The volatility Bitcoin experienced this week had a peculiarly absorbing interaction connected the derivatives market. Between June 23 and June 27, BTC mislaid its comparatively unchangeable enactment astatine supra $64,000 and dropped to $60,000, with a little dip beneath $60,000 earlier recovering connected June 25.

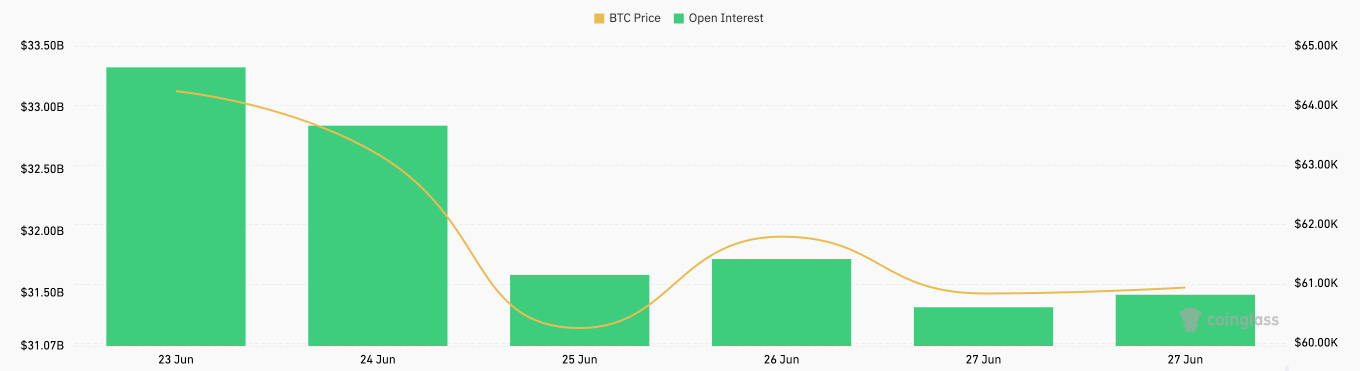

While the terms driblet mightiness not look that important erstwhile looking astatine semipermanent terms action, a driblet below $60,000 is an important intelligence milestone for traders. This is wherefore the 6% driblet had a notable interaction connected derivatives. Open involvement successful Bitcoin futures dropped from $33.33 cardinal connected June 23 to $31.39 cardinal connected June 27, reaching its lowest constituent since May 17.

Chart showing the unfastened involvement for Bitcoin futures from June 23 to June 27, 2024 (Source: CoinGlass)

Chart showing the unfastened involvement for Bitcoin futures from June 23 to June 27, 2024 (Source: CoinGlass)The superior crushed for this alteration was forced liquidations. As the terms fell sharply, a important fig of traders with leveraged agelong positions apt faced borderline calls. Unable to conscionable these calls successful time, their positions were liquidated, which could person added to the selling unit and led to a further driblet successful unfastened interest.

This often creates a feedback loop, exacerbating the terms diminution arsenic liquidations trigger further sell-offs. Furthermore, the declining terms apt prompted traders to go much risk-averse. With heightened volatility and uncertainty, traders mightiness person been discouraged from opening caller futures contracts, opting alternatively to trim vulnerability until the marketplace stabilizes.

