In periods of utmost price volatility starring to massive losses crossed the market, it’s important to recognize wherever astir of these losses travel from. While erstwhile CryptoSlate investigation focused connected the quality betwixt the behaviour of long-term and short-term holders, there’s different furniture of extent successful on-chain information that tin supply a amended knowing of marketplace sentiment.

One of these metrics is the measurement spent successful loss, which calculates the full measurement of Bitcoin sold beneath the acquisition price. By categorizing this measurement successful nonaccomplishment by property cohorts and wallet sizes, we tin amended recognize the organisation of loss-making movements crossed antithetic capitalist classes and timeframes.

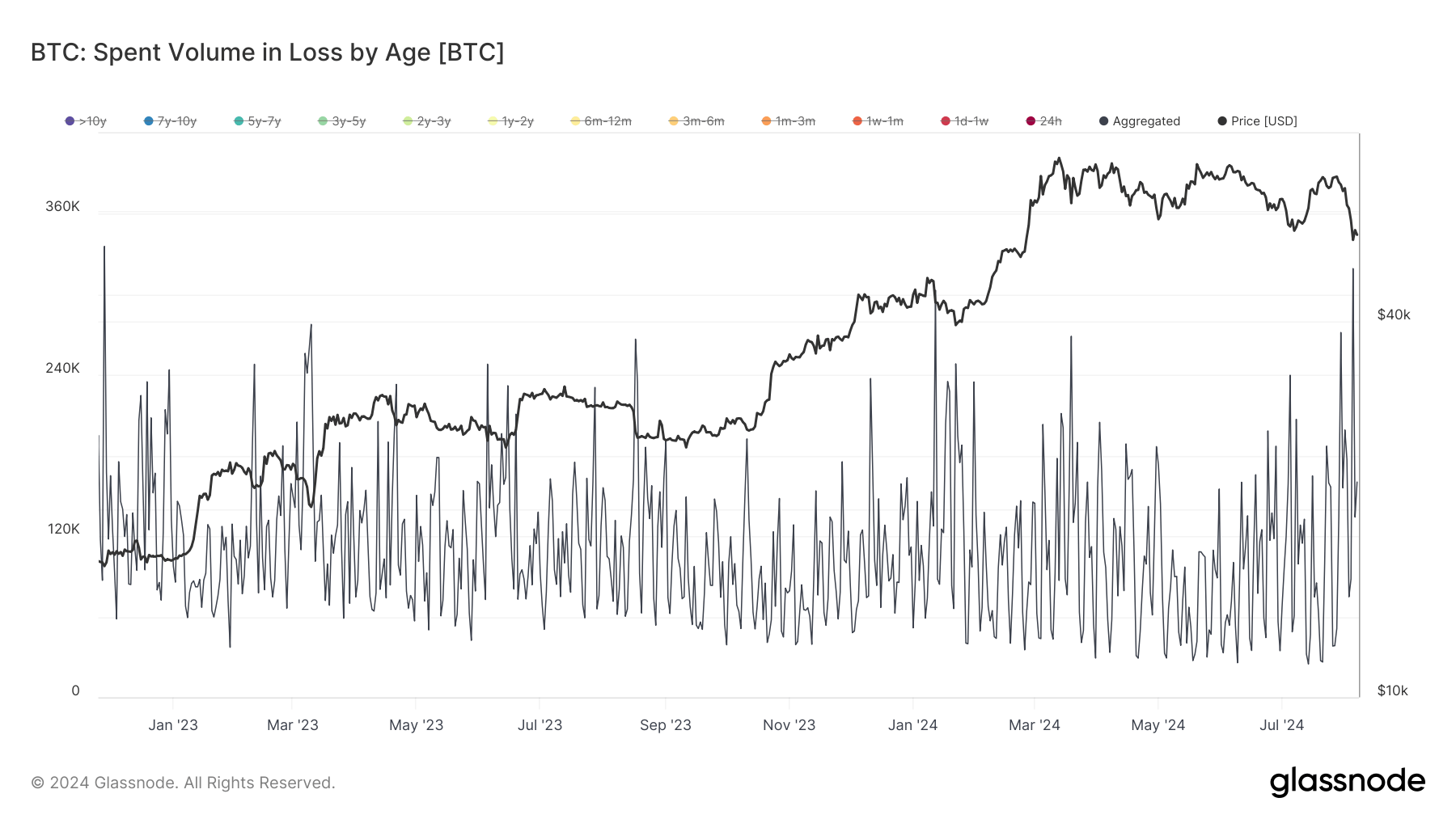

Bitcoin’s driblet from $60,000 to $54,000 betwixt Aug. 3 and Aug. 5 led to a important spike successful spent measurement successful nonaccomplishment for Bitcoin. The full spent measurement successful nonaccomplishment was conscionable supra 74,890 BTC connected Aug. 3, spiking to 319,290 BTC connected Aug. 5. This is the highest measurement spent successful nonaccomplishment since Nov. 28, 2022.

Graph showing the full Bitcoin measurement spent successful nonaccomplishment from Nov. 25, 2022, to Aug. 8, 2024 (Source: Glassnode)

