What is the “Christmas Rally?”

The Christmas rally, besides known arsenic the “Santa Claus rally,” refers to a recurring signifier successful which crypto markets thin to emergence during the last weeks of December and aboriginal January.

Several factors lend to this trend, including improved capitalist sentiment during the festive play and year-end portfolio adjustments arsenic traders and institutions rebalance their holdings. Lower liquidity during the holidays tin besides amplify terms movements, adding to the rally’s momentum. Around Christmas, crypto investors often behave otherwise than they bash passim the remainder of the year.

While this signifier archetypal appeared successful accepted banal markets, its power has since extended to golden and, much recently, to Bitcoin (BTC). Each year, arsenic planetary markets dilatory for the holidays, investors revisit the thought of a “Christmas rally.”

Both golden and Bitcoin are viewed arsenic stores of value, but they thin to behave otherwise erstwhile liquidity tightens oregon marketplace sentiment shifts. As December approaches, galore investors statement which plus — golden oregon Bitcoin — is much apt to payment from the seasonal uptrend.

What makes golden the classical store of value?

For centuries, radical person relied connected golden to support their wealthiness from inflation, which erodes the worth of fiat currencies. Central banks astir the satellite besides clasp important golden reserves arsenic portion of their semipermanent monetary and reserve absorption strategies.

Gold usually sees beardown seasonal request successful the 4th fourth each year, driven by respective factors:

Jewelry purchases successful China and India up of festive seasons

Central slope reserve accumulation

Institutional year-end hazard absorption and portfolio adjustments.

Historically, golden does not acquisition crisp gains successful December; instead, it tends to emergence gradually. During periods of recessionary interest oregon geopolitical tension, golden often outperforms much volatile assets. While its terms reacts to macroeconomic conditions, golden seldom delivers the melodramatic returns associated with cryptocurrencies.

Did you know? Gold requires vaults, security and unafraid transportation. Bitcoin, connected the different hand, relies connected private key management, which tin beryllium arsenic elemental arsenic utilizing a hardware wallet. Both contiguous information challenges. Gold faces the hazard of carnal theft, portion Bitcoin is susceptible to cyberattacks.

What makes Bitcoin a integer store of value?

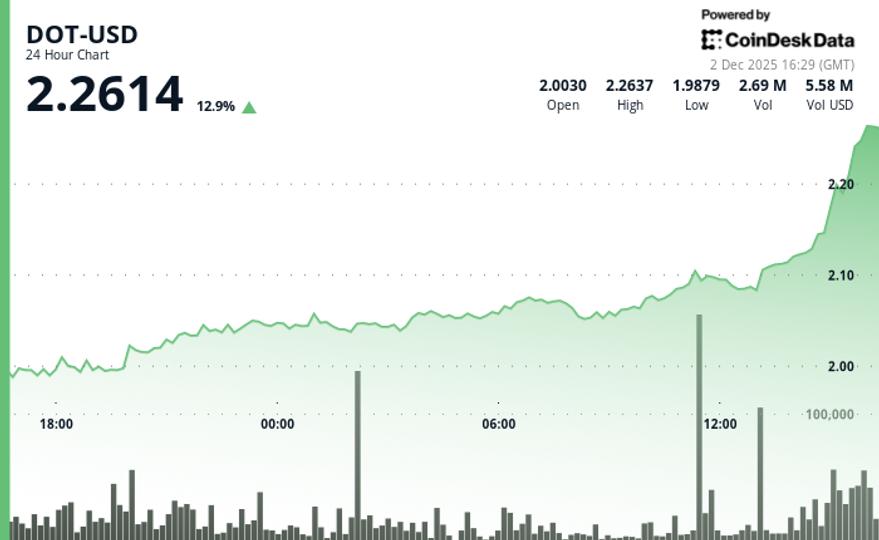

Bitcoin’s estimation arsenic “digital gold” has grown importantly since November 2022, erstwhile it traded astir $16,000. Since then, its terms has risen steadily.

Bitcoin archetypal surpassed the $100,000 people connected Dec. 5, 2024, reaching $103,679. It has crossed this level respective times since, signaling a highest valuation of conscionable supra $125,000 successful October 2025.

Its capped proviso of 21 cardinal coins and decentralized operation marque Bitcoin charismatic arsenic a hedge against monetary inflation. However, dissimilar gold, it is mostly viewed arsenic a higher-risk plus due to the fact that it is wholly intangible. Its terms tin surge rapidly erstwhile sentiment is beardown and diminution sharply during periods of uncertainty.