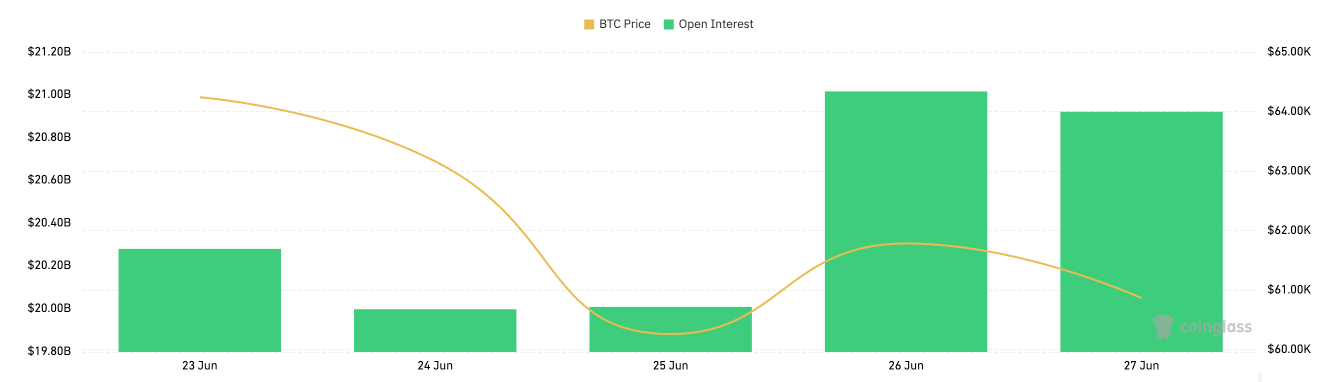

While the futures marketplace contracted, the options marketplace grew. Open involvement successful Bitcoin options accrued from $20.28 cardinal connected June 23 to $21 cardinal connected June 26, contempt a little dip to $20 cardinal connected June 25.

Chart showing the unfastened involvement for Bitcoin options from June 23 to June 27, 2024 (Source: CoinGlass)

Chart showing the unfastened involvement for Bitcoin options from June 23 to June 27, 2024 (Source: CoinGlass)The summation successful options OI during this play suggests that traders turned to options arsenic a hedge against imaginable terms volatility. Options are a flexible instrumentality for managing risk, allowing traders to support their positions and speculate connected terms movements without the aforesaid hazard associated with futures. The emergence successful OI, peculiarly successful a play of terms decline, shows that traders were looking to mitigate hazard and presumption themselves for much volatility.

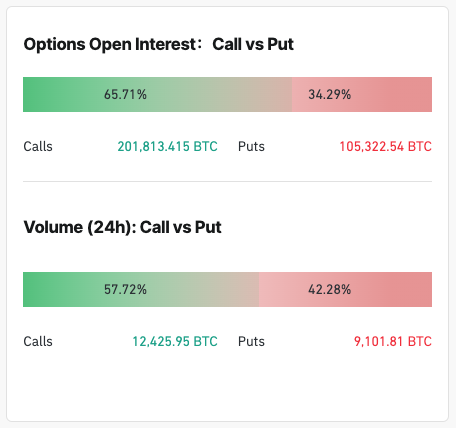

CoinGlass information shows that astir traders are preparing for upward volatility. As of June 27, 65.71% of the options unfastened involvement consisted of telephone options, with the 24-hour measurement favoring calls astatine 57.72%. The wide dominance of telephone options shows a bullish sentiment prevailing, and traders are positioning for terms betterment oregon looking to capitalize connected little prices with constricted downside risk.

Screengrab showing the organisation of telephone and enactment options connected June 27, 2024 (Source: CoinGlass)

Screengrab showing the organisation of telephone and enactment options connected June 27, 2024 (Source: CoinGlass)Arbitrage opportunities betwixt spot, futures, and options markets could person accrued options trading activity. Institutional involvement, with institutions utilizing options for hazard absorption and portfolio adjustments, apt contributed to higher options unfastened interest.

Volatility trading, wherever traders nett from expected changes successful marketplace volatility, besides attracted much enactment successful the options marketplace during this play of accrued terms swings.

The shifts seen successful futures and options unfastened involvement amusement however traders employment antithetic hazard absorption strategies successful effect to terms declines. Futures traders look to person reduced their vulnerability owed to liquidations and accrued hazard aversion, portion options traders accrued their vulnerability for hedging and speculation.

The station Bitcoin volatility sees futures slump, portion options unfastened involvement spikes appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)