Bitcoin (BTC) has been successful a downtrend since aboriginal October, with the terms dropping beneath its web value, suggesting a imaginable betterment successful 2026.

Key takeaways:

Bitcoin terms dropped beneath its just value, a setup that has historically preceded affirmative one-year returns.

Strengthening web enactment suggests robust adoption beyond speculation.

Bitcoin spot CVD flipped positive, signalling renewed buy-side activity.

Bitcoin’s web worth hints astatine BTC terms recovery

Bitcoin terms is trading 31.4% beneath its $126,000 all-time precocious reached connected Oct. 6, according to information from Cointelegraph Markets Pro and TradingView.

This drawdown has seen the BTC terms driblet beneath its web worth (Metcalfe) for the archetypal clip successful 2 years, a setup that has historically predicted Bitcoin recoveries with accuracy, according to economist Timothy Peterson.

Related: Bitcoin battles $50K terms people arsenic Fed adds $13.5B overnight liquidity

Bitcoin's Metcalfe Value is the theoretical just terms derived from Metcalfe’s Law, which states that the BTC terms rises successful correlation with the maturation of progressive addresses and transactions, i.e., web value. This means that the much wallets and transactions determination are, the higher the just terms of Bitcoin.

This divergence signals Bitcoin is undervalued comparative to its expanding web (e.g., progressive addresses), often aft speculative excess.

“While this does not needfully awesome a bottom, it does bespeak that astir leverage has been removed and the ‘bubble’ has deflated,” Peterson said successful an X station connected Tuesday, adding:

Notably, erstwhile the BTC/USD brace dropped beneath its just worth successful 2019 and 2020, the terms saw important terms recoveries successful the months that followed. The past clip this happened was successful aboriginal 2023, preceding a much than 340% BTC terms rally to its erstwhile all-time highs of $74,000, reached successful March 2024.

Bitcoin betterment likelihood look strong, with web maturation intact, arsenic evidenced by a crisp summation successful the fig of investors who person held BTC for much than six months.

Hope. The archetypal uptick successful 6M holders since the April lows. pic.twitter.com/vFijIByTZI

— Charles Edwards (@caprioleio) December 2, 2025Additional information from Nansen reveals that the fig of transactions connected the Bitcoin web has accrued by 15% implicit the past 7 days to 3.06 million, a bullish motion of adoption and utility.

Looking to 2026, a convergence of factors, including persistent institutional buying and macroeconomic tailwinds specified arsenic Fed easing, could thrust BTC backmost supra the Metcalfe’s worth trendline by mid-year, targeting caller all-time highs.

Bitcoin spot enactment shows signs of recovery

Spot marketplace information is besides supporting the lawsuit for BTC’s recovery.

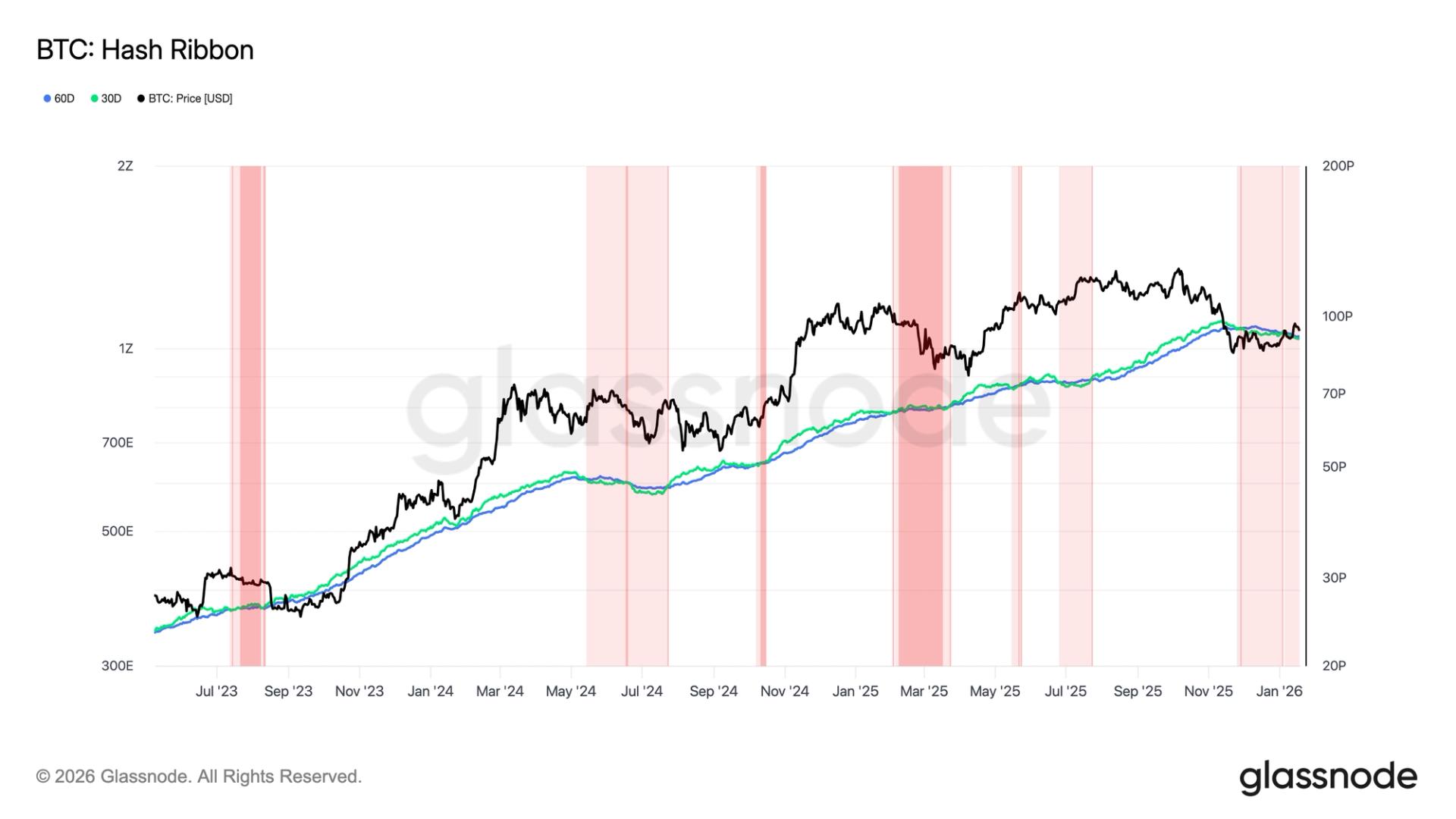

Spot CVD (cumulative measurement delta, a metric measuring the quality betwixt buying and selling measurement implicit time.) has reversed from -$106.6 cardinal to $29 cardinal implicit the past week, according to information from Glassnode.

This signals “stronger buy-side travel and a displacement toward improving sentiment,” said the onchain information supplier successful its latest Weekly Market Impulse report, adding:

“With CVD turning affirmative for the archetypal clip successful respective weeks, it signals renewed buy-side aggression contempt thinning liquidity.”As Cointelegraph reported, Bitcoin needs to regain momentum with higher trading volumes and sustained betterment successful spot CVD for BTC to instrumentality to six figures.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 month ago

1 month ago

English (US)

English (US)