Data shows that Bitcoin volatility is presently astatine historically debased levels, thing that has led to convulsive terms moves successful the past.

Bitcoin 7-Day Range Has Compressed To Just 3.4% Recently

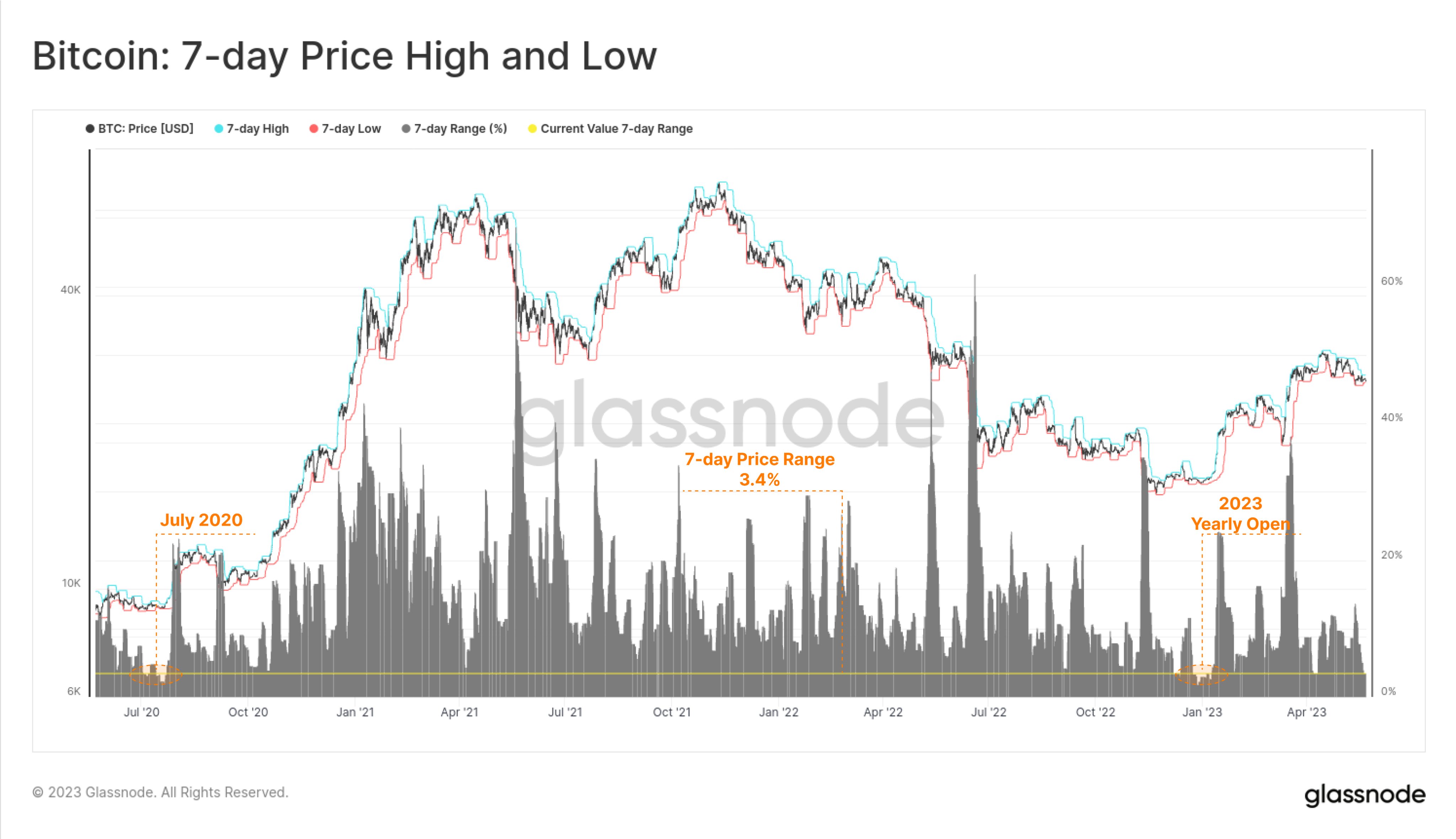

According to information from the on-chain analytics steadfast Glassnsode, the existent 7-day terms scope is comparable to levels seen backmost successful January of this year. The “7-day terms range” of Bitcoin present refers to the percent quality betwixt the highest and the lowest points that the asset’s worth has observed during the past 7 days.

This metric tin supply hints astir the caller volatility that the cryptocurrency has experienced. When the indicator has a debased value, it means the terms enactment during the past week has been rather stale. Naturally, this suggests that the volatility of the plus is debased close now.

On the different hand, precocious values of the 7-day terms scope connote the coin has seen a precocious grade of fluctuation wrong the past 7 days, and hence, the volatility has been high.

Now, present is simply a illustration that shows the inclination successful the Bitcoin 7-day terms scope (as good arsenic the 7-day precocious and low) implicit the past fewer years:

As shown successful the supra graph, the Bitcoin 7-day terms scope had people succumbed to rather debased values during the carnivore marketplace lows that had followed the FTX crash, arsenic the BTC terms had been stuck successful a sideways movement.

These debased values of the indicator continued into the caller twelvemonth arsenic the coin refused to amusement immoderate important movement. Soon after, however, the metric’s worth had seen an detonation arsenic the rally had begun to instrumentality place.

In the adjacent fewer months, the 7-day terms scope of the cryptocurrency had assumed comparatively precocious values, but recently, the indicator has observed different plummet.

The crushed down this caller plunge has people been the constrictive consolidation scope that the plus has followed successful the past week betwixt the $27,400 and $26,500 levels.

Because of this debased volatility, the 7-day terms scope of Bitcoin has collapsed to lone 3.4%. In the chart, Glassnode has besides highlighted the erstwhile instances wherever the cryptocurrency had seen this metric driblet truthful low.

It looks similar the indicator dipped to akin levels mode backmost successful July 2020, and the aforementioned lows from the commencement of the twelvemonth had besides observed the indicator attain specified values.

An absorbing happening to enactment astir some these periods of debased volatility is that the terms had gone connected to spot accelerated terms enactment not excessively agelong aft they occurred, and the erstwhile debased was followed by the 2021 bull run, portion the ongoing rally succeeded the second one.

If the existent compressed 7-day Bitcoin terms scope volition travel a akin pattern, past immoderate chaotic terms enactment whitethorn beryllium coming for the cryptocurrency successful the adjacent future.

BTC Price

At the clip of writing, Bitcoin is trading astir $26,800, down 2% successful the past week.

Featured representation from Maxim Hopman connected Unsplash.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)