One of the main aspects of on-chain investigation is to analyse transactions implicit the network. Unlike exchange-involved transactions, which often pb to terms volatility, transactions extracurricular of exchanges show the web inferior arsenic imaginable payments among users. It makes a affirmative publication to the improvement of the web implicit the agelong word if users are interacting with 1 another. Therefore, it is indispensable to analyse the transaction behaviour implicit the network.

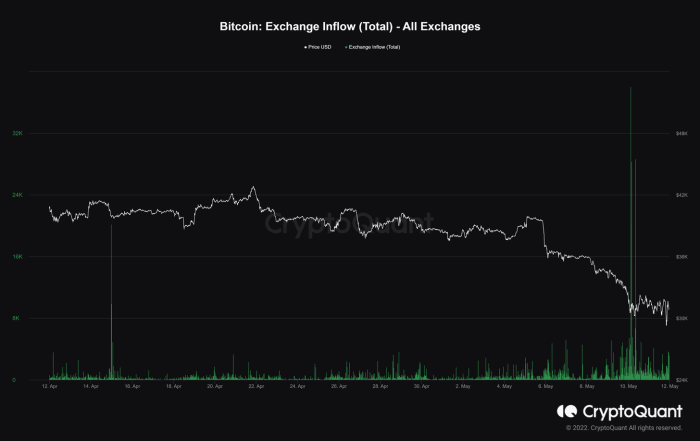

The caller spike of bitcoin inflows to exchanges marque galore worried, but does it adversely impact the full web connected the macro view? (source)

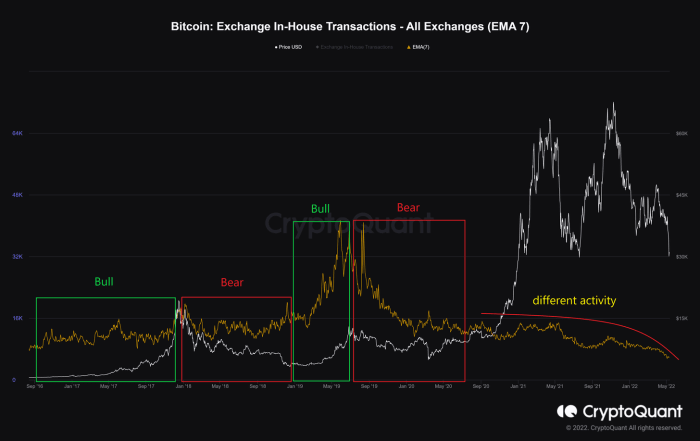

Regarding the sum of each speech in-house transactions, the fig of transactions circulated wrong the exchanges’ wallets person been trending little from the May 2021 peak. That means determination is not arsenic overmuch transportation enactment done the marketplace. It looks antithetic from the erstwhile terms cycles erstwhile this fig was powerfully correlated to the terms action.

Transactions conducted wrong exchanges’ wallets successful downtrend. (source)