Bitcoin has shown notable fourth-quarter show trends implicit the years:

Did you know? Bitcoin trades 24/7, allowing investors to respond instantly, adjacent during the vacation season. This includes weekends erstwhile accepted markets stay closed.

What are the macro forces driving the Christmas rally?

The result of immoderate Christmas rally mostly depends connected macroeconomic conditions. Key factors see Federal Reserve policy, ostentation information and wide marketplace liquidity.

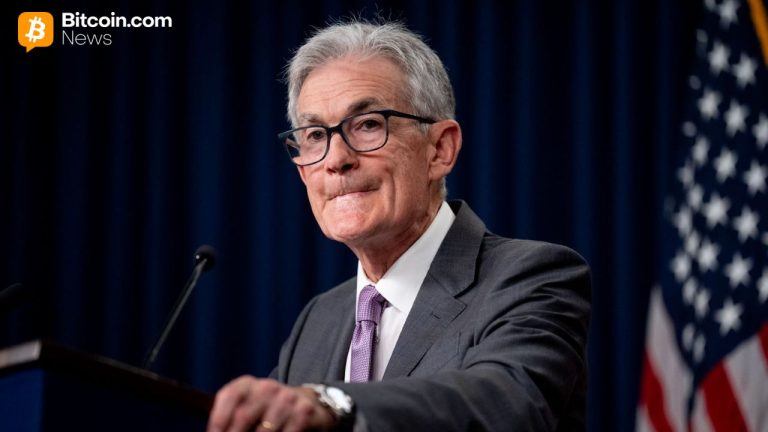

The US Federal Reserve reduced the national funds complaint by 25 ground points (bps) astatine its October 2025 meeting, mounting the caller people scope astatine 3.75%-4.00%. The determination was successful enactment with marketplace expectations and followed a akin complaint chopped successful September, bringing borrowing costs to their lowest level since precocious 2022.

Lower involvement rates thin to weaken the US dollar and tin summation capitalist appetite for alternate assets specified arsenic Bitcoin.

The US yearly ostentation complaint roseate to 3.0% successful September 2025, up from 2.9% successful August, according to authoritative data. However, halfway ostentation eased somewhat to 3.0% from 3.1%.

Periods of elevated ostentation often summation capitalist involvement successful alternate assets specified arsenic Bitcoin and gold.

In presumption of liquidity, Bitcoin tends to respond much sharply than accepted assets. Even comparatively tiny amounts of organization inflows, including exchange-traded money (ETF) purchases, tin power short-term terms movements.

Did you know? Gold’s largest buyers see cardinal banks, sovereign wealthiness funds and jewelers. Bitcoin’s astir enthusiastic adopters are retail investors, tech entrepreneurs and younger generations who favour integer assets.

Case studies: When Bitcoin and golden performed

Historical marketplace cycles item however Bitcoin and golden respond otherwise to changing economical conditions. These examples supply penetration into erstwhile Bitcoin tends to outperform golden and erstwhile golden acts arsenic the much dependable harmless haven.

Case study: When Bitcoin shined

In 2020, governments introduced large-scale monetary stimulus to antagonistic the economical slowdown caused by the pandemic. Investors turned to assets that could assistance sphere worth arsenic fiat currencies weakened. Gold rallied powerfully aboriginal successful the year, portion Bitcoin gained momentum successful the 2nd half.

By December 2020, Bitcoin had closed adjacent grounds highs astir $29,000, whereas golden ended the twelvemonth with humble gains adjacent $1,900. This lawsuit survey illustrates that during periods of abundant liquidity and debased involvement rates, Bitcoin has historically shown stronger show than accepted stores of worth similar gold.

Case study: When golden ruled

Between 2021 and 2022, ostentation surged, prompting cardinal banks to respond with crisp involvement complaint hikes. Risk assets fell broadly, and Bitcoin, being much speculative, suffered steep declines.

Gold, however, remained resilient, with periods of terms gains arsenic investors turned to it arsenic a accepted harmless haven. This lawsuit survey illustrates that golden tends to sphere worth amended than Bitcoin during periods of monetary tightening and marketplace stress.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

3 weeks ago

3 weeks ago

English (US)

English (US)