Bitcoin has plummeted to nether $64,000, its lowest level since mid-May, driven by heightened selling unit successful the market.

BTC has mostly traded downwards oregon sideways aft exceeding the $70,000 people astatine the commencement of the month. Since then, the flagship plus has shed much than 10% of its summation during this period.

Why is BTC falling?

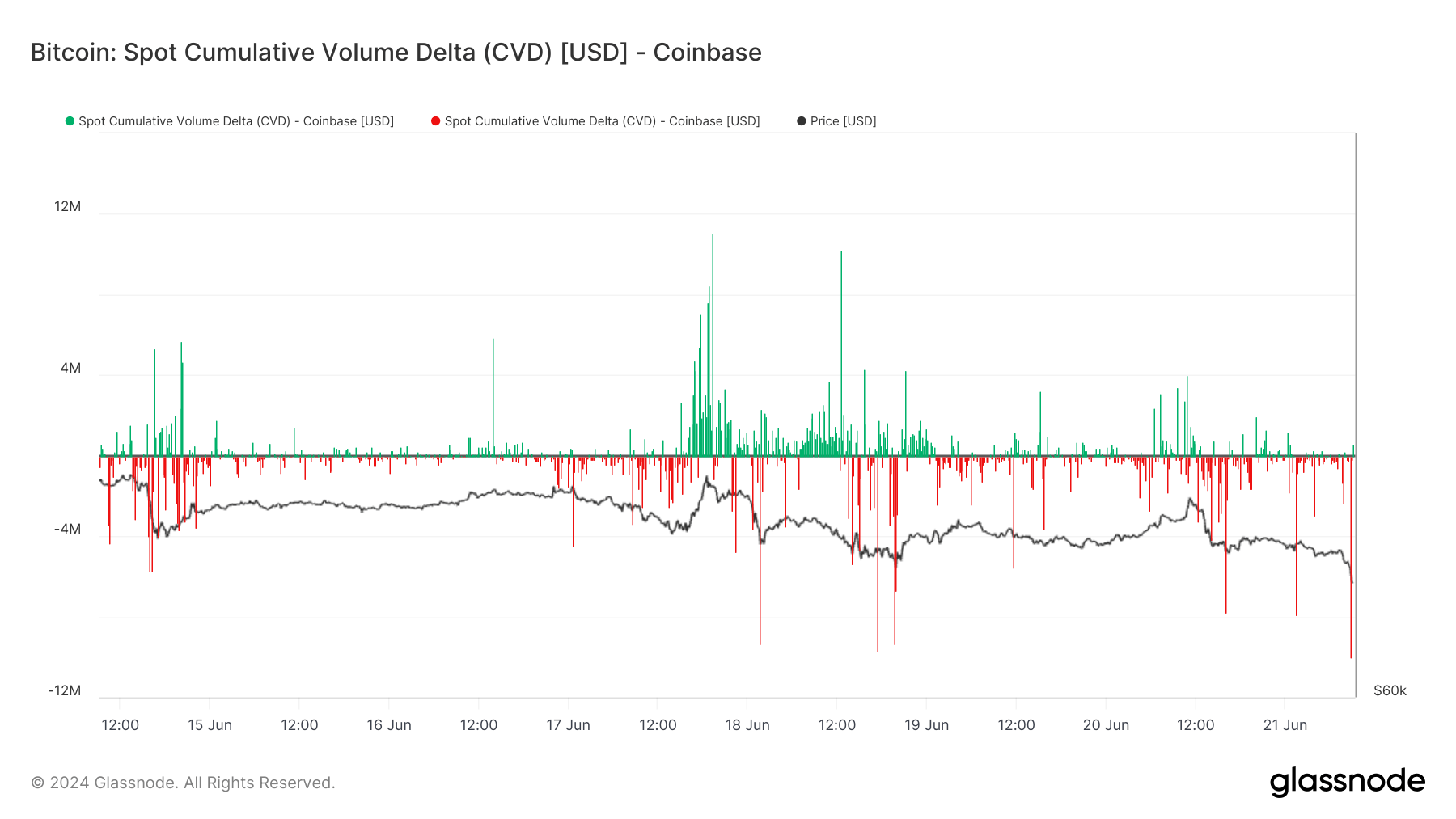

On-chain information reveals that immoderate caller selling unit originated from Coinbase, the largest US-based crypto exchange. Glassnode information shows that the level experienced $10 cardinal successful spot-selling activity, marking the highest magnitude wrong a 10-minute model successful a week.

Chart Showing Coinbase Spot Volume (Source: Glassnode)

Chart Showing Coinbase Spot Volume (Source: Glassnode)Notably, the German authorities is besides contributing to the existent selling pressure, moving $600 cardinal successful BTC connected June 19, with $195 cardinal sent to 4 speech addresses, including Kraken, Bitstamp, and Coinbase.

Market experts person attributed BTC’s existent terms weakness to accrued outflows from the US-based spot Bitcoin exchange-traded funds (ETFs). While involvement successful these ETFs surged aft their support successful January, starring to implicit $53 cardinal inflow, the past week has seen nett outflows exceeding $900 million.

Additionally, BTC miners person been offloading their holdings owed to the fiscal unit introduced by the caller halving event. Bitcoin expert Willy Woo said BTC’s terms would lone retrieve “when anemic miners dice and hash complaint recovers.”

$20 cardinal liquidation successful 1 hour

Coinglass information reveals that the marketplace downturn liquidated astir $20 cardinal successful crypto positions wrong the past hour, totaling $150 cardinal successful the past 24 hours.

A person look astatine the liquidations indicates that agelong traders who stake connected terms increases faced the astir important losses, losing $106 million. In contrast, abbreviated traders, holding a much bearish outlook, were liquidated for $44 million.

Bitcoin traders experienced the highest losses, totaling $42 million—$26 cardinal from agelong positions and $16 cardinal from abbreviated positions. Ethereum traders followed closely, with liquidations reaching astir $28 million.

The astir important azygous liquidation occurred connected Bybit, involving a BTCUSD transaction valued astatine $8.09 million.

The station Bitcoin tumbles to lowest terms since mid-May nether $64k appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)