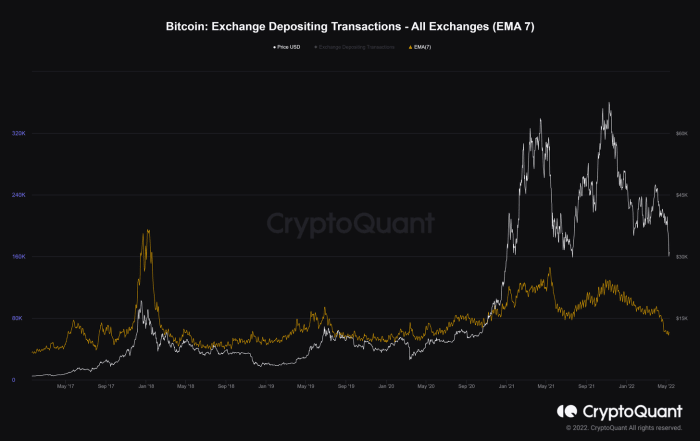

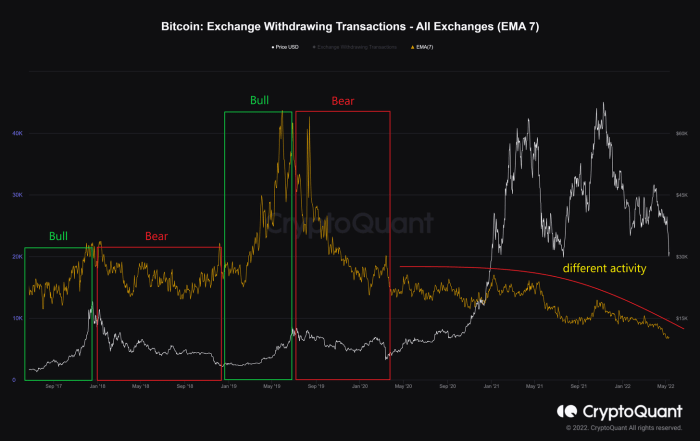

Meanwhile, the full fig of deposits and withdrawals to and from exchanges has plunged downwards, demonstrating that radical whitethorn beryllium little engaged successful the exchanges.

The deposits to exchanges plummeted. (source)

The withdrawals from exchanges are besides decreasing. (source)

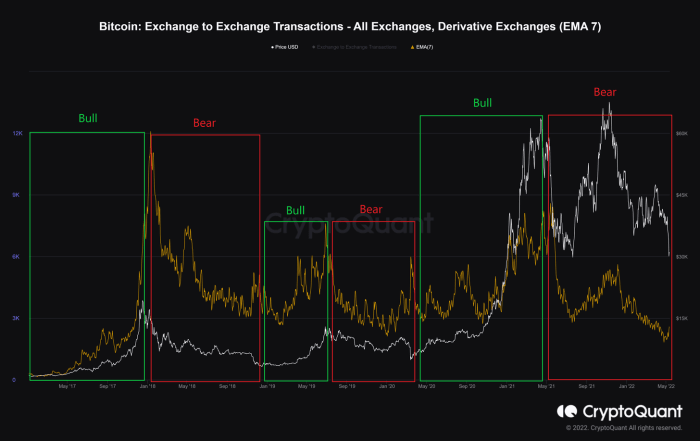

Additionally, the fig of transactions from each exchanges to derivatives exchanges has plummeted arsenic a hint that derivatives trades are not precise charismatic astatine the moment.

Fewer transactions into derivatives exchanges. (source)

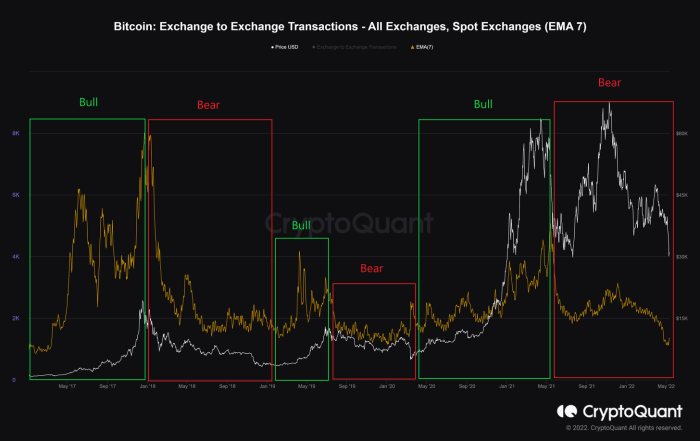

In the meantime, determination is nary further anticipation of cumulative selling unit owed to the important driblet successful the fig of transactions from each exchanges to spot exchanges. This offers the slightest of encouragement and mitigates bearish sentiment among stakeholders.

