The caller dip successful the terms of Bitcoin beneath the $59,000 enactment level has sent jitters done the cryptocurrency market. While the terms driblet triggered liquidations successful futures markets, analysts pass that a much important diminution could beryllium connected the skyline successful the lack of a full-blown marketplace capitulation.

Measured Retreat, Not Mass Exodus

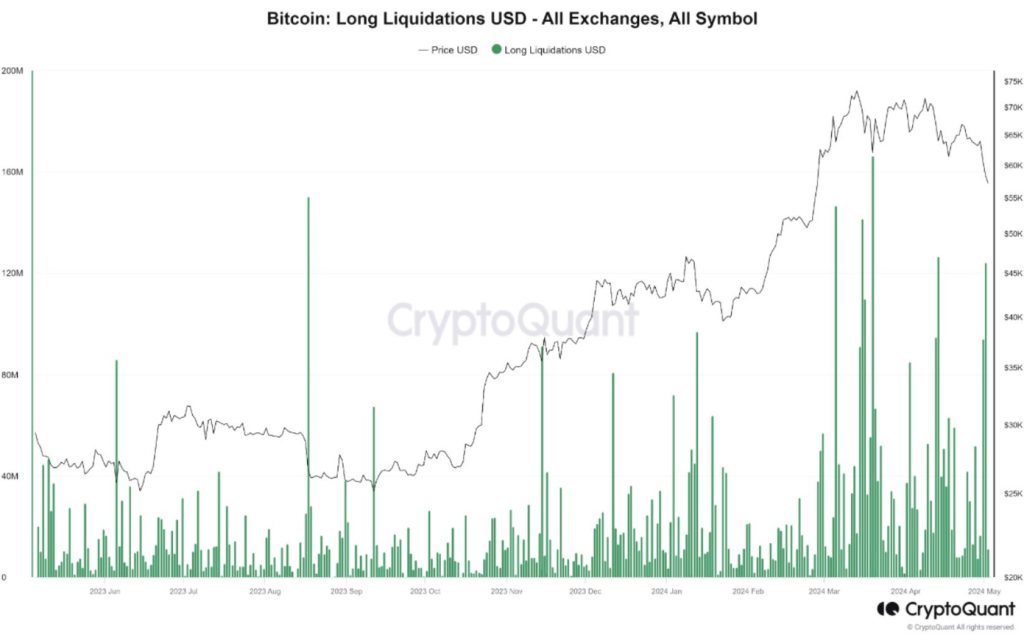

Following the terms drop, CryptoQuant, a cryptocurrency investigation platform, reported astir $120 cardinal successful liquidated agelong positions (bets that the terms would spell up). This liquidation is noteworthy, but dissimilar erstwhile selloffs astatine the aforesaid enactment level, it doesn’t awesome a panicked exodus from investors. Investors look to beryllium taking a much measured approach, suggesting a imaginable short-term correction alternatively than a semipermanent carnivore market.

$BTC Futures Market Not Yet Signaling Capitulation

“Given the comparatively tiny magnitude of agelong presumption liquidation and the deficiency of melodramatic antagonistic backing ratios, we judge that a ‘capitulation’ has not yet occurred successful the futures market.” – By @MAC_D46035

Link 👇… pic.twitter.com/xqArLQiITf

— CryptoQuant.com (@cryptoquant_com) May 2, 2024

A Glimmer Of Hope For Long-Term Investors

While the short-term outlook appears cautious, determination are reasons for semipermanent investors to stay optimistic. On-chain metrics, which analyse information straight connected the Bitcoin blockchain, connection hints of a imaginable aboriginal upswing.

Metrics similar MVRV (Market Value to Realized Value) suggest there’s a accidental for an upward determination successful the larger marketplace cycle. This accusation empowers strategical investors to presumption the existent concern arsenic a imaginable buying opportunity, peculiarly if a important capitulation lawsuit unfolds successful the futures market.

Bitcoin terms enactment successful the past week. Source: Coingecko

Bitcoin terms enactment successful the past week. Source: Coingecko

Navigating The Bitcoin Maze: Data-Driven Decisions Are Key

The existent marketplace volatility presents a analyzable situation for investors. Understanding marketplace sentiment is important for making informed decisions. The backing rate, an indicator of sentiment successful futures contracts, has dipped into antagonistic territory astatine times.

Traditionally, this suggests a stronger beingness of bears (investors betting connected a terms decline) than bulls. However, the negativity hasn’t reached the extremes witnessed during past important downturns, leaving the wide sentiment somewhat unclear.

Bitcoin’s Long-Term Narrative Remains Unwritten

Closely monitoring futures markets for signs of capitulation, on with analyzing different marketplace indicators similar the backing rate, is indispensable for occurrence successful this dynamic environment. Sharp investors equipped with a strategical knowing of marketplace dynamics are apt to nett from immoderate aboriginal moves.

Bitcoin’s caller terms driblet has caused short-term volatility, but the semipermanent communicative remains unwritten. While the coming weeks mightiness trial capitalist resolve, those who tin analyse marketplace information and marque strategical decisions could beryllium well-positioned to capitalize connected aboriginal opportunities.

Featured representation from Pixabay, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)