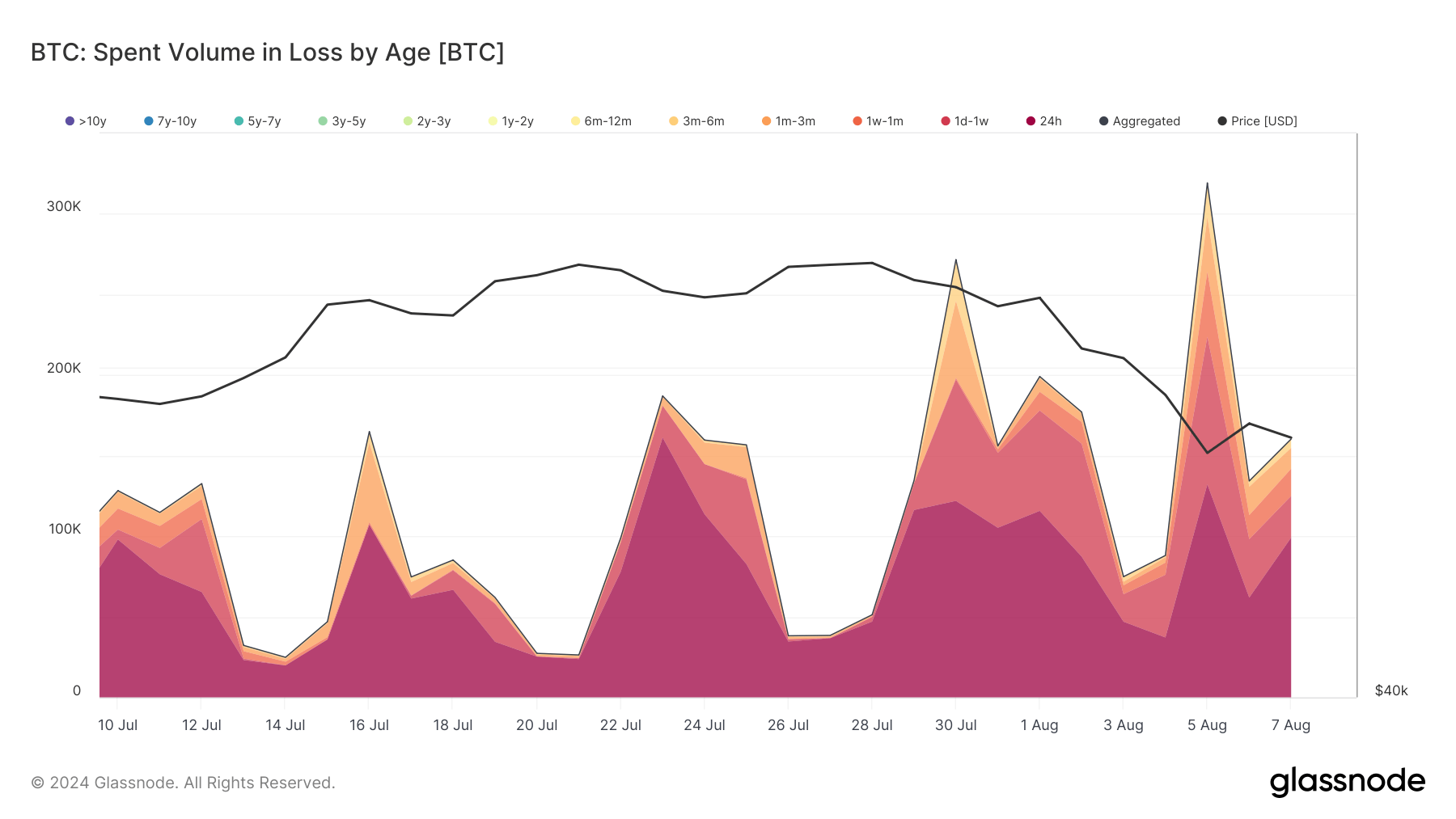

Graph showing the full Bitcoin measurement spent successful nonaccomplishment from Nov. 25, 2022, to Aug. 8, 2024 (Source: Glassnode)Looking astatine property cohorts, we tin spot that the bulk of the measurement spent successful nonaccomplishment was spent by wallets that held onto BTC for little than 24 hours — 132,180 BTC. The 2nd highest measurement came from the 1-day and 1-week cohorts — amounting to 91,685 BTC.

The 1-week to 1-month cohort spent 40,235 BTC, the 1-month to 3-month cohort spent 34,088 BTC, and the 3-month to 6-month cohort spent 18,869 BTC successful loss. Meanwhile, the 6-month to 12-month cohort spent 1,077 BTC, portion cohorts older than 1 twelvemonth spent little than 1,300 BTC successful total.

Graph showing Bitcoin measurement spent successful nonaccomplishment by property from July 10 to Aug. 7, 2024 (Source: Glassnode)

Graph showing Bitcoin measurement spent successful nonaccomplishment by property from July 10 to Aug. 7, 2024 (Source: Glassnode)This important measurement tin beryllium attributed to respective factors. Investors who get Bitcoin with the volition of short-term gains often respond rapidly to marketplace movements. Additionally, galore traders usage stop-loss orders to automatically merchantability their assets erstwhile the terms drops to a definite level. The crisp terms diminution could person triggered a cascade of stop-loss orders, resulting successful a important measurement of Bitcoin being sold astatine a nonaccomplishment wrong a abbreviated clip frame.

Moreover, automated trading bots that execute high-frequency trades whitethorn person contributed to the precocious measurement of Bitcoin spent successful loss. These bots are programmed to respond to marketplace movements wrong seconds oregon minutes, starring to a important fig of transactions from recently acquired coins.

