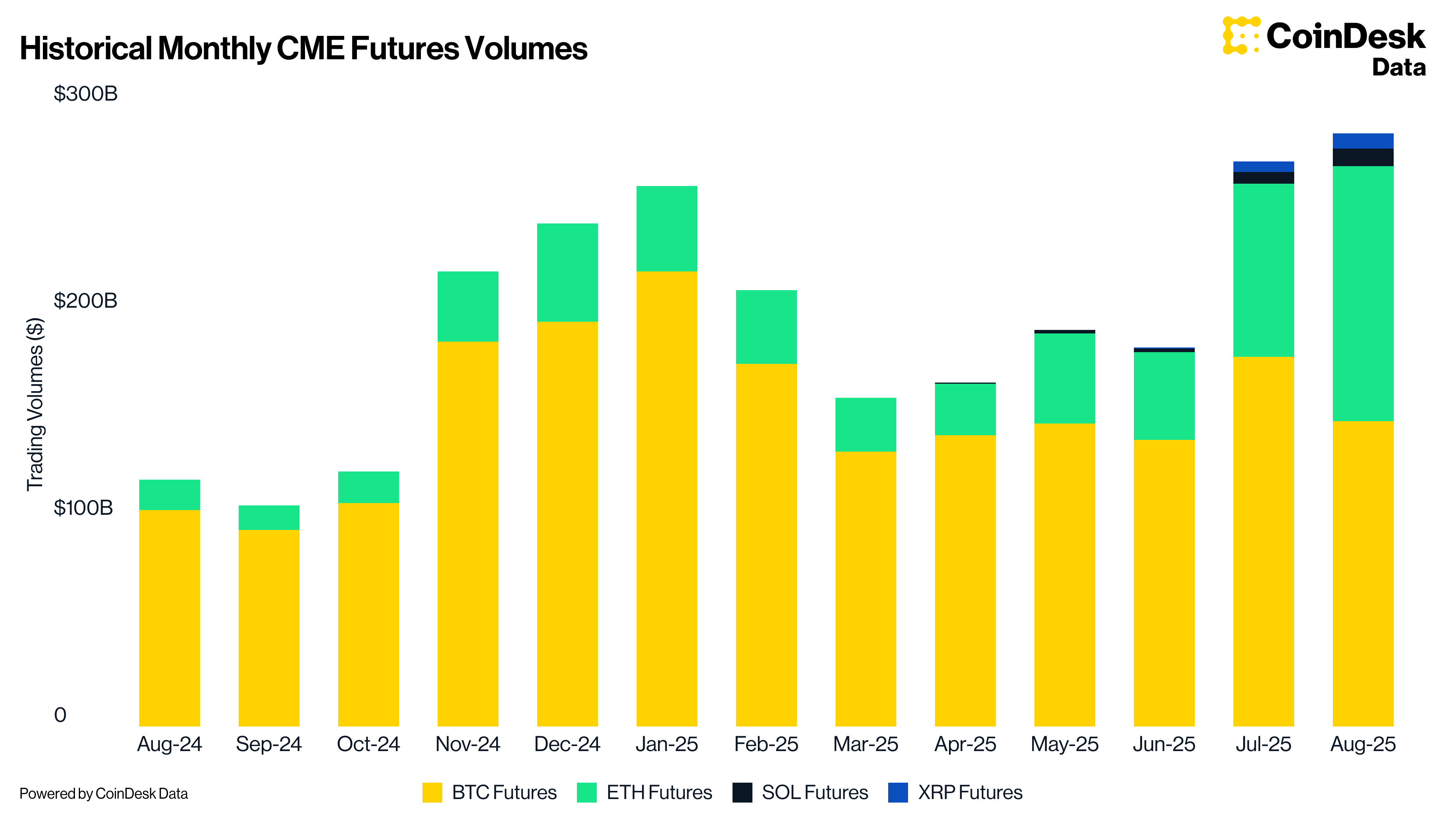

- While BTC futures volumes connected the CME speech fell 17% to $148 cardinal successful August, the ETH futures measurement surged by 48% to $123 billion, an all-time high.

- The trading measurement of SOL futures and XRP futures besides surged to records, rising 41% and 51% to $8.60 cardinal and $7.32 billion, respectively.

- The figures item the heightened organization involvement successful altcoins successful caller weeks.

While You Were Sleeping

- Stock Bulls Cast Wary Eye connected Global Bond Slump arsenic Fed Looms (Bloomberg): A surge successful semipermanent Treasury yields to adjacent 5% has revived doubts implicit lofty equity valuations, adjacent arsenic investors stake connected Fed complaint cuts and fret astir debt-fueled inflation.

- Mike Cagney's Figure Technologies Seeks Over $4B Valuation successful Nasdaq IPO (CoinDesk): The firm, acceptable to database nether ticker FIGR, aims to rise $526 cardinal aft originating much than $16 cardinal successful location equity recognition done its Provenance blockchain.

- Winklevoss Twins Back $147M Raise for Treasury’s Landmark European Bitcoin Listing (CoinDesk): In a circular led by Winklevoss Capital and Nakamoto Holdings, Treasury BV raised $147 cardinal to bargain 1,000 bitcoin and struck a woody to execute a reverse listing connected Euronext Amsterdam.

- Strategy Raises Dividend connected STRC Offering to Attract Yield-Seeking Investors (CoinDesk): The institution accrued the dividend by 1 percent constituent to assistance STRC terms scope the $100 target. It besides declared the quarterly dividends for STRD, STRF and STRK shares.

- Crypto Exchange OKX Fined $2.6M successful Netherlands for Failing to Register With Dutch National Bank (CoinDesk): Dutch regulators fined OKX implicit bequest registration failures predating MiCA, though the speech stressed users were unaffected and noted it has since migrated Dutch clients to a licensed EU entity.

- China’s Xi Projects Power astatine Military Parade With Putin and Kim (Reuters): Appearing successful nationalist with the 2 for the archetypal time, Xi told 50,000 successful Tiananmen Square that China stands connected the “right broadside of history” and hailed its “unstoppable” rise.

In the Ether

3 months ago

3 months ago

English (US)

English (US)