The decreasing anticipation of selling unit connected spot exchanges with less bitcoin connected spot exchanges. (source)

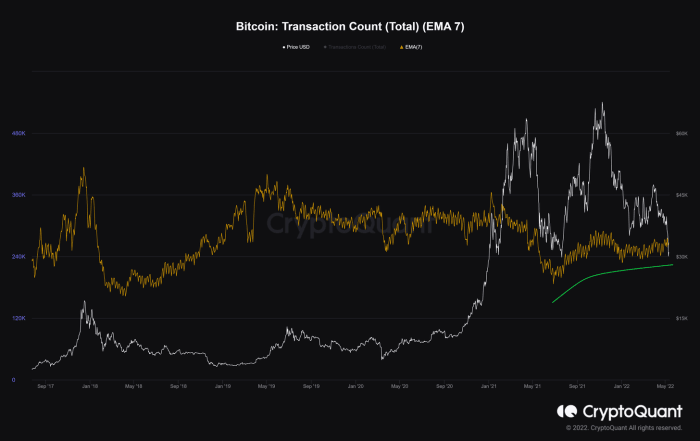

Concurrently, the sum number of transactions has moved up successful opposition to the downtrend successful exchange-related transactions. It implies an accrued supply/demand extracurricular of exchanges, resulting successful a precocious usage of the Bitcoin network.

High web utility, arsenic full transaction number is expanding and speech transactions decreasing. (source)

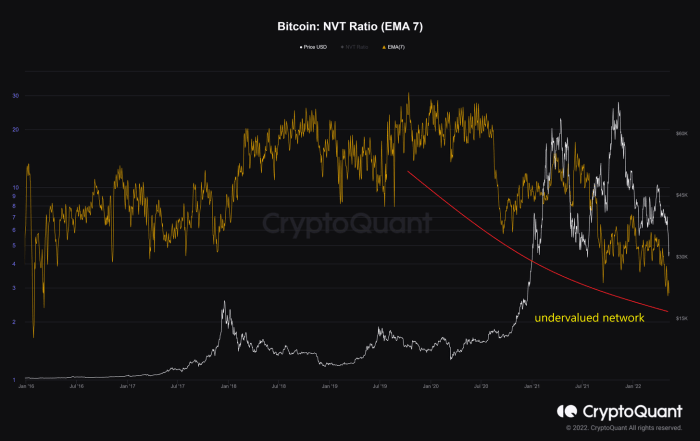

Network value-to-transaction (NVT) is the ratio of marketplace capitalization divided by transaction volume. That helps gauge the relativity betwixt web worth and web usage arsenic transaction measurement represents web usage. A falling NVT proves that the velocity of coins circulating successful the bitcoin system has risen, and the web worth is comparatively undervalued compared to its precocious utility.

NVT ratio illustrating the undervalued web and precocious velocity. (source)

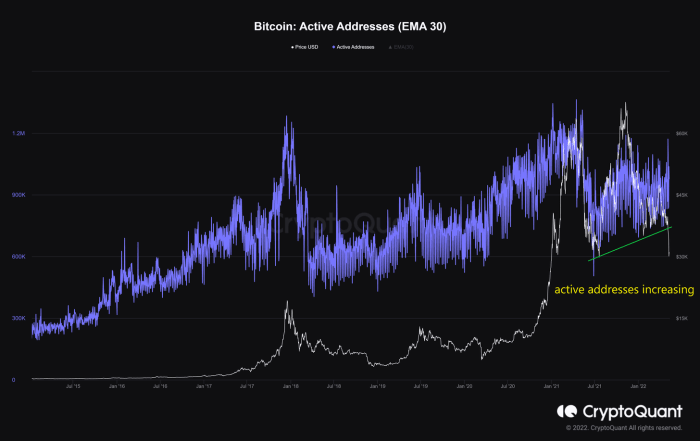

It is wide however rapidly and proportionally transactions are conducted connected the web successful and extracurricular of exchanges. We should wage attraction to the sum of unsocial progressive addresses, including some senders and receivers. The sum of progressive addresses has gradually accrued since the July 2021 bottom. This has been a bully indicator for the improvement of web enactment since Bitcoin’s inception.