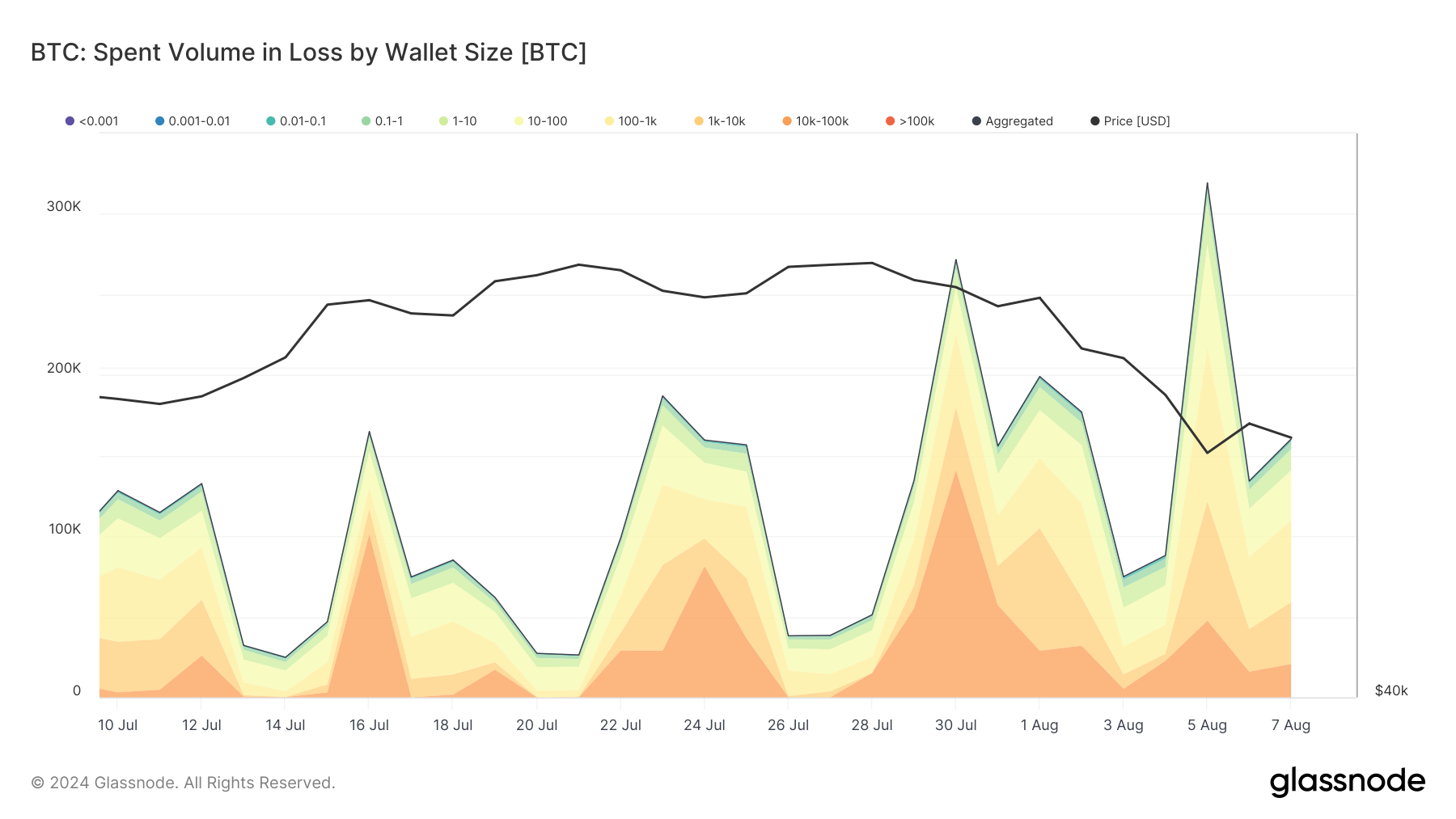

The spent measurement successful nonaccomplishment by wallet size shows that the highest measurement came from wallets holding betwixt 100 BTC and 1,000 BTC, totaling 95,590 BTC. Wallets holding 1000 to 10,000 BTC spent 73,990 BTC, portion wallets holding 10 BTC to 100 BTC spent 63,869 BTC successful loss.

Graph showing Bitcoin measurement spent successful nonaccomplishment by wallet size from July 10 to Aug. 7, 2024 (Source: Glassnode)

Graph showing Bitcoin measurement spent successful nonaccomplishment by wallet size from July 10 to Aug. 7, 2024 (Source: Glassnode)Wallets holding betwixt 100 BTC and 1,000 BTC often beryllium to organization investors oregon ample holders. The information suggests that ample investors were actively selling their Bitcoin during the terms drop. With the expanding prevalence of Bitcoin ETFs (Exchange-Traded Funds), important sell-offs from these funds could lend to the precocious measurement of Bitcoin spent successful loss.

ETFs that way Bitcoin prices request to set their holdings based connected marketplace movements and capitalist demand, starring to important transactions. Additionally, galore exchanges clasp ample amounts of Bitcoin successful blistery wallets, which autumn wrong the 100 BTC to 1,000 BTC range.

During periods of heightened trading activity, specified arsenic a accelerated terms decline, exchanges mightiness determination important volumes of Bitcoin to negociate liquidity oregon facilitate ample merchantability orders from their users.

The station Bitcoin measurement successful nonaccomplishment deed highest level since FTX collapse appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

![Why Crypto Market Is Going Up Today [Live] Updates, Reasons & Price Action](https://image.coinpedia.org/wp-content/uploads/2025/11/11142238/Crypto-Market-Today-Bitcoin-Holds-Around-105K-Altcoins-Stay-Cautious-While-UNI-WLFI-TRUMP-Thrive-1024x536.webp)

English (US)

English (US)