The long-awaited accomplishment of spot Bitcoin ETFs has ignited a golden unreserved successful the crypto world, attracting some newcomers and seasoned investors. While these caller concern vehicles connection a convenient and accessible mode to summation vulnerability to Bitcoin, their interaction connected the cryptocurrency’s halfway principles and semipermanent stableness remains a analyzable question.

Bitcoin ETF: Initial Surge, But Ownership Shift A Concern

The information paints a fascinating picture. Following the SEC’s approval of 11 ETFs, the fig of non-zero Bitcoin wallets initially soared, reaching a highest of astir 53 cardinal successful January. This surge was apt fueled by the accessibility and information offered by ETFs, attracting individuals antecedently hesitant to straight prosecute with the intricacies of crypto wallets and exchanges.

However, according to information provided by Santiment, a concerning inclination emerged 30 days later: astir 730,000 less wallets held immoderate Bitcoin, suggesting a imaginable displacement towards holding done ETFs alternatively of straight owning the tokens. This raises questions astir the semipermanent interaction connected Bitcoin’s decentralized quality and the imaginable for decreased on-chain activity.

📊 There are 729.4K little #Bitcoin wallets holding greater than 0 $BTC, compared to 1 period ago. After the #SEC approved 11 Spot Bitcoin #ETF‘s, this magnitude of non-0 wallets peaked connected January 20th astatine 52.95M. This is attributed to the accrued involvement successful #hodlers

(Cont) 👇 pic.twitter.com/FThtSDOmk0

— Santiment (@santimentfeed) February 21, 2024

ETF Boom, But Supply/Demand Dynamics Unchanged

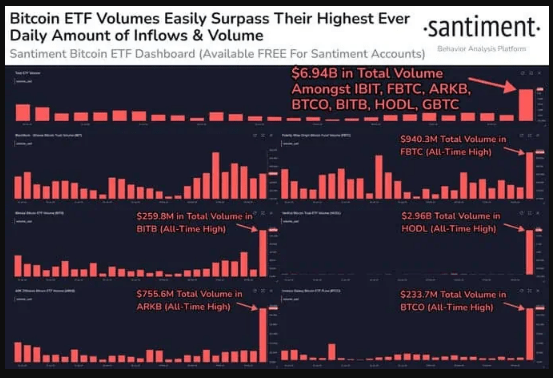

While the ETF marketplace is thriving, its interaction connected Bitcoin’s halfway principles is little clear. The caller grounds measurement and inflows exceeding $7 cardinal crossed the apical 7 ETFs item beardown marketplace involvement and the imaginable for mainstream adoption.

However, it’s important to retrieve that these ETFs tin clasp some existent Bitcoin and futures contracts. This means investors summation vulnerability without straight impacting the underlying proviso oregon request of the cryptocurrency itself. This raises questions astir whether ETFs are genuinely driving adoption oregon simply creating a derivative-based marketplace with its ain acceptable of risks and dynamics.

Speculation Surges, Raising Red Flags

Perhaps the astir concerning inclination is the surge successful speculative trading utilizing derivatives. Open involvement connected centralized exchanges, peculiarly for Bitcoin, has reached unprecedented levels, exceeding $10 cardinal for the archetypal clip since July 2022.

This indicates investors are taking connected much hazard by leveraging derivatives, perchance fueled by the “crowd euphoria” surrounding Bitcoin and the allure of perchance speedy gains. This echoes the speculative frenzy seen successful 2017, raising concerns astir imaginable marketplace volatility and imaginable crashes. Ethereum, Solana, and Chainlink besides grounds important unfastened interest, suggesting broader market-wide trends beyond conscionable Bitcoin.

The Verdict: A Double-Edged Sword

The accomplishment of spot Bitcoin ETFs has undoubtedly opened doors for caller investors, but it’s important to admit the imaginable downsides. While accessibility has increased, nonstop ownership mightiness beryllium decreasing, and the emergence of speculative trading utilizing derivatives raises concerns astir aboriginal marketplace stability.

Moving forward, it volition beryllium important to show however these trends germinate and their semipermanent interaction connected the wide wellness of the crypto ecosystem. Additionally, ongoing regulatory developments surrounding ETFs and derivatives could further signifier the landscape.

Featured representation from Nicola Barts/Pexels, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)