Total progressive addresses revealing the improvement of the Bitcoin network. (source)

Ultimately, semipermanent investors are acrophobic astir the integer attributes to the velocity of bitcoin usage successful the system alternatively than its trading price. With constricted proviso and expanding demand, an summation of transactions and progressive addresses implicit clip demonstrates the maturation of the Bitcoin network’s utility.

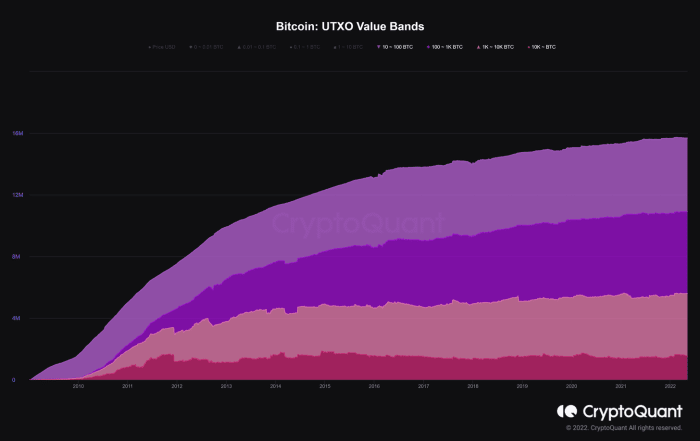

The cardinal diagnostic of the on-chain investigation is the HODLing behaviour of semipermanent investors. One of the astir reliable indicators is UTXO worth bands which exemplify the organisation of each UTXOs successful presumption of their size. All studied UTXO bands herein correspond the full worth of each UTXOs ranging from 10 to much than 10,000 bitcoin, which focuses connected the behaviour of whales. As seen successful the pursuing figure, much UTXOs person been held successful tremendous quantities suggesting that whales are not distributing coins and are alternatively accumulating.

Whales are accumulating successful enactment with UTXO worth bands. (source)

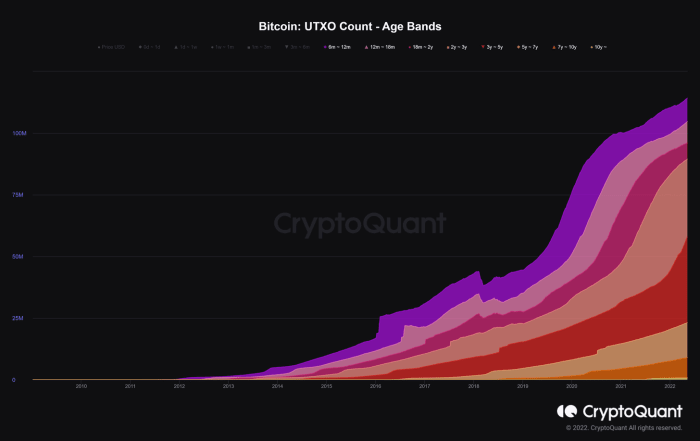

In addition, UTXO property bands show the fig of UTXOs that past moved wrong a specified duration. All considered bands (over six months) person been maintained and gradually expanded. This implies that much investors person been holding and accumulating much coins.

Coin property maturity with notation to UTXO property bands. (source)

The UTXO number property bands and worth bands suggest that short-term liquidity is ascendant passim the market, whereas semipermanent liquidity is inactive virtually dormant and somewhat increasing. Simply put, long-standing HODLers are calmly assured careless of the short-term volatility successful bitcoin’s price.

On balance, the inferior of the Bitcoin web has been increasing during the caller semi-bear market. The transaction behaviour extracurricular of exchanges has been carried retired arsenic a feasible outgo process, and the Bitcoin assemblage has adopted the HODLing attitude.

This is simply a impermanent station by Dang Quan Vuong. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)